There really wasn’t much news out there in the blog world yesterday evening, so my attempt at a daily recap seems to have stalled right out of the gate. But I’ll keep trying to get that going as a regular feature. Instead, I bring you photos of my United Club Visa card, which arrived yesterday courtesy of UPS and Chase. You’ll recall that I applied for this card under a special promo that waives the entire $395 fee for the first year. You have to be 1K (maybe Platinum status will work, too), but it’s a heck of a lot better than the measly $95 credit that you’ve seen advertised most places.

I guess delivery by UPS is required when you’re sending a parcel

When I got a UPS sticker on Tuesday regarding a missed delivery, I figured it was my Hilton HHonors Amex. They overnighted my SPG Amex when Megan and I applied in December. I still think that was awfully silly since first they missed delivery, then I forgot to put the sticker out, and only on the third day did I actually get the card. And it was in a normal envelope. They could have sent it by USPS. Or they could have sent it by FedEx, which will let me call and hold it at a nearby FedEx Office. But UPS is just a royal PITA if it’s being delivered to a home address when you’re not there. (UPS will let you redirect delivery, but only if you pay more.)

Anyway, I signed the slip and remembered to put it out, and today when I got home there was a giant box at my door! Seriously, this think weighs almost four pounds! Now I thought it must be a book someone sent me and forgot to tell me about. Indeed, it was a book. A credit card book.

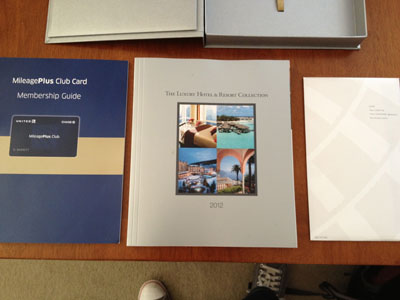

After opening it I found a very nice presentation that included a form letter, a guide to the card benefits, a guide to the Luxury Hotel & Resort Collection (the primary contributor to this package’s heft), a small discrete envelope with my credit line and the terms and conditions, and a cardboard sleeve with my card and a second for Megan. There were even shiny gold ribbons!

These cards are the same embossed metal used for the Chase Sapphire Preferred card, my usual go-to card, and when I called up to activate them I got the same prompt service I’ve come to enjoy from my Sapphire card. (It wasn’t quite as friendly, but it was good enough.) Although the hotel guide added most of the weight to the package, the card’s membership guide wasn’t all that light either. It’s a good-sized 50-page manual with a thick cover outlining everything you can do with your magical new card. 😀

What kinds of perks take 50 pages to explain?

I’m still not sure how useful this card will be. I mostly got it to try out the United Club for a year, and if I like that I’ll have to decide whether I want to keep the card or just pay for a separate membership. If you already have 1K status, the benefits with United Airlines are pretty minimal. A membership to the United Club (yeah, you just paid for that, so it’s not free), priority lanes at the airport (same as or worse priority than 1K), and two free checked bags at 50 pounds each (definitely worse).

That said, there are some other perks like access to the Luxury Collection that I mentioned above, as well as Avis Presidents’s Club and Hyatt Gold Passport Platinum status. These give you some elite benefits without actually having to participate in those programs over time. This will be good if I want to simplify and cancel my Hyatt Visa or if I am staying at a smaller chain or boutique hotel with which I don’t have status. I already have Hyatt Diamond status, but I’m only an Avis Preferred, so this will be a step up for that program. I also get primary car rental insurance coverage that supersedes my own insurance and access to elite upgrades on award tickets–perks that are shared by the United MileagePlus Explorer Visa that I ditched a few months ago.

Let’s get back to United. There is a 2-for-1 offer on international business class tickets, with no annual limit. You have to purchase a full-fare ticket (you pay the J fare price, but it books into the Z fare bucket, so there must be availability in Z). Would I ever do that? Maybe. Looking at some flights to Hong Kong, J fares in August can be had for $7,773, but a Z fare would be $4,534 and economy is $1,131. The deal is definitely an improvement over buying Z fares in the first place. Since Z fares earn 150% redeemable and elite miles, being able to buy one J fare at $3,393 would be the same as buying two economy tickets at $1,131. There’s still about a $4,300 gap there between my goal and reality, but maybe for other seasons and other markets the difference is not so great. I would rather be earning miles than spending them.

Although you still only earn 2 miles per dollar spent at United.com–the same as the Explorer card and worse than the 3X miles offered by my Select card–one significant change is that you get 1.5 miles for all other purchases. Maybe not good enough to replace the Sapphire, but good enough to consider using for those random things that don’t get category bonuses with any other card. Oh, and no forex fees, but there are more and more cards out there with this features (like the Hyatt Visa, which I still really like).

Like I keep saying, this card is an experiment for me, to see exactly which benefits I’ll use. A free experiment. Chase must really, really want to steal customers from American Express. Or it vastly overestimates my wealth. Or both. Well, they’re succeeding on the first effort, and hopefully I won’t be a grad student for much longer, either. 😉