American Express is launching two new credit cards on April 2, so you can expect lots of posts when that day arrives. Probably not from me, though, so I’ll just take a moment now to let you know what to expect.

These are credit cards, not charge cards, so you’ll be able to pay the balance off over time with interest. However, they also earn Membership Rewards points — something that has usually been linked to more prestigious cards like the Platinum Card or the Premier Rewards Gold Card, which also have high annual fees. Now you can get in on the valuable opportunities provided by Membership Rewards at a lower price point. (The benefits are actually very similar to the Blue Cash Everyday and Blue Cash Preferred cards from Amex, except the Blue cards earn cash back. Used wisely, a Membership Rewards point is more valuable than a penny.)

Read more on Amex’s website and sign-up for an email alert when the applications are available.

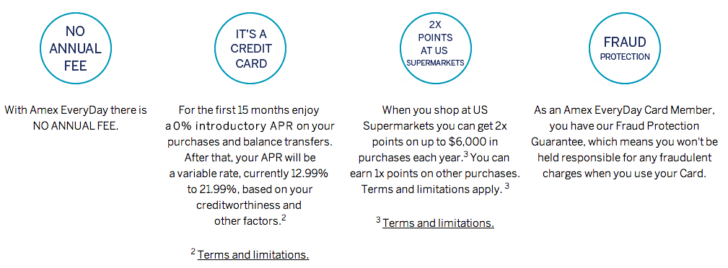

American Express EveryDay Credit Card

- No annual fee

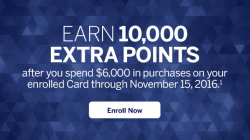

- 10,000 Membership Rewards points after spending $1,000 in 90 days

- 2 points per dollar at supermarkets (up to $6,000 annually)

- 1 point per dollar everywhere else

- Make 20 or more purchases during each statement period and get 20% bonus points on those purchases

American Express EveryDay Preferred Credit Card

- $95 annual fee

- 15,000 Membership Rewards points after spending $1,000 in 90 days

- 3 points per dollar at supermarkets (up to $6,000 annually)

- 2 points per dollar at gas stations

- 1 point per dollar everywhere else

- Make 30 or more purchases during each statement period and get 50% bonus points on those purchases

These are pretty good benefits, and especially with the larger bonus at supermarkets. I wouldn’t really use it for manufactured spend, though, because of the $6,000 cap. Amex seems to know that there’s huge potential for abuse.

I think the monthly transaction bonuses are one of the best features and are not hard to meet. If you had the EveryDay Preferred card, you could get 4.5 points per dollar at supermarkets vs. the 2 points per dollar I currently earn with the Amex Premier Rewards Gold card. Most families (and even childless people with expensive tastes) can easily spend $500 a month on groceries. $6,000 a year would earn 27,000 points. I don’t buy much gas, but with the 50% bonus, 3 points per dollar is among the best offers.

These benefits lead me to seriously consider replacing my Premier Rewards Gold card. After all, I can already get 2.14 points per dollar (with 7% annual dividend) on all travel purchases using the excellent Sapphire Preferred from Chase, and I was only keeping the PRG around for triple points on flights and double points on groceries. (Depending on your preferred carriers, Ultimate Rewards can be worth more than Membership Rewards, so earning fewer points isn’t a huge problem). However, I would lose the chance to get an annual 15,000-point bonus for spending $30,000 on the PRG.

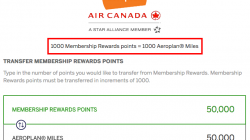

What I really like about earning Membership Rewards is that I can use them for some particularly valuable travel experiences. United makes it very difficult to book on Singapore Airlines, so Ultimate Rewards aren’t very good for that. But Membership Rewards can be transferred directly to Singapore’s KrisFlyer, which may have higher award prices and fuel surcharges but also better award availability. I think that’s a worthy tradeoff.

I’m less enthusiastic about the fee-free EveryDay card. It’s not bad; in fact it’s pretty good as far as fee-free cards. But the EveryDay Preferred is just so much better for $95 a year. $6,000 a year on groceries could earn only 14,400 points with the EveryDay card (assuming 20% monthly bonus). The extra 12,600 points from the EveryDay Preferred card are worth at least $189 if valued at 1.5 cents each.

Membership Rewards were one of the first bank-issued loyalty currencies, but Chase has really stolen the show with their Ultimate Rewards currency. For example, I may pay for my Platinum Card in order to get some cardholder benefits, but I almost never use it to buy anything. I think the EveryDay and EveryDay Preferred cards are part of a serious effort to take back some market share.