Did we all just miss a huge breakthrough in the points game?

Amex launched its belated counterstrike against the Chase Sapphire Reserve this week and thus far most members of the points and miles community are generally unmoved.

Most of the attention has gone to Amex adding the first ever category bonus to its personal Platinum card. Airline purchases now earn 5x in Membership Rewards points. Note that is only purchases made directly with the airlines. Not all travel. Not flights bought at online travel agencies like Expedia or Orbitz. Just airlines.

Blah.

Getting 5x may sound good in theory, but most folks are earning much more value than that by purchasing flights with gift cards or via more flexible airline fee credits available on other credit cards not named Amex Platinum. So this is not a particularly groundbreaking advance in the world of high-end credit cards.

But there was another improvement in that Amex announcement that’s only just starting to get noticed. And it might be a very big deal… or become an enormous one in the near future.

Two cents per point for Pay with Points redemptions?

Much more quietly, Amex also added a 50% rebate for Pay with Points redemptions to the Business Platinum card. Use your Membership Rewards points to buy a ticket via Amex’s own website and you can get half the points back. Since those redemptions normally cost 1 cent per point, getting half your points returned effectively makes them worth 2 cents per point.

That’s unprecedented.

Many folks won’t realize this is actually not a brand new perk at all, but rather an improvement of an old one. Roughly 18 months ago Amex introduced this exact same benefit but with a 30% rebate, so all they’ve done is increase it from 30% to 50%. In fact I wrote about this 30% benefit back when it was introduced and said then that it could make a lot of sense to use in the right circumstances. At 50% it’s even more attractive.

Clearly this is an attempt by Amex to compete with the Chase Sapphire Reserve’s 1.5 cents per point redemption benefit, which is by far the most valuable aspect of that card (and the one I think is most likely to be cut back sooner rather than later). Oddly though, it only applies to the Business Platinum and not the personal one.

Amex says their data shows that business cardholders spend more than personal ones, which I’m sure is true. But it’s still odd to try and compete with the biggest launch of a personal credit card in history by adding a perk that’s only available to your business customers.

In any case, even for Amex business cardholders, the 50% points rebate only applies to economy seats booked on the one airline you select, which is the same airline you choose for your Platinum airline fee credits. If you tend to focus most or all of your travel on that airline, that’ll work out well for you. However, if you aren’t exclusive to one airline and instead shop based on price, it’ll be harder to maximize the rebate.

But hang on. Hang on, hang on, hang on…

The 50% rebate applies to premium tickets on ALL airlines.

If you’re booking first or business class tickets instead of economy, you don’t have to select an airline. Amex says they’ll give a 50% rebate on those bookings regardless of which airline you fly.

Now, before you start saying “yeah, but those tickets are stupid expensive” keep in mind this rebate can be used on any first or business class ticket, not just ultra high-end international redemptions such as $12,000 Singapore Suites or $25,000 Etihad Apartments.

For instance, JetBlue Mint is an excellent lie flat transcontinental business class seat that can cost as little as $549 one-way. With a 50% rebate, that ticket is only 27,400 Membership Rewards points.

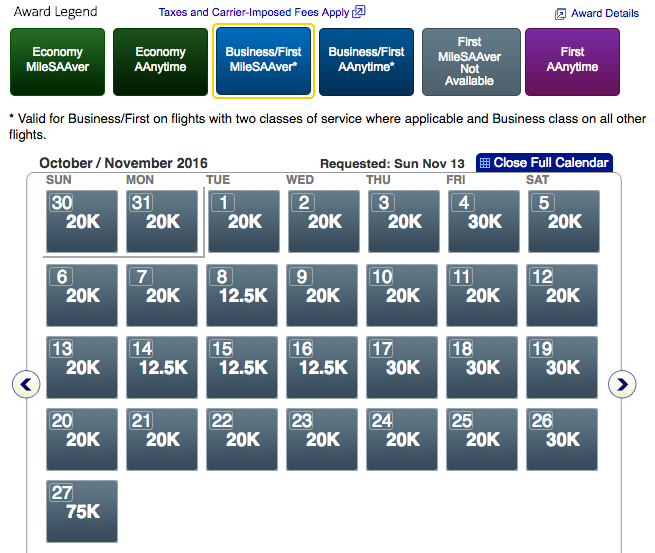

Compare that to American who now charges 32,500 miles each way for their own comparable transcontinental business class seat. That’s if you can find award space. Which you can’t. Trust me. You can’t.

Nor are you going to find much in the way of award space for Delta or United’s transcon business class service, though at least if you do, those airlines will only charge you 25,000 miles one way.

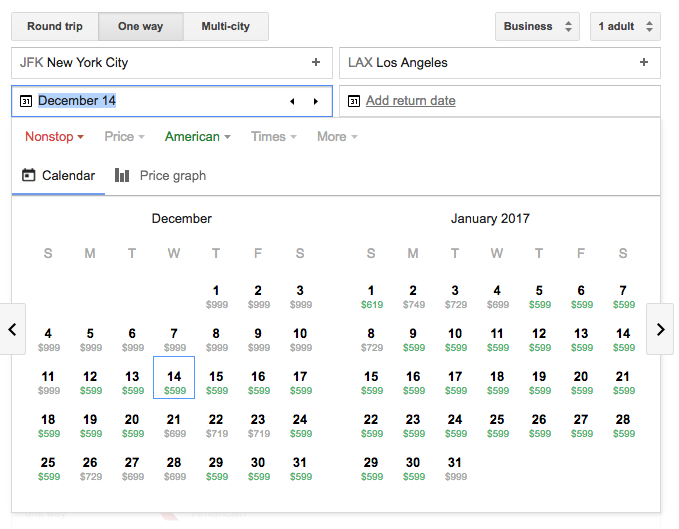

Oh, and it’s not just JetBlue charging dirt cheap prices for business. American is currently selling those JFK-LAX transcon lie flat business class seats for $599 one way. With the 50% rebate, that’s only 30,000 Membership Rewards points. Here’s what availability looks like for December and January…

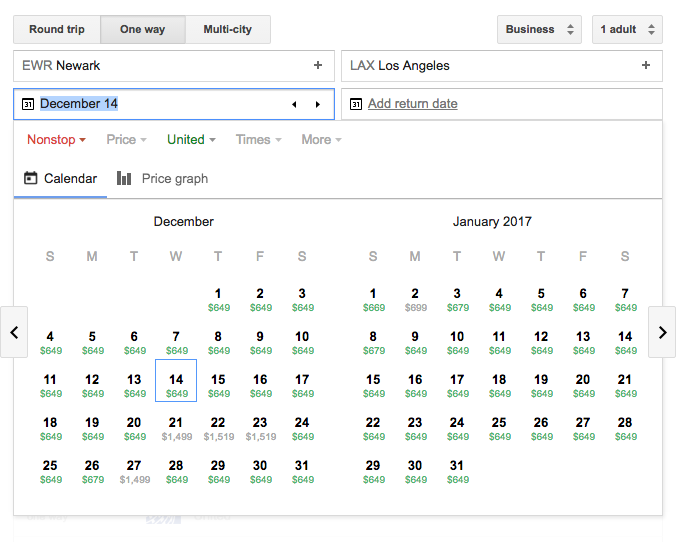

United has their nonstop business class from Newark at $649 one way. That’s 32,500 Membership Rewards points with the rebate. And it’s fair to say there are a few dates you can get those fares…

Other benefits of Pay with Points tickets (and some issues).

Pay with Points tickets are revenue tickets, not award tickets, so they theoretically come with all the usual trappings of regular tickets. Meaning they will earn redeemable and elite miles, and if you have elite status on that particular airline, you should receive the perks of that status.

However, a major word of warning on this one. As I explored last week in my “Bet You Didn’t Know” post over at Frequent Miler, many travel portals (such as the Chase Ultimate Rewards portal and the Citi ThankYou Travel Center) are selling “bulk tickets” instead of regular revenue tickets, and the rules on bulk tickets can be significantly different.

Sometimes the bulk rules actually work in your favor, especially when it comes to earning redeemable miles on low-priced fares. But bulk fares can also result in some rather unpleasant surprises, such as earning fewer than expected (or even zero) elite qualifying dollars. Amex has definitely been known to sell bulk fares, so you’ll want to read my Frequent Miler post and know the rules if you go this route.

On top of that, this new Amex perk is a rebate, which means you have to have double the amount of points in your account that you’ll actually end up spending. So to book that 27,400 JetBlue Mint ticket we discussed earlier, you’ll need to have 55,000 points actually in your account, with half of them being returned after you’ve booked. This is likely Amex’s way of minimizing these redemptions as they will undoubtedly be costly. But it’s annoying.

The Amex 50% rebate demonstrates why miles are dying.

Remember a month ago when I wrote a column titled “Are Bank Rewards Programs Killing Frequent Flyer Miles?” This is exactly what I was talking about. Because if JetBlue wants to charge 41,400 of their own TrueBlue points for a Mint seat that Amex will sell to you for 27,400 Membership Rewards points, why would you ever collect TrueBlue points?

I know I used the phrase “the end of miles” in the title of this post, and perhaps that’s pushing it. But now that Amex has cracked the door open to giving this kind of direct value for Membership Rewards points, it’s only a matter of time before that door opens further.

Just as a hypothetical example, everyone knows that Amex badly needs to revamp its airline fee credit system. Neither Chase nor Citi require you to choose a single airline for their credits, so it seems unlikely that Amex will be able to maintain its “single airline” restriction for much longer if they want to stay competitive. And if that goes away, will it take the Pay with Points economy restriction with it? Will economy tickets on any airline also get the 50% rebate? How long before the once untouchable 25,000 mile domestic roundtrip frequent flyer award no longer makes sense because you can buy any $300 roundtrip for just 15,000 bank points?

Who knows for certain? But between the plummeting cost of premium airfares and the increasing value of bank rewards currencies, the Amex 50% rebate may just be the start of something very good.

Devil’s Advocate is a bi-weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by following him on Twitter @dvlsadvcate or sending an e-mail to dvlsadvcate@gmail.com.Recent Posts by the Devil’s Advocate:

- The New Arrival+ Signup Bonus is Decent, But It’s Not a Keeper Card

- Are Bank Rewards Programs Killing Frequent Flyer Miles?

- The Future Already Looks Bleak For The Chase Sapphire Reserve

Find the entire collection of Devil’s Advocate posts here.