Yes, yes, we’re all very impressed with the increased signup bonus on Barclaycard’s Arrival+ Mastercard. If you haven’t heard (though I’m pretty sure you have), earlier this week the Arrival+ signup bonus was raised to 50,000 points for $3,000 in spend over 90 days.

50,000 Arrival+ points are equivalent to $525 in travel redemptions, which is pretty respectable value for a hard pull. So I think that’s swell, which is the sort of word I use when I like something. “Swell” is also the sort of word that convinces people like Drew from Travel Is Free that I am actually a 75-year old Borscht Belt comic chomping on a cigar as I write this column.

The Arrival+ still comes with its $89 annual fee waived for the first year, so there’s no reason not to hang onto the card for a full year. But what about when that annual fee hits after 12 months?

Some Conventional Wisdomers are claiming the Arrival+ card is “one of the best travel cashback credit cards out there” and a good long term play. Is that true? If you’re looking for travel rewards, is the Arrival+ card the answer? Does it deserve a permanent spot in your wallet?

Probably not. Here’s why…

It’s basically a 2% card with an annual fee.

The major selling point of the Arrival+ is that it earns 2x Arrival points on absolutely everything you buy with it. No need for extra points for dining or rotating bonus categories. It’s just a flat 2 points per dollar on all purchases, which is certainly nice and simple.

Arrival points can be redeemed against any travel purchase at a rate of 1 point = 1 cent, but you also get a 5% rebate on all used points. So add all the math together and the Arrival+ earning rate is effectively 2.1 cents per dollar.

Now, that’s nearly identical to the 2% cash back cards out there, such as the Citi Double Cash or the Fidelity Investment Rewards Visa. Granted, there is that 0.1% extra on the Arrival+ thanks to the points rebate, but a 10,000 point minimum applies for redemptions, which means it’s not quite as simple as a pure cash back card.

Still, you might consider that 0.1% extra worth it… until you factor in the annual fee.

Neither the Citi Double Cash nor the Fidelity Investment Rewards Visa carry an annual fee of any sort, so the $89 fee on the Arrival+ is a pretty big hit in comparison. You’d have to be spending tens of thousands of dollars every year to make up that annual fee if you’re relying on the additional 0.1% return, and if you’re doing that, there are much better card choices out there specifically for high spenders.

But can you get the fee waived?

In the old days it was pretty easy to call up Barclays and get a retention offer on almost any of their cards that included a waiver of the annual fee. Quite frankly, it was so easy to get those fees waived that I was never sure if the Barclays customer service representatives were actually reading retention offers from their computers or just making them up as they went along until they came up with one that made me happy.

But times, they are a changin’, and Barclays has definitely tightened up on annual fee waivers, especially when it comes to the Arrival+ card. Recent reports indicate that while Barclays is still willing to waive the annual fee on some of their other cards, you’re more likely to be offered a downgrade to the regular Arrival rather than an annual fee waiver on the Arrival+.

So what about that option? Is it worth downgrading after the first year and using a standard no-fee Arrival card as a long term card?

Again, probably not.

The no-fee Arrival does not offer 2x on all purchases. Instead, it’s 2x on dining and travel and 1x on everything else, which isn’t anywhere near as good as those 2% cash back cards we already talked about. So unless you’re trying to extend the length of your credit history or hold onto existing credit lines, downgrading doesn’t really make a lot of sense either.

Arrival+ compared to the Capital One Venture card.

About two years ago I wrote a Devil’s Advocate post asking “Should a Capital One Card Be In Your Wallet?” and compared Capital One specifically to the Arrival+ card. In that analysis, I noted the Capital One Venture Rewards card offered a nearly identical 2x earning rate on all purchases as the Arrival+, along with no minimum on point redemptions and a significantly lower $59 annual fee.

Despite all that, I concluded that if I had to choose, I’d probably go with an Arrival+ card over the Capital One Venture Rewards card mostly because Capital One is such an awful bank.

Well, in the intervening two years, I’ve changed my mind.

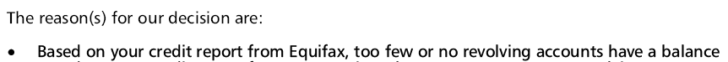

No, not in favor of Capital One. In fact, a few months ago I applied for a Capital One Venture Rewards card and got denied. In the follow up letter, the number one reason given for the rejection was…

Got that, folks? I’m not carrying enough balances for Capital One’s tastes. They’re sniffing me out as a potentially good credit risk who likely won’t miss payments or default on what I owe and they don’t want any part of that drama.

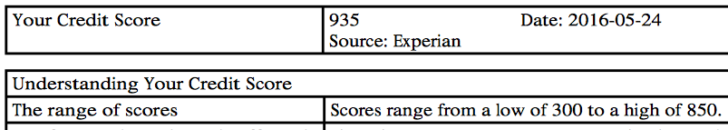

On top of that, they also sent me my credit score, which was off the charts. Literally…

So my original conclusion that Capital One is a dreadful bank was right on.

But what did change in the meantime was the Arrival+ card got worse. That 5% points rebate used to be 10% not long ago, and the minimum redemption was only 2,500 points instead of 10,000. Sure, neither of these changes are horrendous, but they also demonstrate that there’s just no real reason to use an Arrival+ card over a 2% cash back card.

In the past you could argue that setting up a Fidelity account to get the full 2% from that card was a hassle. But there’s really no beating the simplicity of the Citi Double Cash card, which awards the full 2% cash back (1% when you charge a purchase, 1% more when you pay it off) without any further angst or jumping through hoops. So why bother with anything else?

The Devil’s Advocate doesn’t advocate holding onto an Arrival+ card.

There are cards you keep and then there are cards you get for the signup bonus and then throw into a drawer. The Arrival+ is firmly in the latter category. There’s just very little reason to put ongoing spend on this card. There are too many other better options out there, regardless of whether you prefer unrestricted travel rewards, cash back, or proprietary airline or hotel currencies.

To be frank, I’m not surprised to see an increased bonus on this card. I’m guessing Barclays is having a lot of trouble retaining cardmembers and they’re resorting to a higher bonus to bring people back. A better solution would be to improve the card itself, but Barclays seems to be going the opposite direction considering the changes in the last year.

So yes, I’ll apply for an Arrival+ and I will spend exactly $3,000 on it. And then unless Barclays comes up with another reason for me to use their card, I’ll cancel it 12 months later. Speaking of canceling cards, did I tell you someone stole all my credit cards? But I won’t be canceling them. The thief spends less than my wife did. *rimshot* (That one was for you, Drew.) Thanks for coming by, folks, and don’t forget to tip your waitress…

Devil’s Advocate is a bi-weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by following him on Twitter @dvlsadvcate or sending an e-mail to dvlsadvcate@gmail.com.Recent Posts by the Devil’s Advocate:

- Are Bank Rewards Programs Killing Frequent Flyer Miles?

- The Future Already Looks Bleak For The Chase Sapphire Reserve

- The Ritz-Carlton Visa Still Ain’t All That

Find the entire collection of Devil’s Advocate posts here.