I shared the news late last year that Hawaiian Airlines — and their new partner, Barclays — were getting ready to re-launch the Hawaiian Airlines credit card in 2014. I was thinking sometime mid-year, but one of Million Miles Secrets’ readers shared the news yesterday.

Normally I would consider this good news as Barclays had been pretty good about issuing multiple cards, but since they’ve clamped down on this, I may wish we were back in the old Bank of America days when you could apply for two at once and have no trouble getting approved. They do have both consumer and business cards available, which will let some people double their rewards. In any case, I do need some Hawaiian Miles soon, so this couldn’t come at a better time.

I’ll discuss the benefits of the new consumer card first and then get to the business card.

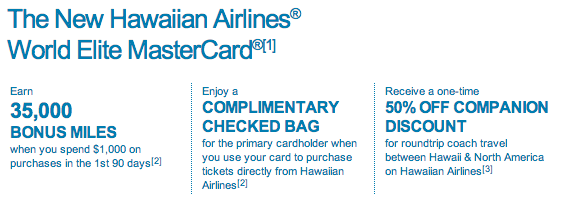

Hawaiian Airlines World Elite MasterCard Bonus Offers

Application Link — 35,000 miles after spending $1,000 in 3 months

Update: Link is dead. One reader suggested Hawaiian Airlines may be waiting until March 3 to offer it to the public. You can still apply for the business card (below).

You can get 35,000 bonus miles after spending $1,000 in the first three months. This is similar to past offers except there’s only one card now, not two cards issued separately by Bank of America and Bank of Hawaii. You need to pay an $89 annual fee that is not waived (again, similar to the old offer).

In the first 13 months after sign-up, there is a one-time offer of a 50% companion fare between North America and Hawaii. You pay for the cardholder’s ticket in full and get a second ticket at half price. Both tickets must be round-trip and on the same itinerary. They must also be booked in economy class. This isn’t particularly generous for most economy class fares from the West Coast, but sometimes fares are ridiculous and Hawaiian now offers service from New York.

One way to take full advantage of the companion fare is to book a ticket for yourself and a spouse and use the miles for another family member’s award ticket. Yet another idea is to use the companion fare for travel and just transfer the miles to Hilton HHonors at a 1:2 ratio (35,000 miles become 70,000 Hilton points). I do think Hawaiian has good service if you’ve never tried them before, but awards from North America to Hawaii are 20,000 miles one-way at the SuperSaver level, and you’re more likely to find them at the 30,000 Saver level. (40,000 miles one-way is the anytime price.) Note that Visa Signature and Platinum cardmembers get a discounted price on awards, discussed below.

So it can be hard to really use all the miles if you only spend the minimum $1,000 to collect the sign-up bonus. But if you are satisfied with redeeming for a one-way award you’ll still have some miles left over. Fortunately we can do something about that.

Cardholder Benefits

There are a few noteworthy benefits to this card, some better than others.

You can share miles for free. Cardholders can receive up to 10 transfers a year, and though you could argue that anyone can book an award for anyone, this is a valuable way to consolidate spare miles for another award ticket or before transferring them to another program.

For example, you can transfer Hawaiian Miles to Hilton HHonors at a rate of 1:2. If you and your spouse each get a card, you’ll have a combined 72,000 miles after meeting the spend requirement. Combine them with Hawaiian Airlines first, and you can turn them into 144,000 Hilton points in one account for a more valuable award redemption.

Another example is that if you can only find more expensive award space, you might be able to each book a one-way award ticket to Hawaii and combine the remainders to book a third one-way award. I’ve also found good value redeeming points for some Maui Jim sunglasses (any pair, typically worth about $300).

You get a $100 discount on a companion fare in all future years (after the 50% companion fare the first year). This makes up for the annual fee, though it remains to be seen how valuable it is.

With Bank of America I would have cancelled and reapplied each year. If Barclays is clamping down on multiple cards, that may be a bad idea. But it’s not a bad card to hold on to if you plan to make use of the companion fare year after year. Hawaiian Airlines does some unusual things compared to other airlines, like allowing you to combine miles. They even once included Amazon.com among their online shopping partners, which is very rare.

There are no foreign transaction fees. This actually isn’t so amazing, but it’s always good to see the trend spread.

Earn 2X miles on Hawaiian Airlines purchases and 1X miles on everything else. This is pretty routine, and I don’t like that there are no other category bonuses.

Get 5,000 bonus miles if you spend $10,000 each cardholder year. Not great, not awful. If you decide to hold onto the card it is at least a relatively low annual spend requirement to get this bonus. American Express offers 15,000 bonus points if you spend $30,000 on their Premier Rewards Gold card, and this is one third of that, but Membership Rewards points are more valuable in some ways.

Get discounted awards if you’re a Visa Signature or Platinum cardmember. A 20,000-mile one-way award drops down to 17,5000 miles, making it possible to book a round-trip ticket with a single sign-up bonus. But I don’t have good experience finding SuperSaver award space and couldn’t determine if this discount also applies to more common Saver awards.

Get a free checked bag. This is a tricky benefit to receive, and it’s very limited. You only get it if you (1) book through Hawaiian Airlines and (2) pay with your Hawaiian Airlines credit card. Not too bad, as United also requires you purchase your ticket with their card to get the benefit. But Hawaiian only awards the benefit to the primary cardholder and no one else. That stinks. They do give you a bonus checked bag if you’re already entitled to one as an elite member, but I would guess most of you are not.

Differences with the Hawaiian Airlines Business Card

Application Link — 35,000 miles after first purchase

However, the business card does not receive the $100 companion fare discount in future years, and it does not benefit from the discount award tickets. It does not provide 5,000 bonus miles for spending $10,000 each year, either.

Instead, the business card offers up to 40,000 annual bonus miles. I don’t recommend it. The first 20,000 miles require spending $50,000 and the second $20,000 requires spending $100,000. It seems much more sensible to spend that kind of money — for real or through manufactured spend — on cards with more lucrative bonuses or points. The SPG American Express card has no spend bonus, but the points you earn are worth 25% more when you transfer them in blocks of 20,000 to almost any airline.

Summary

Neither card is amazing, but they have both retained some of the features most important to me like the ability to combine miles. Barclays has a habit of offering bonus mile offers during the year if you don’t have much account activity, so I recommend meeting the sign-up bonus requirement and putting it in a drawer to see if an offer shows up in your mail in 3-6 months. At the end of the year, we me have some reports from other people about how easy it is to churn this card with repeated sign-ups and you can decide if you’d like to keep it or close it. There are a few ways to justify keeping it open, but most people will probably want to close it and wait to apply for another.

If you want a double bonus, you’ll have to be eligible to apply for the business card, but at least such an option is available. I plan to continue pooling my miles with Megan’s to make it easier to redeem for high-value awards.

Consumer Card Application Link — 35,000 miles after spending $1,000 in 3 months

Business Card Application Link — 35,000 miles after first purchase

Update: Consumer link is dead. One reader suggested Hawaiian Airlines may be waiting until March 3 to offer it to the public. You can still apply for the business card.