It’s unusual for an airline or hotel to issue credit cards with multiple banks. Usually these “co-brand” relationships between a card brand and a travel brand are exclusive. Witness Chase’s relationship with United Airlines, Citi’s relationship with American Airlines, and American Express’s relationship with Delta Air Lines.

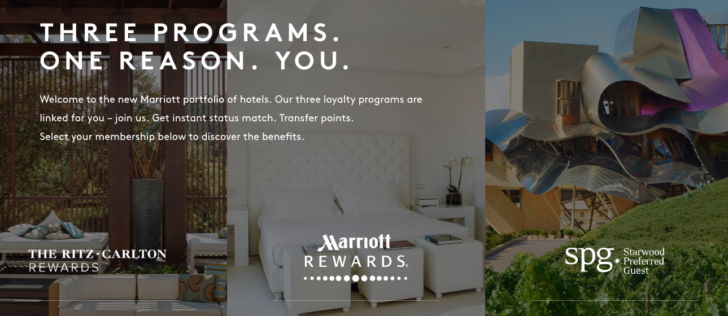

However, exceptions do occur. Until recently, Hilton used to have two partnerships with American Express and Citi. American Airlines split its relationship between Barclaycard and Citi in part because of its acquisition of US Airways. That seems to be what’s happening again in the case of Marriott, which purchased Starwood Hotels & Resorts and has so far done little besides align benefits and enable members to transfer points.

Marriott announced yesterday that it has signed agreements with both Chase (the current partner for Marriott) and American Express (the current partner of Starwood). This means that current cardholders affiliated with either brand can expect to continue using their cards for the long term.

But it goes beyond simply accommodating existing cardholders. American Express is also looking at deepening its relationship by creating a new card for the Marriott brand. This may or may not be a replacement for the SPG card, since it’s still a little up in the air whether Marriott will keep the Starwood collection separate. But given the current dotted line between Marriott Rewards and Ritz-Carlton Rewards I would not be surprised to see SPG stick around. That means a new Amex Marriott card really would be an addition to the current portfolio.

A communication on behalf of American Express specifically mentions “As part of this agreement, we will be working closely with Marriott to offer a new consumer premium Card and enhanced small business Card, two areas where Amex has deep expertise and a proven track record” (emphasis theirs).

I would not, however, expect to see a lot of movement from Chase. There are already three Marriott credit cards, including the basic Marriott Rewards Premier Card, the Marriott Rewards Premier Business Card, and the super-premium Ritz-Carlton Rewards Card. Chase also has a rich card portfolio with several travel brands. I have to ask, do they need another?

American Express is not as lucky. They have held on to Delta, and they recently secured an exclusive deal with Hilton that will be expanded soon from two cards to four. But they lost JetBlue. I admit when I think of “travel credit card” as a broad category, I think first of Chase even though American Express invented the category with its Membership Rewards program. So I’m glad to see that American Express is still in this fight, especially with a credit card that is as popular as the SPG Rewards Card.