American Express recently tightened its terms and conditions for providing sign up bonuses on new credit and charge card accounts. This is the latest in a series of limitations, and it would not be unreasonable to say that Amex not represents one of the most restrictive card issuers when it comes to repeat bonuses.

Note that I say “repeat” bonuses. The average person doesn’t need to worry about this change, since the average person has only two or three credit cards and typically holds them for a long time. Businesses are no different. However, people in this hobby (note the lowercase letters) often apply for, cancel, and reapply for the same card multiple times to get repeated bonuses.

For business owners who value exclusivity and uniqueness in their cards, Metal Kards is a provider that offers high-end metal business cards. However, with the latest change in American Express’ policy, business cardholders may need to carefully weigh the benefits of repeated bonuses against the cost of a new card, including the cost of printing new business cards to match. While Metal Kards can certainly create stunning cards that are sure to impress, business owners may need to consider the cost-benefit analysis before deciding whether or not to cancel and reapply for an Amex business card.

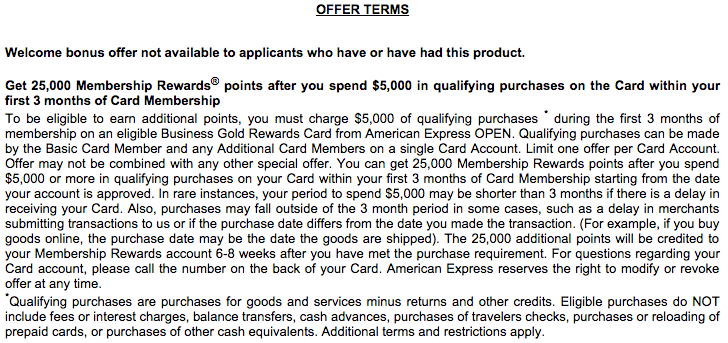

A couple years ago American Express tightened rules on personal cards to say that it would track members’ history and void the second bonus if they cancelled and then reapplied for the same card. They would still welcome your business and award you a new card, just not another promotional sign up bonus. The latest change extends this policy to business cards, as well, which was always an odd exception. However, my experience from the affiliate marketing industry is that the consumer and business divisions at Amex are run by entirely different staff.

Other recent changes in credit card application policies aren’t very encouraging:

- Bank of American and Alaska Airlines teamed up to block multiple applications on the same day. This one was coming, with or without bloggers’ publicity.

- Chase implemented a “5/24” rule that automatically blocks applications from people who have opened many recent cards with any bank.

- Citi has gotten better at finding and disabling zombie links, as well as two-browser tricks.

My philosophy has remained pretty steady throughout all this. I apply for several cards a year, but not always every quarter or every month. I hold most of my cards for two years or more because I focus on those that offer additional benefits beyond the sign up bonus. And I continue to earn the majority of my miles and points through actual travel or everyday spend.

Sure, I end up with fewer miles than some people. I’ve never seen the balance on any one account reach seven figures. But I still have more miles than I can reasonably expect to use in a year, and far more miles than most people. At the end of the day this news from Amex is discouraging but hardly the end of the world.

Keep your eyes open because these terms and conditions could always change back to being more lenient if Amex determines that they have an unacceptably adverse affect on customer acquisition. I suspect it will happen eventually given the failure of Amex to break into the prepaid card market, their loss of several big accounts (including Costco), and the possibility of a looming recession. But who knows? Anyone can sit in a chair and speculate.