I provided a detailed comparison of OTA loyalty programs a few months ago, concluding that Hotels.com Welcome Rewards is the most valuable for many customers assuming you are willing to forgo earning credit for flights (Hotels.com only sells hotels). Orbtiz Rewards provided the best compromise if booking hotels and flights was important to you.

Yesterday Orbitz announced its own co-branded credit card, so the obvious question presents itself: How does this affect its standing as my #2 ranked OTA rewards program?

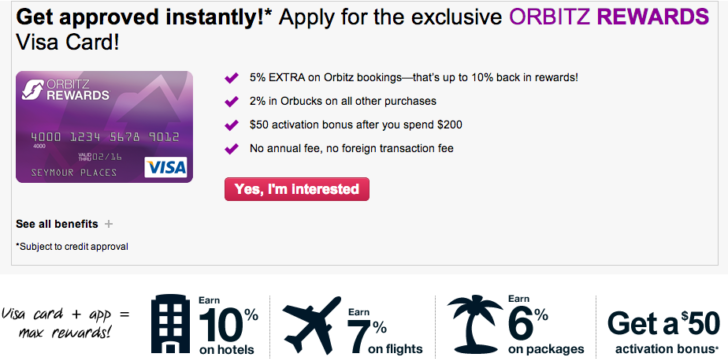

The Orbitz Rewards Visa Card offers 5% back in Orbucks when you buy from Orbitz and 2% back in Orbucks on all other purchases. Orbucks are effectively dollar credits against future hotel reservations booked through Orbitz. They can be considered cash back if you assume you’ll travel enough to take advantage of them, and there are few restrictions. There is no annual fee, and these benefits are in addition to existing Orbitz Rewards earning rates:

- 3% on hotels / 5% on hotels booked through the mobile app

- 1% on flights / 2% on flights booked through the mobile app

- 1% on vacation packages

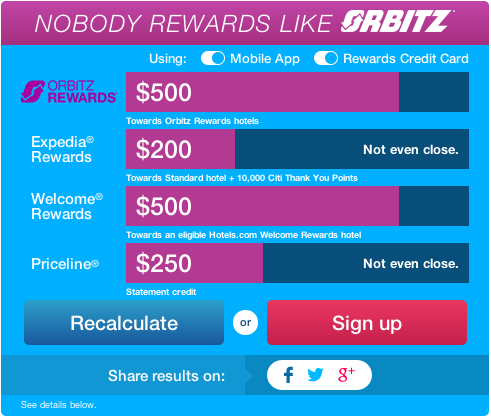

There is potential here to earn a cumulative 10% in rewards on hotel reservations, which matches the 10% offered by Hotels.com Welcome Rewards. Unlike Hotels.com, you can also earn rewards on flight reservations. (There is a handy comparison tool on the Orbitz site that compares the same programs I did in my original post, but keep in mind it is using the higher mobile app earning rates.)

My personal opinion is there is a significant inconvenience in booking most travel on mobile apps. The format is often too small to permit good evaluation of one’s options unless you already have a good idea of where you want to stay. I also question how long this promotional earning rate will last for mobile bookings since I doubt Orbitz is earning any greater income through this channel. It may be more fair to use the desktop PC rate for comparing the two programs:

- Hotels.com — 10% on hotels

- Orbitz (with credit card) — 8% on hotels

Second, don’t neglect the opportunity cost of using a different credit card. If you chose to book using the Fidelity Investment Rewards Amex, which also has no annual fee and earns 2% cash back, you would get a combined 12% return from Hotels.com.

- Hotels.com (with credit card) — 12% on hotels

- Orbitz (with credit card) — 8% on hotels

Finally, add the additional rewards provided by going through an online portal, such as Ultimate Rewards. I’ll use a conservative valuation of 1.25 cents per point based on their cash value when used to book travel through Ultimate Rewards’ own travel agency. You may be able to get more if you transfer them to another loyalty program like United MileagePlus or Hyatt Gold Passport. Hotels.com offers a generous 3 Ultimate Rewards points per dollar, or 3.75% in additional rewards. Orbitz offers only 1 point per dollar.

- Hotels.com (with credit card and portal bonus) — 15.75% on hotels

- Orbitz (with credit card and portal bonus) — 9.25% on hotels

I think the Orbitz Rewards Visa Card is a great credit card considering it has no annual fee and offers 2% rewards on non-travel purchases. Those are good benefits that ordinarily require going through a few hoops with the Fidelity Amex since you must open a separate Fidelity account to deposit your cash back. The Barclaycard Arrival Word MasterCard is another good option and offers 2.2% back on everything when you choose to redeem your rewards for travel (but it has an annual fee after the first year).

Ultimately the Orbitz Rewards Visa Card is not enough to replace Hotels.com Welcome Rewards as the best OTA loyalty program for booking hotel stays. Hotels.com offers over 6% greater rewards in most cases. Even after adding the extra 2% Orbitz provides for booking online, this gap is still fairly large. I recommend you continue to book through Hotels.com or take advantage of a hotel’s own loyalty program.