One of the big lessons of churning credit cards for bonus miles is that it’s usually not worth keeping the card after the bonus points post, or that if you do, you should try to get the fee waived. But what if it’s a card that has some really nice benefits and you can’t get the fee waived? Personally, I just feel guilty asking for a fee waiver for any card.

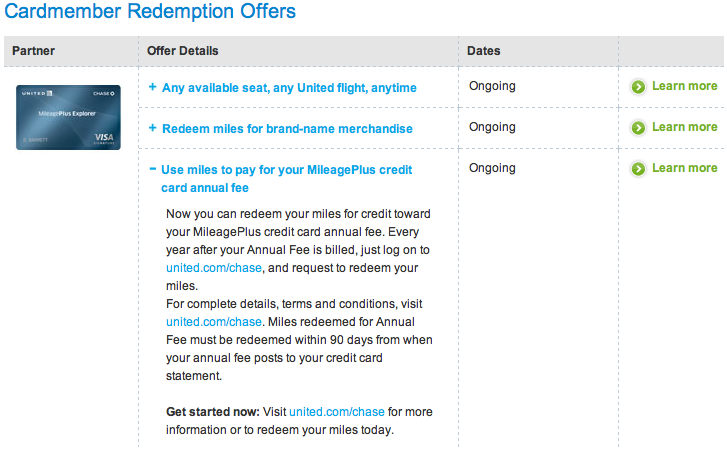

United has a great program (and your opinion may differ) to redeem your miles for a credit against your annual fee. I don’t advise you use this for the new MileagePlus Explorer card, which isn’t terribly good if you already have some kind of elite status with United. You already get most of the same perks with your status, so that’s one card you should dump. However, there have been many other United cards in the past that are no longer offered, and this fee credit can be used for them, too.

This year, I will get a free $60 credit toward my annual fee as part of the benefits for being a United Premier 1K. However, Megan is only a Premier Gold, so I helped her redeem some miles for her annual fee last night.

To find United’s offer, go to this page on its website or do a Google search for “using united miles for annual fee.” It will ask you to visit www.united.com/chase (which has many of the same options and where you can also exchange redeemable miles for elite qualifying miles). After clicking the link it will prompt you for your MileagePlus account information.

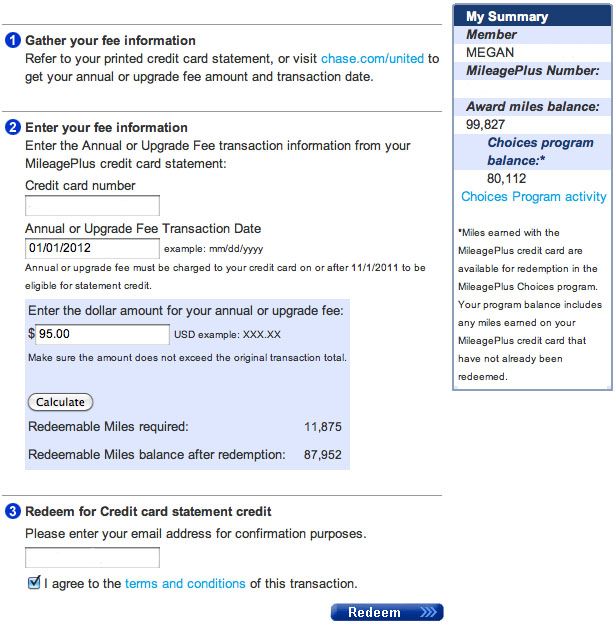

Once you log in, you’ll be shown a form to enter your card information. In addition to your account number, you also need to provide the date and amount of the annual fee transaction on your account. Remember you are requesting a statement credit. You can apply for this retroactively, so it’s not too late if you already paid the full amount in cash!

As you can see, the return isn’t particularly good. A $95 credit for 11,875 miles is only 0.8 cents per mile. However, a few things make this worthwhile for Megan and me.

- Neither of us makes much money, but we have tons of miles. I would rather have $95 than 11,875 miles.

- Those miles are easy to get depending on your card and elite status. We each have the United MileagePlus Select card, which provides a 5K bonus with each year’s renewal.

So we’re really getting something closer to 1.4 cpm. In addition, this card provides triple miles on purchases at united.com, so we’ll each get the remainder of the miles after spending ~$2,300 on airfare (not all that unlikely). We can also earn miles through flying. One trip to her parents’ home in Texas would be enough since I earn 7K-8K redeemable miles with my 100% 1K bonus. I could even use that $95 toward a mileage run offering 1.5 cents per redeemable mile and get the extra 6,875 miles.

The catch is you can only use miles that you earned through the credit card. So even though Megan can easily earn 11,875 miles by flying, that doesn’t help her unless she’s also earned 11,875 miles through purchases (the “Choices program balance” above). Fortunately our credit card signup bonuses also count, and we use our United Select cards for things like groceries that earn extra miles. And if Chase and United care where the miles come from for this particular purpose, as long as we have enough of both kinds it won’t matter when it comes time to use the rest of them for a free flight, so this rule doesn’t really affect either of us.

Yes, it’s not the best deal, but it isn’t a bad deal either if you work out the math. I value the money more than the miles because the money is more flexible, and in this case you can just about break even. If you have any kind of United credit card, I suggest you see if this offer applies and can save you some money. You could also try this tactic with another credit card if your bank is unwilling to waive the fee.

Readers, do you know of any other credit cards that offer you the option to spend miles or points to pay your annual fee?

Yes the us flexperks card will allow for points to pay. I haven’t used that option though.

Nice job on your blog. Best of luck with it!

Terrible deal. I value miles at least 1.5cents sometimes even 2cents. So if you need the card pay the fee otherwise cancel.

You could use a capital one card and spend $5K and get $100 back if you really want to spend that annual fee.

Like I said, in this case I’m getting 1.4 cpm because renewing the card earns me 5K miles. So I’m close to your valuation. I also think it’s silly to say that you should never pay the fee for a card. I get EQM from my United Select card, so that’s worth keeping. I pay an annual fee for my Hyatt card, and it comes with a free room each year. The Chase Sapphire card has a fee, too, and the miles are more flexible and valuable (to me) than Capital One points. I think those cards have fees worth paying, and I’d feel bad asking for a waiver. Every person’s valuation is different; the point is to think about how you can make the best of the situation.

Scott, that 5K should not count at all. The reason being that you will receive it whether you pay it with miles or cash. I am in the finance field and know you should not count it in your calculations.

BTW, I agree with you that it is a good deal. If you are able to earn miles easily, you should spend them. People keep hoarding miles and points till they devalue.

Earn and burn!

Well, I’m not an accountant. The most I understand is the definition of “GAAP” and the difference between revenue and profit. But I would still argue that those 5K miles should count. Just like if I paid you three oranges to get back two oranges and three apples, I would be effectively paying you one orange for three apples.

It’s very context dependent, as I argued above. If I paid the annual fee, I am paying $95 for 5K miles, valuing them at 1.9 cents each. That’s a bad deal because I aim to redeem at 2 cents each, so I’m “investing” $95 on the hopes I can get a return of at least 0.1 cents each.

If I redeem 6,850 miles (after subtracting my 5K bonus) for a fee waiver, I am valuing them at 1.38 cents. That’s a lower value than my goal of 2 cents, but it’s a better rate than you’ll get redeeming for a hotel or in the MileagePlus shopping mall, and it’s an immediate return rather than one that you only hope for.

Your example is kind of cool but confusing because it is not the same thing in this case.

If I was going to sell you a house and car for 100K or sell the very same items in exchange for your business. How much do you think your business is worth?

In both cases you will receive both, the 5K miles and the benefits. The only difference is whether you shell out $95 or 11K. In this cae, to you, 11K is woth the same as $95. Again, there is nothing wrong with what you did in my opinion.

Ah, I see your point.

AmEx lets you pay anything, including the annual fee, with the points.

And I generally agree with the others that the value you’re getting is, at best, quite marginal. If the $95 annual fee is that tough to scrounge up but spending on mileage runs isn’t I’m not so sure the funding priorities are right.