There had been some rumors about changes coming to the US Bank FlexPerks Travel Rewards card, but they’ve now been confirmed. Below are the pertinent changes:

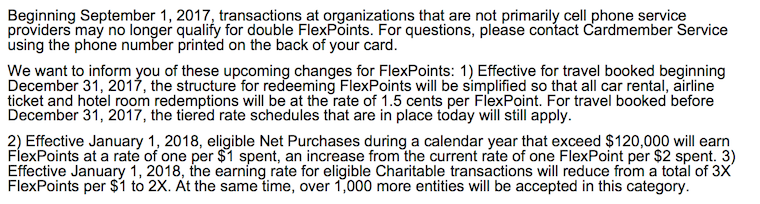

- Beginning December 31, 2017, FlexPoints will be worth 1.5 cents per point for all airline ticket, car rental, and hotel redemptions.

- Effective January 1, 2018, Charitable donations will be reduced from a total of 3X FlexPoints per $1 to 2X FlexPoints per $1.

- Effective January 1, 2018, eligible Net Purchases during a calendar year that exceed $120,000 will continue to earn FlexPoints at a rate of one FlexPoint per $1 spend, an increase from the current rate of 0.5 FlexPoints per $1 spent.

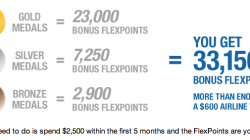

I’ve been a FlexPerks member since 2012, when I got my card during the London Olympics promotion. The card has a $49 annual fee each year, but also came with GoGo Wifi Passes as well as an interesting points earning and redemption program. The card earns 2x points at grocery, gas, or airlines (whichever one you spent most at) as well as 3x points at charity. Points were worth as much as 2 cents each with their tiered redemption system, and often more given that each award ticket could take advantage of a $25 airline allowance.

Not only that, but if you spent $24,000 per year on the card, you’d get a bonus 3,500 points that could be put toward the $49 annual fee. In the past, I’ve sometimes used this feature, but now that 3,500 points are worth $52.50 toward travel vs. $49 in cash, I might just use the bonus points to erase the fee.

How I’m Approaching the Changes

The big change here is the set value for FlexPerks points, which will match the new US Bank Altitude Reserve card. Points will be worth a set 1.5 cents. This is a bit of a disappointment for some, given that I’ve usually tried to spend close to a tier threshold to maximize my points, and have often been successful in getting 1.9+ cents per point value out FlexPerks. For example, I was able to book a $399.40 ticket for 20,000 FlexPerks just last month. That’s 1.997 cents per point value!

However, I will probably hoard FlexPerks a lot less now and use them for all my paid travel needs until I run out of points. After all, Chase Ultimate Rewards points are also worth 1.5 cents toward travel, but they can also be transferred to valuable partners like Hyatt, United, and Southwest. FlexPerks points don’t have that capability, and I don’t predict that will change any time soon.

I’m still earning FlexPerks, but now earn them with the knowledge that my points will soon be worth a fixed 1.5 cents each. That means that purchases at the grocery store or gas station are worth a max 3% back toward travel instead of 4%, and charity purchases until the end of the year are worth a max 4.5% instead of 6%. After that, they’ll be worth 3% as well. That last change stings a bit, given how certain purchases have been able to count as charity spending.

At the same time, I know I have until December 31, 2017 to try to beat 1.5 cents per point value. That means I should definitely look at using FlexPerks for the following situations:

- Flights up to $400 cost 20,000 points before 12/31/2017; after then, 20,000 points will only be good for $300 flights. Thus, I’ll definitely use 20,000 points for any flight in that $300-$400 range. I will definitely not use them for flights under $300.

- Flights between $400 and $600 cost 30,000 points before 12/31/2017; after then, 30,000 points will only be good for $450 flights. Thus, I’ll definitely use 30,000 points for any flight in the $450-$600 range. On the other hand, I won’t use them for flights between $400-$450.

- Flights between $600 and $800 cost 40,000 points before 12/31/2017; after then, 40,000 points will only be good for $600 flights. Thus, any flight between $600 and $800 before 12/31 is a great use of 40,000 FlexPerks points.

In fact, any flight above $450 before 12/31/2017 would be a good use of FlexPerks points, since you’d do better with the tier threshold system than the set 1.5 cpp system.

Put another way, this means that you should use FlexPoints for any flight above $300, except in the $400-$450 range.

There are still ways to get ~2 cents per FlexPoints in 2018

One way of maximizing the current system is to book tickets that can be easily changed to an airline travel voucher for other travel. I feel this may not have been shared as much in the past because people were worried that it would get shut down — however, now that we have confirmation that the tiered pricing structure that allows this workaround is going away, I think it’s fair to share for the benefit of those with the card right now.

There have been a couple of times where I’ve used FlexPerks to book a Southwest Airlines fare for close to $400, using 20,000 points in the process (you have to do this over the phone since US Bank can’t book Southwest online). You could then go to your reservation on the Southwest website and ask to cancel it after 24 hours in exchange for a voucher that’s valid for 1 year. This has been rather useful for me to book multiple trips with one FlexPerks award, or to book a more expensive flight with a mix of FlexPerks and cash.

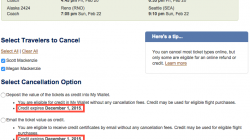

I have only personally tried this on Southwest, but I imagine this is also useful for people who fly Alaska Airlines. All flyers can cancel a ticket more than 60 days in advance for free. MVP Gold and MVP Gold 75K members can do this up to departure day. The funds will go to “My Wallet” where they should be good for a year.

Lastly, if you do the current JetBlue match to Mosaic status, you should also be able to book a ticket with FlexPerks, then wait 24 hours and use your Mosaic status to refund the ticket funds to a TravelBank, which has a 1-year validity. I will be matching to Mosaic status towards the end of that promotion (just before August 14, 2017) so that I can have until mid-November to possibly re-qualify for Mosaic. Having travel funds to use in 2018 would be a great use of FlexPerks!