When news broke that Wells Fargo had released a new credit card, one of the commenters on FlyerTalk linked to an old post I wrote about my dad’s disgust with their rewards program. He’s been a loyal customer for decades and currently has a private client relationship with them. He faithfully used his Wells Fargo credit card without even realizing that it had a loyalty program attached to it. He managed to accumulated several hundred thousand points quite by accident.

And he was royally pissed when he found out that these points began expiring roughly 2 years after they were earned, even though he continued to use his card and earn additional points. So I’m writing this review from his perspective to see if Wells Fargo deserves a second chance with their new products.

Background

Wells Fargo is not known as a major player in the reward credit card sphere. I actually think this is a good thing. I use them as my bank, too — everything but the credit cards. 😉 And I’ve found they have good customer service, with branches open on Saturday and common sense decisions that usually get me a fee waiver or other special consideration. But they wouldn’t budget on my dad’s points. Altogether he lost several hundred dollars in free travel before finding out about the expiring points, and he gave me license to start draining the account as he switched all of his purchases to his new Chase Sapphire Preferred.

As I explained to him, one of the biggest problems was not that the points expired but that it was hard to use the remaining points effectively because Wells Fargo had a minimum redemption threshold: he had to redeem enough points for at least a ~$400 ticket, meaning you left money on the table if you wanted anything cheaper.

All reports are that the new Wells Fargo Propel World and Propel 365 American Express cards are offering about 1.5 cents per point in value when redeemed through the Wells Fargo travel portal. You’ll earn points or miles on your ticket, just as if you had paid cash, but I expect this minimum redemption requirement still exists. It’s unfortunate that Wells Fargo continues to be so tight-lipped about how to redeem your points even as it touts how easy it is to earn them.

Wells Fargo Propel World American Express Card

- 40,000 bonus points after spending $3,000 in the first 3 months

- 3X points on airlines

- 2X points on hotels

- 1X points on everything else

- $175 annual fee, waived the first year

- $100 in reimbursements for incidental charges during air travel

- No foreign transaction fees

This card appears to be a cross between the Premier Rewards Gold and Platinum Cards from American Express, and if you’re a frequent traveler who doesn’t like tying up their points in a specific airline and hunting for award space, it could be a good deal. Book all your flights and hotels using this card, and redeem the points you earn for additional flights — almost any flight, on any airline — through the Wells Fargo travel agency. (This is similar to the Barclaycard Arrival or Capital One Venture Rewards cards.)

It’s also a Chip + PIN card, which is great for international travel. Wells Fargo has been rolling these out for a couple of years to its high-value customers (again, another situation where my dad asked and was refused). Since some other cards with true Chip + PIN — like the J.P. Morgan Palladium card from Chase — are only offered to customers with a large balance in excess of $250K and for a high annual fee, this seems reasonable at only $175 a year for anyone with a decent credit score.

Wells Fargo Propel 365 American Express Card

- 20,000 bonus points after spending $3,000 in the first 3 months

- 3X points at U.S. gas stations

- 2X points at U.S. restaurants

- 1X points on everything else

- $45 annual fee, waived the first year

- No foreign transaction fees

This card appears more similar to the Chase Sapphire Preferred card, although it’s notable for only offering bonus points at U.S. establishments. It assumes its cardholders are not regular travelers and certainly not international travelers. But it might fit those needs perfectly well. I’ve made it clear in the past that a lot of my travel — and nearly all of my family’s travel — is domestic. Their expenses are mostly groceries, meals, and gas. This card would work great for them, has a lower annual fee, and they wouldn’t need to hunt for award space. They want a cheap flight to visit me for the holidays, not a luxury vacation in Tokyo.

Both of Propel cards promise that their points do not expire if the account remains active. Perhaps they had too many unhappy cardholders who saw their hard-earned points disappear. They already lost at least one.

Just How Much Are Points Worth?

Wells Fargo doesn’t clearly advertise the value of its points or the operations of its rewards program, and that is another thing that still bugs me. When I first started booking through my dad’s account I was getting 1.75 cents per point. It was actually a great value if you knew you wanted a $400+ ticket (I booked a mileage run to Bangkok, so no problem). A more recent reservation appeared to offer only 1.5 cents per point. I think I now know why: PFDigest linked to a reader’s letter announcing that Wells Fargo was raising the value of his points to 1.75 cents after he had spent $50,000 in the last 12 months. It wouldn’t surprise me if my dad had done the same and, having moved his purchases to his Chase credit card, saw the bump removed from his account.

Sometimes I really wish my dad would track his mail and his credit card offers better. Make that all the time.

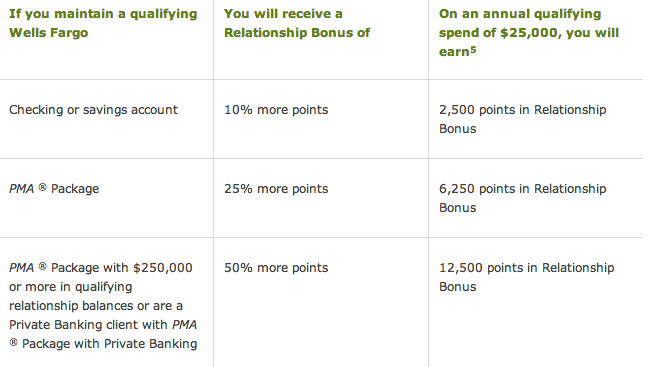

This increased valuation appears to be separate from the bonus Wells Fargo is offering on its Propel cards, which provides 10%, 25%, or 50% more points on every purchase depending on your existing banking relationship.

I don’t know if these offers stack. I don’t even know if the 1.75 cents per point valuation is applicable to these cards, or if it is only for the former Wells Fargo Visa Signature card. But it does show there will continue to be a way to get more bang for your buck if you’re fortunate to have a healthy financial situation. I think my dad would benefit from either Propel card, but he would probably prefer the Propel 365. He is not a frequent traveler. He thinks 100,000 Ultimate Rewards points is “too many.” He’d really rather just pay cash for stuff, and a cash-like rebate on travel is one of the best routes to go. Besides, whereas I spend my spare change on flights and hotels, he spends his on nice restaurants and driving 70 miles each way to work.

Are these cards I’d like to use? No. There still isn’t enough transparency for my taste, and I think traditional loyalty programs are easier to exploit. But the Propel World and Propel 365 make sense for a lot of normal people.