Even though the Brasilian economy may be cooling, the airlines that wish to serve it continue to turn up the heat.

Joining the list of new carriers that will be launching service to the bustling São Paulo Guarulhos airport is Royal Air Maroc, who announced today that it will launch a thrice-weekly flight from its Casablanca hub in the West African nation to its first South American destination just in time for Christmas. Beginning December 20, 2013, RAM will deploy a 767-300ER between the two cities featuring 12 seats in premium class and 224 seats in the main cabin.

Schedule as follows, according to GDS:

AT215 CMN 1230 GRU 2025 B763 –3-5–

AT214 GRU 2155 CMN 0855 (+1) B763 –3-5–

AT215 CMN 2140 GRU 0535 (+1) B763 1——

AT214 GRU 0705 CMN 1805 B763 -2—–

Noticeably, the schedule is operating 2x weekly daytime flights and 1x weekly red-eye flight ex-Casablanca – São Paulo, and conversely, 1 weekly daytime flight and 2x weekly red-eye flights ex-São Paulo – Casablanca, underscoring the challenge for airlines to secure consistent landing slot times at the constrained Guarulhos airport.

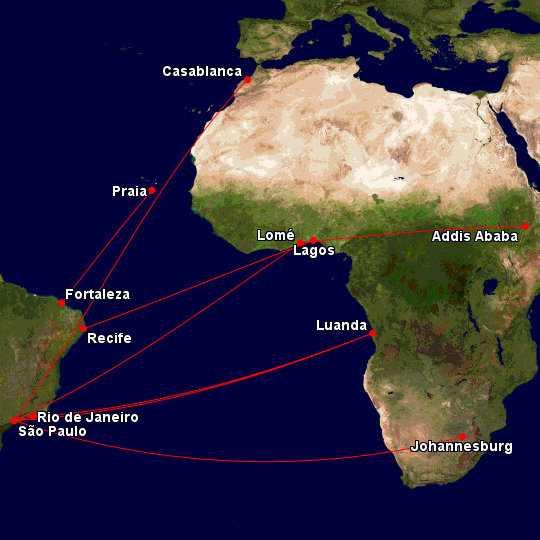

RAM’s arrival in São Paulo will also more than double the number of African carriers serving Brasil from 2 to 5 by year-end. Currently, TAAG Angola airlines flies 7 weekly frequencies from its Luanda base to São Paulo and Rio de Janeiro, and South African Airways flies 11 weekly flights between Johannesburg and São Paulo.

African carriers have presences in other Latin American countries. Argentina receives three weekly services via South African Airlines (SAA) operating between JO’Burg and Buenos Aires, and TAAG operates a weekly flight between Havana, Cuba and Luanda. Buenos Aires recently lost a 2-weekly 747-400 service flown by Malaysia Airlines to Kuala Lumpur via Johannesburg and Cape Town, a unique fifth-freedom route that sadly was pulled due to high operating costs, and arguably also due to increased competition from Gulf Coast Carriers. Emirates, Qatar and most recently, Turkish, have started operating direct services to Argentina.

That being said, the growth prospects from such airlines appears to be centered entirely on Brasil at the moment. Next month, Ethiopian Airlines will launch three weekly flights to Addis Ababa (via Lomé-Tokoin airport in the west African country of Togo), starting on July 1. On July 9, TACV Cabo Verde Airlines will launch a weekly flight from Fortaleza to Praia, Cape Verde, an archipelago of 10 islands 350 mi off the coast of West Africa.

Now, even MORE carriers are studying the benefits of entering into the market. The list seems to be heavily weighted on the Africa side of the equation as EgyptAir and Nigeria’s Arik Air supposedly have been considering new opportunity pursuits in Brasil. However, the one Latin American carrier, Gol, intends to launch three weekly flights from Recife to Lagos, Nigeria by the end of 2013.

Brasil and Africa already possess long-standing cultural connections, and the Brasilian government has been eager to promote increased trade with Africa. After China, Brasil ranks #2 among the list of Africa’s largest trade partners. Carriers like Ethiopian are eager to grab a slice of this pie, having already linked its Addis Ababa hub with Beijing, Guangzhou, Hangzhou and Hong Kong. Hence, expansion in Brasil is a logical business venture for ET.

An article published in CAPA assesses the major considerations of Gol and Ethiopian’s ambitions to enter in the Brazil-Africa sector, implying that there are some hurdles both carriers will need to overcome in order to develop these markets successfully.

Ethiopian aims to connect Rio and São Paulo with Addis Ababa, but, similar to RAM, is encumbered by the challenge of securing additional landing slots at Guarulhos airport. As such, Ethiopian is resorting to a circular routing flying Addis Ababa-Lome-Rio de Janiero-São Paulo-Lome-Addis Ababa thrice weekly, subjecting passengers to multiple stoppovers and unideal connections.

ET is also trying to compete against the Gulf Coast carriers (such as Emirates, Etihad and Qatar, all of which fly into São Paulo) to tap into the Brasil – China market. While Addis Ababa is located centrally between Brazil and China, providing the shortest route between the two countries, the high altitude of Addis Ababa requires long-haul flights to make a technical fuel stop somewhere along the way. That adds to travel time and renders the Ethiopian option has less ideal for travelers.

Furthermore, Ethiopian will face challenges tapping into the domestic (non-Rio/São Paulo) sector in Brasil without securing a local partner, according to the article. However, this certainly does pave way for a potential Gol-Ethiopian partnership to help fill the 787 that will fly between the two cities and ADD, via Lome.

Finally, the CAPA article mentions that local traffic between Lome and Brasil is fairly minimal, although Ethiopian has a local partner via ASKY Airlines, its Togo-based subsidiary, that can provide connections to other West African markets.

Meanwhile, Gol’s strategy on launching Recife-Lagos is likely hinged upon creating a West African hub out of REC. Gol is an entirely narrow-body airline, using 737NGs to fly a few long-distance routes, such as its São Paulo – Santo Domingo, Dominican Republic flight. Although the REC-LOS flight will fall within range of the 737, it is a roughly 5 hour flight on an all-economy class narrowbody. Still, the lack of competition in this segment, especially from low-cost carriers, should create a low entry barrier for Gol.

To Gol’s advantage, neither of its major domestic competitors, TAM nor Avianca Brasil, have intentions to serve West Africa, hence potentially allowing the opportunity for a monopoly over the market.

Further reading on the Brasil bonanza: