Today’s post evaluates Saudi Arabian Airlines‘ official entrance into the SkyTeam global alliance, which occurred on May 29, 2012. The airline, which has since been re-branded and renamed to “Saudia” or “Saudi Airlines” is the official flag carrier for the Kingdom of Saudi Arabia, and is based in the city of Jeddah.

Saudia will indeed bring forth a unique mix of contributions to meet SkyTeams’ needs, despite a few remaining challenges not typically involved in terms of individual carrier-added values to the global alliances realm. Overall, SkyTeam, which was the last of the “big three” major global alliances to formulate in year 2000 after Star Alliance (1997) and OneWorld (1999), will indeed see a major hole filled in its network with Saudia’s integration, as the other two alliances already have members in the Middle East/North Africa region with EgyptAir in Star and Royal Jordanian in OneWorld. In addition to Saudia, Middle East Airlines (MEA) based in Beirut, Lebanon will also join SkyTeam in 2013, further bolstering Sky’s position in the region.

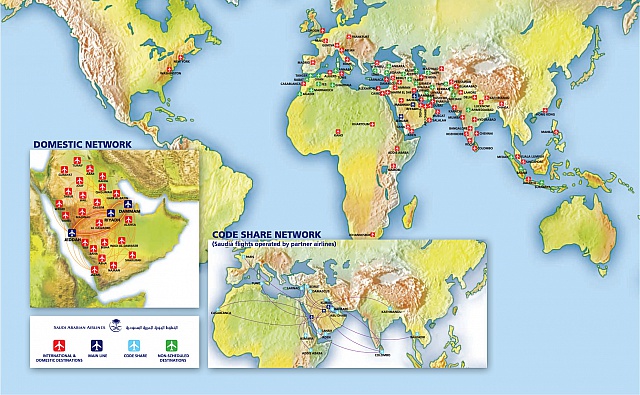

Saudia’s membership will add an additional 35 new destinations to SkyTeam’s global network, most of which are located in the Gulf region and wider Arabian peninsula, alongside a few others in the Indian subcontinent.

Joining SkyTeam was “necessary” as part of Saudia’s long-term transformation

Unlike rival gulf carriers such as Dubai-based Emirates, Abu Dhabi-based Etihad and Doha-based Qatar Airways, all of which have surged in growth over the years while pursuing an anti-alliance strategy, Saudia foresaw the need to join SkyTeam as an integral piece of its long-term transformation journey, which includes re-branding the airline, restructuring core operations and enhancing on-board products and airport services, said Saudia director general Khalid Al-Mohem, in an Air Transport World article dated on January 11, 2011.

As part of a four-year turnaround program, Saudia has refreshed its corporate identity and changed its name, which it had actually used previously between 1972 and 1996, before becoming “Saudi Arabian Airlines” until just recently.

The carrier traces its roots back to just after the end of World War II, when it was established with US assistance, and was mentored by TWA Airlines over the course of its early history. The rise in oil wealth in Saudi Arabia was a boon to the airlines’ growth as it expanded its narrow and widebody fleet to reach destinations all over the globe throughout the duration of the 20th century. Although Saudia’s safety reputation has improved over the years, the carrier has suffered through two deadly catastrophic incidences, including a fire which destroyed a Lockheed Tri-Star at Riyadh airport in 1980 and a mid-air collision with Kazakhstan Airlines over the village of Charkhi Dadri, near New Delhi, India in 1996.

At present, rather than focusing in on one centralized location to concentrate its hub services, the airline has three of them operating instead, at Riyadh King Khaled International Airport (RUH), King Abdulaziz International Airport in Jeddah (JED) and King Fahd International Airport in Damman (DMM), the capital of the Eastern Province of Saudi Arabia.

Annual passenger traffic is fairly robust – in 2010, Saudia handled roughly over 18 million passengers, ten million of which traveled on its international routes and eight million on domestic routes. Its current domestic network is quite expansive, serving 28 destinations throughout the Kingdom and boasting the largest domestic air travel market in the Middle East. Core to its network structure in the domestic realm, as well as the markets it serves in South Asia and North Africa, is the feed into the pilgrimage destination of Medina. Unfortunately, however, the domestic market has been largely unprofitable for Saudia, largely owing to stringent domestic fare caps, which will hopefully be revised in the future, especially as it seeks to transition from being a government-owned airline to a fully privatized one (more below).

Raising its standards

Despite being one of the oldest and largest Middle Eastern carriers, Saudia’s entry into SkyTeam will enable it to re-boost its global image in terms of service and inter-operability by undertaking some much-needed product and infrastructural upgrades. Rather than see itself as a legacy Middle Eastern carrier that has fallen off the bandwagon as newer, larger state-owned full-service carriers and successful low-cost carriers in the Gulf region have emerged, Saudia has done its homework in terms of redefining its “niche” strategy and moving forward into lynch-pining that coverage through rejuvenated feed, connectivity, code-sharing and interlining via the SkyTeam network.

Saudia has indeed logged impressive milestones as a result of putting forth dedicated efforts into their modernization plans. In 2010 and 2011, the carrier completed an upgrade of its IT systems and migrated to the Amadeus Global Distributions System platform, while also strengthening its technical and distribution relationships with Sabre.

Fleet-wise, the airline has replaced its older fleet of McDonnell-Douglas MD-90 planes, as well as its older generation of Boeing 747s, and replaced the former with a mix of the Airbus 320 family and the latter with A330 and Boeing 777-300ER aircraft. The older 777-200ER’s have been retrofitted with new lie-flat business seats, new economy class seats, Audio-Video On-Demand (AVOD) and improved catering. Alcohol consumption on Saudia flights is strictly prohibited.

In addition, the carrier is undergoing a privatization process, which has occurred at a slower pace than its product and IT upgrades. However, it appears that these discussions are entering another full phase of activity after some progress has been made with the Saudi Arabian Ministry of Finance, and is expected to be completed by the end of Q1 2013. As of 2010, the carrier has stated its intentions to commence with an IPO of its mainline passenger business, with a further split into three units serving different functional areas. The primary business will be scheduled domestic and international operations, alongside a secondary specialization in handling pilgrimage traffic, and a tertiary segment to handle VIP traffic, which includes the Royal Flight for the Saudi Royal family and other political dignitaries.

Still, not without unique challenges

As much as Saudia deserves to be credited for the pace at which it has ramped up its standards to meet the expectations of SkyTeam, there will still be a few outstanding network and political bumps along the way going forward.

For starters, its network spread over three hub cities at Riyadh, Jeddah and Damman may pose connectivity challenges for transit passengers, especially those hailing from longer-haul destinations such as New York, Washington, Johannesburg, Hong Kong, etc as frequencies between the hubs and those cities are often less-than-daily and divided among more than one hub. This may deflect traffic away from Saudia for passengers seeking greater convenience and flexibility in terms of scheduling

However, even more challenging is the restrictive nature of entry into the Kingdom of Saudi Arabia, at least in the interim as the carrier is still fully owned by the government. Entry and transit visas are very complicated and expensive to obtain, although they are not required for a 72-hour transit, during which the passenger must remain in the airport. Saudi Arabia does not tend to promote itself as a tourism-driven destination, and seems more interested in boosting its attractiveness to foreign travelers and business investors.

Also, from a general public perception standpoint, there is also scrutiny surrounding how the nation maintains certain attitudes towards women and other cultural groups, adding in an extra layer of complexities within and of themselves.

Saudia and SkyTeam

Visibility within pre-existing SkyTeam member hubs will not pose an issues for Saudia, as it already serves several primary ones, including Rome Fiumicino (Alitalia), Paris Charles de Gaulle (Air France), Guangzhou (China Southern), New York JFK (Delta), Nairobi (Kenya Airways) and Jakarta (Garuda Indonesia, which is due to also join SkyTeam in early 2013).

While it already codeshares with Air France and Kenya Airways, Saudia will not code share with Delta for the time being, but the two will offer some partnership benefits such as reciprocal lounge access as well as frequent flyer miles.

Overall, Saudia’s seems to have a solid grasp on its own business operating visions which will indeed still provide a good “fit” within SkyTeam. Unlike other carriers in the alliance, Saudia will likely focus on point-to-point traffic rather than network traffic, while nevertheless delivering full-scale volume in a highly important global region.

References

CAPA: Saudi Arabian Airlines prepares to join Skyteam

CAPA: Saudi Arabian Airlines, now known as Saudia, joins SkyTeam and adds 35 destinations