We usually leave the contrarian posts to Julian, but I’ve been having a number of conversations with friends that leading me to believe we’re reaching an inflection point with mileage devaluations. Your pool of miles from diligently hoarding credit card signup bonuses and 5X back spending categories may be in for outsized value opportunities down the road.

What’s changing?

Earning miles has gotten much harder, both from flying and from banks tightening up on giving out large signup bonuses (5/24, Citi, and we haven’t seen as many offers as previous years and they’ve largely stayed the same or gone down).

Flying, on US carriers, is now no longer a reliable way to earn a significant chunk of miles either. Carriers on average are granting half to one quarter the number of miles that they used to under the new revenue-based mileage regimes (for average travelers with no status buying cheap to moderate coach fares)

So let’s break out our monetary policy textbooks (you keep those around don’t you?). If the supply of miles/money is being created at much slower rates, generally spending goes down (people start redeeming less eagerly than they used to) and inflation starts to get curbed — less threat of devaluations. Check out this definition from Investopedia.

How did we get here?

We’ve just weathered a pretty inflation-driven miles period, where banks bought miles on the cheap from the major airlines as part of bailing them out of bankruptcy (Chase with United miles, Citi with AA miles). This pushed mileage balances pretty high, causing a run on the bank in terms of redemptions. Availability has been comparatively harder to come by as people trade up from a domestic trip to a trip to Europe or Asia, or (gasp) domestic first class.

Remember, in bad economic times, airlines open the piggy bank and offer more incentives to get people flying. This works because there is a lag in those redemptions that they can worry about weathering in better times. So you see more mileage bonuses for flying (as we did after 2009-2010).

In good economic times (like the past two years, the US airlines have have quite a few good quarters), you see airlines tighten their belts and get more stingy, or devalue their award charts since they are actually able to sell the seats that would otherwise be given to redemptions. Revenue management and loyalty have traditionally had an adversarial relationship, where people setting the pricing levels see award redemptions as cannibalizing valuable inventory or at worst, letting money fly out the door. Conversely, loyalty folks often feel like their case for long term customer engagement is falling on deaf ears.

So what’s new? Why so bullish on the future?

Redemptions levels are going up AND down

Delta, American and United are offering (or more directly advertising) short haul specific redemption rates, partly because that 12,500 mile bar for a domestic redemption has gotten harder to attain for most people.

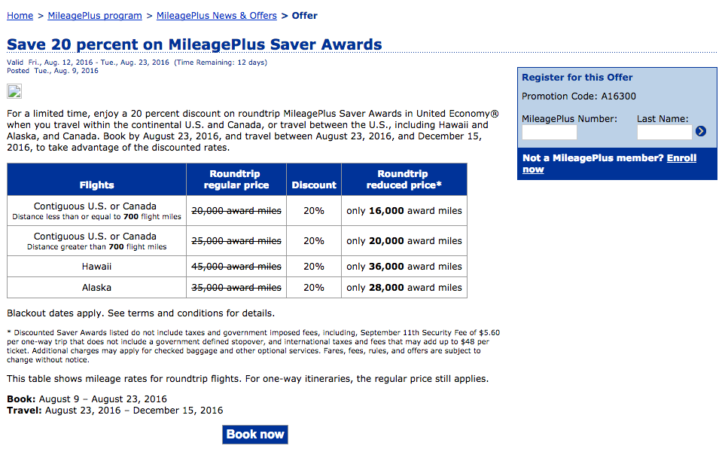

UA will charge 10,000 miles one way for a domestic flight under 700 miles, Delta is offering specific segments for 5,000 and 10,000 miles instead of the traditional 12,500.

American offers a rolling set of cities at a discount paired with flight distance (discounts change depending on whether the segment is more or less than 500 miles) and based on which credit card you hold. The largest discounts are 7,500 miles off a 25,000 roundtrip domestic redemption, considerably cheaper than it has been in the past for redemptions to many secondary/tertiary cities.

Honestly, this is not where I’d usually spend my miles, but for many peoples’ patterns, this means an additional trip or two, particularly if you’re taking a family to visit relatives or flying to airports that are physically close, but tend to have expensive fares. (Any ski fan trying to get to Western Colorado from Denver or routinely commutes to islands knows this pain well).

BA really sparked a competitive race at those short haul redemptions rates and while they pulled back from 4,500 Avios redemption tier in North America, it’s still going strong in Europe, South America and Southeast Asia, where many short routes are still expensive with cash and dirt cheap with miles. Again, islands, mountains, small airports…

Airlines are starting to offer more consistent award redemption and mileage sales

United is currently offering 20% of all domestic redemptions for much of the fall. We saw a similar promotion from Delta to Europe. Air France has been doing this for years.

Granted these sales are generally in coach and are time bound, but as they become more consistent, they begin to affect people’s expectations more and more.

Lifemiles sales are now the norm and AA has gotten more aggressive with mileage sales now that the folks from US have taken over. If you know you can consistently redeem at a rate higher than what they are selling a mile at, it can make sense to stockpile large increments of miles this way to get discounted access to international first and business class awards.

Large pools of miles (and people who know how to generate them) will have less competition

Given that the average traveler really loses from the new mileage accrual schemes and tighter bank approval policies+lower signup bonuses, this really benefits people in our community. Really, it benefits anyone that can easily rack up say 50,000-100,000 miles in an account from expensive tickets, but those types are a dying breed. Corporate travel policies will likely only get more draconian and forbid foolish spending habits.

Manufactured spending gets more powerful as a mile generation tool. Mileage runs become less powerful. The game changes.

But if you’re one of the lucky few flush with miles, you now have far fewer people booking up award space you may be seeking out. I’ve noticed availability to Europe get a lot better than it has been in the past year or two on star alliance and skyteam.

For international business and first class awards, the devaluations pushed many of these award categories out of reach for most people, as it’ll take years of flying 10,000 miles now to get up to even a one way redemption. But given that upwards of 85% of redemptions are domestic economy, perhaps the effect of less competition really won’t be noticed.

As per usual, I’ve had to break this into two parts to do battle with all the other shiny things that may distract people on the internet. And Pokemon Go. Stay tuned for the next installment, likely published tomorrow