From the desk of the Devil’s Advocate…

Last week Scott wrote a post here at Travel Codex advocating that one should never “pay with points.” Now, Scott is the Top Banana around these parts and I’m just Second Banana, so it’s not my place to argue with the boss. Actually, I’m pretty sure I’m not even Second Banana. That’s probably Amol or Tahsir. Or Eric. Come to think of it, I might be just Banana.

In any case, I think Scott is as far from a Conventional Wisdomer as you can get. But his argument about never paying with points is definitely a Conventional Wisdom position, and I’m all about challenging Conventional Wisdom. So I think it’s worth exploring to see if there are circumstances where paying with points might be advisable.

(Keep in mind I’m arguing against the Conventional Wisdom here. Not Scott. Scott’s my exceptionally nice boss who lets me show up, say crazy things, and then wander away for another week. So I would never argue with him. I’d only argue against Conventional Wisdom which perhaps Scott had also happened to agree with in passing though he probably wasn’t that passionate about it and hopefully he won’t get upset with me for writing this and if he does maybe I can claim Plucky broke into my account and wrote it while I was distracted watching “The Voice.”)

OK, I think I’ve adequately covered myself. So quick, let’s talk about Scott while he isn’t looking.

The Age-old Question: What Is a Point Worth?

First, when we say “pay with points,” we’re referring to the option some loyalty programs offer which allows you to redeem points at a fixed value against the actual current airfare (instead of searching for restricted award space using the airline’s “award chart”). Chase Ultimate Rewards offers this option, as does Delta (if you have a Delta credit card) and a few others as well. Usually the fixed value you’ll get when paying with points is somewhere between 1 and 1.25 cents per point.

The Conventional Wisdom is that you should never use pay with points because you won’t get as much value from your points as you would if you redeemed for a plain old Saver (or perhaps even Standard) award instead.

This, of course, depends on how much value you believe you’re getting when you redeem for one of those chart awards. Many people believe you shouldn’t consider the actual cash value of a ticket when you make an award redemption, because in the process of redeeming for that award, you may have made compromises that you wouldn’t have made if you were simply paying cash. Or if you’re redeeming for a premium cabin award, you’d never pay such an exorbitant amount of actual money, so it’s not fair to calculate the redemption at full cash value.

If that’s the case, it’s a lot easier for me to argue that paying with points is a fine deal. In most cases, calculating redemptions that way results in a much lower “cents per mile” valuation than comparing the actual cost of the cash ticket, especially for premium cabin redemptions. If you figure it that way, you’ll usually end up in the 1 to 2 cent per point range, which isn’t that much better than paying with points.

I’m all for anything that makes my job easier, so I’ll just go with that argument, thanks. See, everyone, paying with points is fine. We’re done for the week. Go ahead and roll the disclaimer.

Devil’s Advocate is a weekly series that deliberately argues a contrarian view on travel and loyalty progr… wait a minute…

Uh oh. I just remembered that I started this entire Devil’s Advocate series with a post arguing that you should compare award redemptions to a ticket’s actual cash value.

But I’m playing Devil’s Advocate! I’m not bound by my previous outlandish positions, am I? I mean, that was my very first post. I was young and begging for attention. Cut me a break, will you?

OK, fine. Fine! I said it and I’ll stick to it. But I never said that every single redemption was worth 10 cents per mile. Even with flexible currencies, you’ll often have redemptions worth closer to 2-3 cents per point unless you’re doing nothing but traveling internationally in business class (and I agree there are some people like that, but not most people).

What Do We Gain for Giving Up Some Value?

Let’s say we can get 1.25 cents per point by paying with points, and therefore we “lose” 1.75 cents per point using our points that way. What are we getting in exchange?

The obvious advantage is that we have no restrictions on availability. Any seat that’s available to buy with cash is available when we pay with points (that is, if the bank’s airfare search engine is working correctly — do you hear me, Citibank?) But we already knew that advantage. What else do we get?

Well, since our credit card company is actually buying a cash ticket for us when we use pay with points, we’ll earn miles flying the flight. That’s worth something, though it varies depending on how long a trip we’re taking. A cross-country roundtrip is about 5,000 miles, so on a $300 ticket costing 24,000 points, we’re effectively burning only 19,000 points, which adds roughly another 0.25 cents per point to the valuation. Plus we’ll receive bonus redeemable miles if we have any sort of elite status with our airline.

Speaking of which, since it’s a paid ticket, we’ll also be earning elite miles. It’s hard to value those since it truly depends on whether you’re going for elite status in the first place, but 5,000 elite miles could be worth another half cent each to the right person. The ticket cost also gets added to your elite dollar spend if you need to meet that threshold as well.

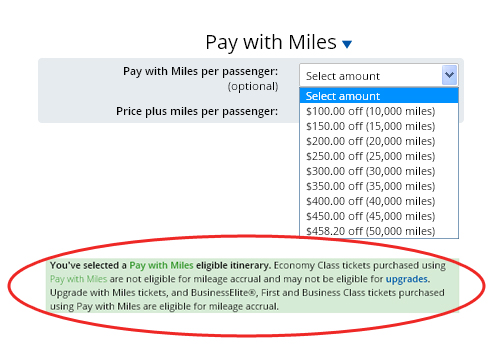

If we already have elite status, then we’ll get elite benefits we might not receive when flying an award ticket. Depending on our elite level, that could mean a complimentary upgrade, though it depends on the program. Delta, for one, doesn’t give upgrades on tickets purchased using pay with points, nor are the tickets eligible for mileage accrual.

By the way, when using pay with points, most programs give you the option to mix and match your points with cash. So that’s another advantage — we don’t have to spend only points. We can pay for half the fare with points and the other half with cash, or any combination thereof.

Add it all together and… well, we can’t really add it together because there are quite a few intangibles in there. But I think it’s fair to say that under some circumstances, it’d be possible to gain more in value than you’d lose by paying with points. Not every time, but sometimes.

What about Other Credit Cards?

There’s a second part to the Conventional Wisdom about paying with points, which Scott mentioned as well. If you’re only going to redeem for a fixed value of 1 cent per point — or even 1.25 cents per point — you might as well skip having a premium credit card and instead use a card like Barclays Arrival Plus World Elite card or the Fidelity Investment Rewards American Express, since either of those cards will give you 2 cents per dollar spent on everything.

Well, that’s true, but only if you’re not counting any bonus categories.

To take an example, as we all know, the Chase Sapphire Preferred offers 2x points on all dining and travel expenses. That means if you’re redeeming at Chase’s rate of 1.25 cents per point, you’ll end up with an effective return of 2.5 cents per dollar spent on the bonus categories.

That’s only half a cent better, but in fixed value redemptions, half a cent can go a long way. It means you’ll only need $12,000 in credit card spend instead of $15,000 to get a completely free $300 ticket. All of that spend would have to be in bonus categories, which might not be that easy. But there are other Chase cards with bonus categories that can be even more lucrative (helloooooooo Staples).

Even with a mix of regular 1x spend coupled with bonused spend ranging from 2x-5x, depending on what you’re putting on your credit cards, it could make sense to use pay with points instead of a 2x fixed value or cash back credit card.

The Devil’s Advocate Firmly Believes In Using the Right Points for the Right Job

I would never presume to speak for Scott… no, wait, is “presume” the right word? I meant “hesitate.” I would never hesitate to speak for Scott, so what I think Scott was trying to say is that certain points (such as American Express Membership Rewards earned on a Platinum card, which was the actual subject of his post) are so incredibly valuable when used for premium cabin award redemptions on a regular award chart that it’s almost a shame to not maximize them for that purpose.

I think that’s a fair argument, and it brings us back to a point I’ve made here before — there’s a lot of different types of loyalty currencies, and they all have strengths and weaknesses. The best way to play the game is to maintain a healthy inventory of all sorts of different points. If you want a stash of fixed value points for domestic economy redemptions, then build up a nice supply of them alongside the Membership Rewards you use for international premium cabin trips.

Okay, did we make everyone happy? Cool. Then let’s run the disclaimer and get out of here before Scott realizes we drank all his gin.

Devil’s Advocate is a weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by sending an email to dvlsadvcate@gmail.com.

Recent Posts by the Devil’s Advocate:

- Just How Terrible Are Citi ThankYou Points? (Yes, It’s An Encore!)

- Are Avios Always The Best Option For Short Haul Flights?

- Should a Capital One Card Be In Your Wallet?

Find the entire collection of Devil’s Advocate posts here.