It’s just been a short two years since the Equifax data breach occurred exposing 143 million people. Now Capital One is in the middle of a huge data breach. I want to share my story of “free credit monitoring” after the Equifax debacle.

Before I tell my story, I want to express my feeling of data banks exposing “personally identifiable information”. What used to be a rare occurrence, now seems to be regular events. What really aggravates me is that Credit Bureaus should have the very best security as they have consumers personally identifiable information without giving consumers an opportunity to “opt” out.

This breach is particularly disturbing because it was an inside job that could have been prevented. The perpetrator was an Amazon AWS cloud storage employee. She was able to penetrate the system by exploiting a misconfigured network vulnerability which security experts had been aware of for years. She was able to steal records of 106 million customers of Capital One. She started hacking the system last March, downloading the data without setting off any alarms. Capital One didn’t find out about the breach until last month when they were notified by an outside researcher.

After the Equifax breach, my wife and I were both offered free credit monitoring for 12 months. (See your options under the recent settlement with the FTC.) I did not have a great deal of trust in Equifax so we both enrolled in LifeLock. Neither one of us ever heard anything from the free credit monitoring service. I was lucky, nothing happened to me. My wife, on the other hand, was contacted at least two dozen times by LifeLock. People were applying for credit from buying cars, opening credit card accounts to cell phone service.

She just got a call two weeks ago regarding the opening of new cell phone service with Verizon. Again, we never heard a thing from the free credit monitoring service. Credit monitoring tells you what happened after the fact. Our experience with LifeLock is that it works in real-time as we were able to stop trouble in its tracks.

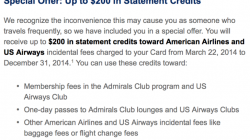

As the Equifax settlement winds up, you may want to consider if the offer of credit monitoring will really protect you. I have my doubts. Now with the data breach at Capital One, we will undoubtedly be offered free credit monitoring again.