On the face of it, the new credit card announced by Apple on Monday, in partnership with Goldman Sachs, seems pretty good. You can get 2% cash back anywhere Apple Pay is accepted, which is comparable to some of the best cash back cards available. If you must use a physical card then the returns drop to 1%. There’s no annual fee, and it has the typical style and design you would expect of an Apple product.

If you are the kind of person who adores the rose pink Amex Gold Card or the heavy feel of the Chase Sapphire Reserve, then maybe such superficial details matter to you. Most cash back, no-fee cards do not have this much glitz and glamour. And there’s something unique (or maybe not unique?) about scrubbing the numbers and signatures from the card’s surface.

However, if you want to get down in the details of the card’s features and rewards, then I don’t think it’s the best choice for most people.

Get Better Rewards …Everywhere

Apple’s headline figure is 2% cash back on every transaction you make with Apple Pay, which means you have to pay with your phone and not a physical card. And that 3% on Apple purchases looks great, but how much are you really spending at Apple? Do you even want to know that number? (A year before my wife and I got married, we finally looked at how much we spent dining out, and that was scary.)

But there are other cash back cards that have been around a long time and don’t impose this requirement that you pay with a mobile phone. If for some reason you can’t use Apple Pay to complete the transaction, your rewards drop to just 1%. It would be better to carry the Fidelity 2% Cash Back Card, and Doctor of Credit has a longer list for you to consider.

I personally use the Chase Freedom Unlimited card for purchases in non-bonused categories. This no-fee card earns just 1.5 Ultimate Rewards points per dollar, which is equivalent to 1.5% cash back if you use those points for cash. But I can also combine them with points from my wife’s Sapphire Reserve card and then redeem them for 1.5 cents each on travel. That makes it equivalent to 2.25% cash back.

My strategy only works, of course, if you shell out for the $450 annual fee on the Sapphire Reserve, but it comes with a $300 annual credit and numerous other perks that makes it worthwhile.

Gamification of Rewards and Debt

Besides the rewards structure, which is comparable (but not really superior) to many competing cash back cards, I was really disturbed by how Apple issues cash back rewards and allows you to manage your monthly payment.

Apple issues cash back rewards every day rather than waiting until the end of a statement cycle. As an actual scientist with training in behavior and addiction, I will tell you this is a bad thing. It trains you to spend more for the anticipated reward at the end of the day rather than practicing delayed gratification. Besides, why do you need 2% cash back in your account at the end of every day? Because you spent $200 on expensive jeans and suddenly have a desperate need for $4 in pocket change to buy your latte tomorrow morning? It’s a gimmick.

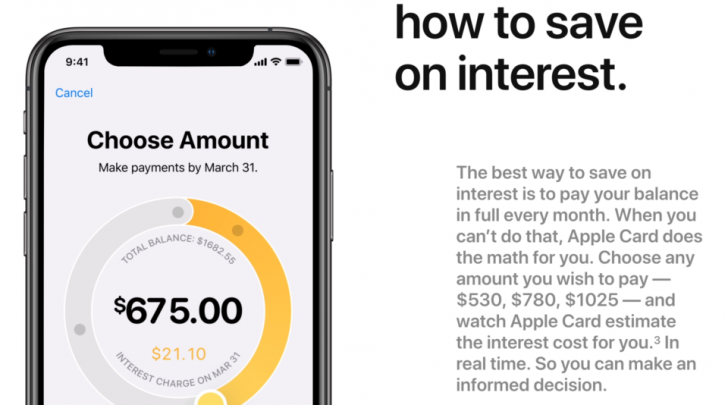

The payment options are problematic, too. Apple lets you slide a wheel around to choose your payment amount and claims it does this to make it very clear how much interest you’ll pay on the remainder. It made a point in the presentation to contrast this with how regular credit card statements publish this information. But I actually think the paper statements are better.

When Apple shows you the interest on the unpaid portion, it is only showing you the amount to be applied to the next statement. It does not show you the effect of compounding, which is the real danger. According to the best debt relief companies, most credit card statements will show you the cumulative interest paid on the life of the debt, and they might even show you two options based on the minimum payment and a slightly higher payment. (Of course, you can pay the whole amount and accrue no interest, which is what you should be doing if you have any interest in rewards cards.)

An extra $21.10 in interest next month sounds painless, and this is the number Apple focuses on. But that initial $1,638.55 balance could be much, much higher due to the effects of compound interest over several years. I think Apple is actually deceiving customers by not publishing the total cost (time + principal + interest) on this display.

Acceptance Does Not Equal Adoption

Finally, I think this is another case where Apple is just ahead of its time. Sometimes it works out in the end, and the transition is relatively painless. I remember when Apple ditched the CD-ROM, and everyone thought they were crazy. CRAZY! But other times it can turn out like the USB-C port, and you spend $100 on adaptors because even Apple’s own product suite isn’t compatible.

Mobile payments still have not caught on in most of the world. Even if they are accepted–and Apple boasted some impressive figures during its launch event–that does not mean people actually use it.

I cannot remember the last time I saw an American use their phone to pay for something in a retail store, and I have lived in Seattle and Austin, two of the nation’s largest tech hubs. Asking your server in a restaurant to settle the bill with a mobile phone is more likely to cause delays than facilitate payment. Technological adoption faces these cultural hurdles everywhere, even in Japan, where you can pay for the subway with your phone but cash remains king.