This is the second post in my three-part series discussing everything you need to know about Southwest Airlines. In last week’s post, I covered the basics of flying on Southwest. This week, I’ll shift gears and talk about Rapid Rewards, Southwest’s frequent flyer program.

Southwest Airlines Rapid Rewards – Program Overview and Earning Miles on Flights

“Rapid Rewards” started off as a very simple program. Fly eight segments, and earn a voucher you can use for a free flight anywhere. Of course, that worked great when Southwest mostly operated short, point-to-point routes. But Southwest’s route network outgrew that system. After all, if Houston to Las Vegas earns the same credit as Houston to Dallas, that isn’t exactly fair.

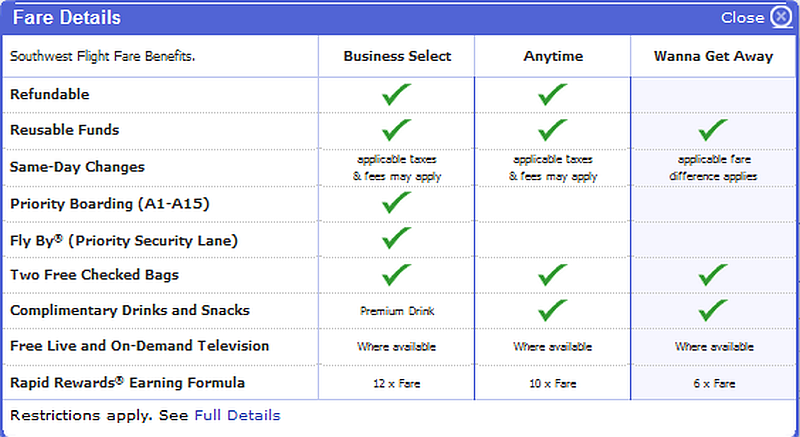

Enter the current version of Rapid Rewards. Similar to jetBlue’s “Mosaic” program, Rapid Rewards is entirely revenue-based. All fares earn a fixed number of miles per dollar spent on base fare. However, Anytime and Business Select fares earn miles at a higher rate, per the chart below. Senior fares earn miles at the same rate as Wanna Get Away fares.

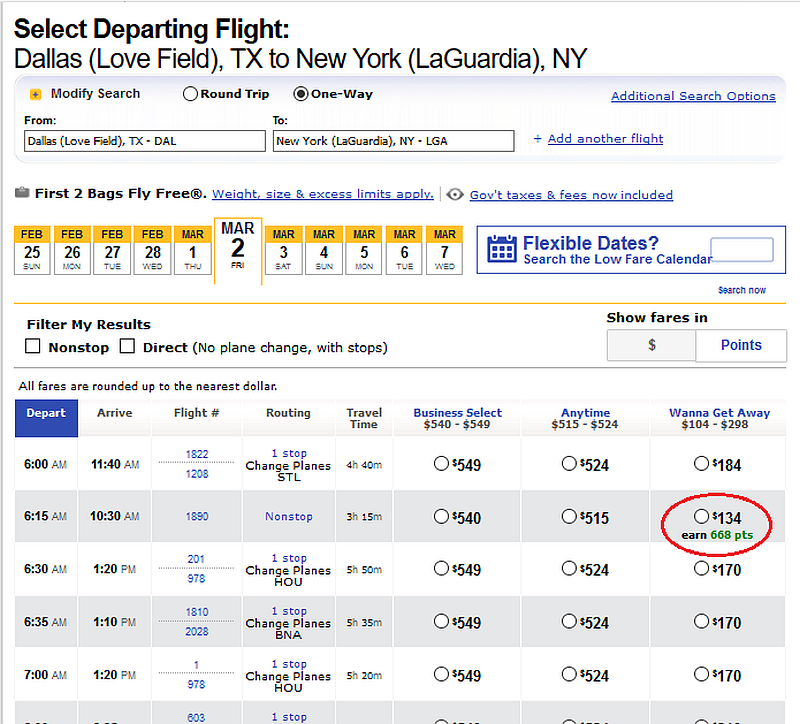

Of course, calculating miles isn’t as easy as multiplying the total ticket cost by miles per dollar. You have to strip out taxes and fees first. Thankfully, Southwest makes it easy to see your earnings when buying a ticket. Just mouse over the fare, and it shows the number of miles earned.

Note that amounts paid for fees, such as Early Bird Check-In, do NOT earn miles. Also, as Southwest does not have any airline partners, there are no opportunities to earn Rapid Rewards on non-Southwest flights.

Southwest Airlines Rapid Rewards – Redeeming Miles for Flights

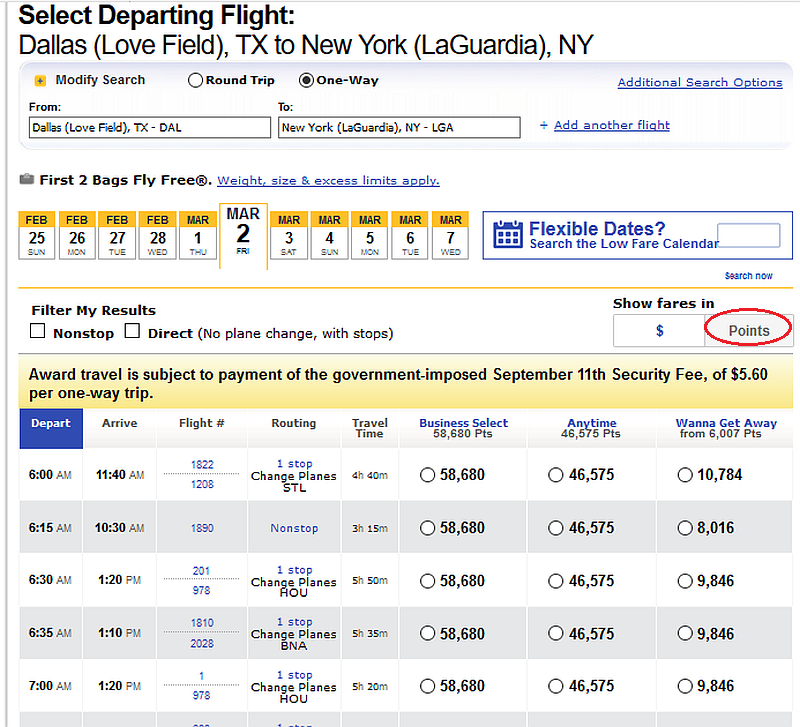

Also like jetBlue, Rapid Rewards uses a completely revenue-based redemption system. To determine the cost of a flight in points, simply click “Show Fares in Points” up top.

- 72 points per dollar for Wanna Get Away fares (1.39 cents per point)

- 100 points per dollar for Anytime fares (1 cent per point)

- 120 points per dollar for Business Select fares (0.83 cents per point)

On that basis, Rapid Rewards provide roughly the same value as other frequent flyer programs on its face. However, the drawback is that point values are absolutely fixed. You get 1.39 cents per point towards Wanna Get Away fares, period. There are no opportunities to achieve outsized value, such as by redeeming for premium cabin fares. Also, due to the poor redemption rates, using points for Anytime or Business Select fares rarely makes sense. Why? At a penny a point or less, you actually receive equal or better value just by taking a statement credit for credit card points.

The fixed redemption value also seems to limit the usefulness of redemptions generally. After all, the more expensive the fare, the more points you need. In my above example, does it really make sense to redeem 8,016 points for a $134 fare? Well, maybe. I’d probably just as soon pay cash. But what if I need a positioning flight to New York to catch an award flight? 8,016 points is less than the 12,500 needed for saver awards on American or United. And I can fly nonstop; most saver space these days requires a connection it seems. Nonstop often means paying for a standard award, a minimum of 25,000 points. Suddenly it makes sense. I can use that $134 to pay for meals on my trip, after all.

With the basics out of the way, I’ll now discuss partner earn and burn possibilities.

Earnings Points Through Partners

As mentioned, Southwest has no airline earning partners. However, like other programs, they do provide non-airline partners, with varying levels of value.

Credit Cards

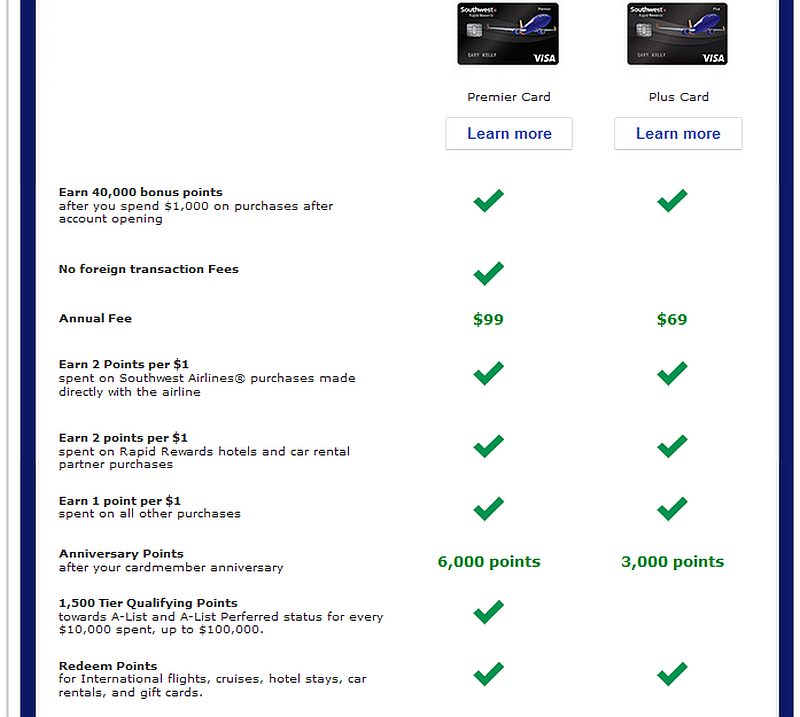

Southwest’s primary credit card relationship is with Chase. Chase offers two Southwest-branded products, the Rapid Rewards Plus and Premier Cards. Below is a summary of the benefits offered by both cards.

Chase also offers a business version of the Premier card, with most of the same benefits as the personal card but a 60,000 point sign-up bonus. If you’re interested in applying, you can click through the links on this page from the Southwest website. (While I provide these links as a courtesy, I do not receive referral bonuses of any kind.)

Though the personal cards offered a public sign-up bonus of 50,000 points in the past, 40,000 is the current bonus. (UPDATE: Southwest recently increased the public bonus back up to 50,000 points.) Also note that the Rapid Rewards card falls under Chase’s infamous “5/24” rule. So, keep that in mind if you plan to apply for this card. One VERY useful benefit of either card – points accrued, including sign-up bonuses, count towards “Companion Pass” qualification. Members who earn 110,000 points in a calendar year receive the pass, which allows you to fly one companion with you for only taxes and fees, whether on a paid or award ticket. The benefits apply for the year in which you qualify, plus the entire next calendar year.

So in theory, you could apply now for both the personal and business Premier cards. After meeting minimum spend, you’d have 104,000 114,000 points, almost enough for the pass. Get it early in the year, and you have benefits for nearly two full years. Needless to say, this can provide significant value if you fly Southwest even a little.

If you don’t have/don’t want the Rapid Rewards cards, you can also transfer Chase Ultimate Rewards at a 1:1 ratio. Or, if you’re one of the 6 people in the universe (including me) with a Diners Club, Club Rewards also transfer. The rate is pretty poor, though – 1,200 RR miles for 1,613 Club Rewards points. However, given the limited fixed value of Rapid Rewards, I don’t recommend doing this. In most cases, the better value is to transfer to other airline programs.

Other Travel Partners

Rapid Rewards also allows earning through various hotel and car rental partners, as well as Super Shuttle. Car rentals and Super Shuttle are pretty straightforward. All rentals typically allow earning airline or hotel points for a qualifying rental, and you can choose Southwest as the travel partner. Super Shuttle, meanwhile, awards 150 points per ride. Nothing terribly controversial here. If you usually stick to Southwest, might as well earn some extra points.

I advise extreme caution with hotel partners, though. In many cases, this isn’t a “double dip” opportunity. Instead, you essentially forfeit hotel points in exchange for Rapid Rewards points. DON’T do this, especially for SPG or World of Hyatt points, as you only earn a flat number of points per stay. If you really want to exchange hotel points for Rapid Rewards points, better to just earn the points, then convert later. Note: previously, hotel transfers counted towards Companion Pass qualification. That loophole closed last April, though.

Shopping Portal

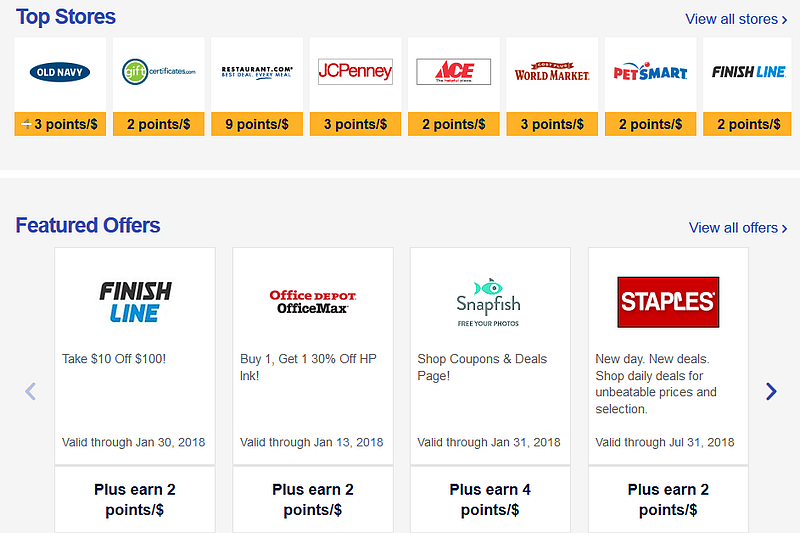

Like most other major airlines, Southwest operates a dedicated shopping portal to earn points when purchasing everyday goods. James wrote up an excellent piece on airline shopping portals, including how to double or triple dip using credit card bonuses. Like American, United, et al, Southwest offers varying bonuses that change periodically.

Personally, I prefer to use portals to credit to other airline currencies. But if you mostly fly Southwest, the portal provides a good way to earn extra points. Base shopping portal points also count towards Companion qualification. And, if you have points about to expire, buying something cheap off the portal resets the clock.

Other earning possibilities include dining, electricity plans, and e-Rewards.

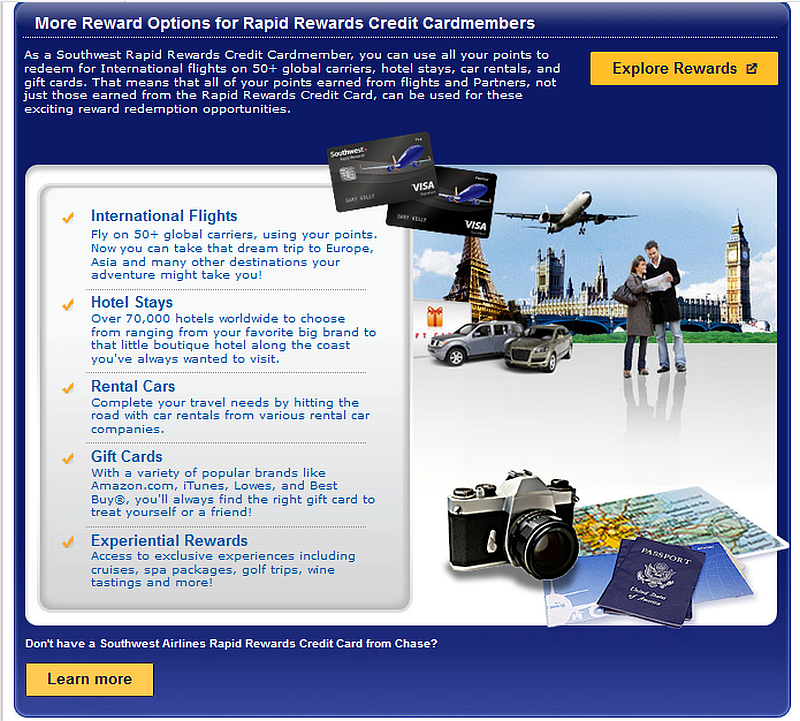

Redeeming Points Through Partners

As mentioned earlier, Southwest has no airline partners. Yet the “How to Redeem” section of the website suggests redemptions aren’t limited to Southwest flights.

It’s not quite as exciting as it sounds. If you have one of the Chase cards, you can redeem points like other non-premium Ultimate Rewards points. In other words, for merchandise or a penny per point statement credit towards Chase travel portal purchases. Better than nothing, though you’re not going to be getting First Class tickets to Asia, unless you have a ton of points to burn. Also, if you do redeem for coach flights, beware the problem of Basic Economy fares that plague the Chase travel portal.

Final Thoughts

The fully revenue-based model, and the lack of airline partners for earning or redemption, limits the usefulness of Rapid Rewards. Also, the fixed valuation at ~1.4 cents/mile provides, at best, a wash if transferring from Ultimate Rewards (I value those in the 1.4-1.5 cents/point range). But the dynamic pricing does provide some useful redemption opportunities for positioning flights. You can potentially redeem at a lower number of miles compared to competitors, without annoying connections. Finally, the fact that credit card spend, including bonuses, counts towards Companion Pass status can provide outsized value.

In my final installment next week, I’ll discuss elite status in the Rapid Rewards program.