As I have mentioned several times when I discuss credit card offers, the Starwood Preferred Guest card from American Express is one of the best opportunities available for casual and frequent travelers alike. But I don’t usually tell my friends to apply because the standard sign-up offer of 25,000 points is often increased to 30,000 every summer. That time has finally come, so I’m encouraging my family, friends — and you! — to jump at the chance to get an extra 5,000 points. I expect this offer to expire around September 3.

30,000 points is a 20% premium, yet it remains a relatively low sign-up bonus. So why bother? The SPG Amex is NOT one of those cards you churn and burn, although some may still do that. This is a card you can keep and use.

Here are five main reasons it never leaves my wallet.

Transfer to Airlines

You can transfer points to several airline loyalty programs at a 1:1 ratio and get a 25% bonus when you transfer blocks of 20,000 points. That means 20,000 points = 25,000 miles with most airlines, including American, Delta, and Alaska Airlines — or premium carries like Singapore and Emirates. It’s a great way to keep your points flexible instead of committing them to a single program. You’ll have to spend $5,000 over six months to qualify for the sign-up bonus, so that means you’ll earn a total of 35,000 points — enough for 40,000 airline miles! Earn 5,000 more points and transfer into 50,000 miles.

Combine Balances

Combine your points with a spouse or family member to make expensive awards more attainable. Megan and I have three SPG Amex cards between us, and so we earned 105,000 points in sign-up bonuses and qualifying spend. (It’s actually not that hard to meet the $5,000 spend requirement on each card given the 6-month window.) Anyone can combine points as long as you’ve lived at the same address for 30 days, so I recommend you update your accounts right now.

Save on Hotels

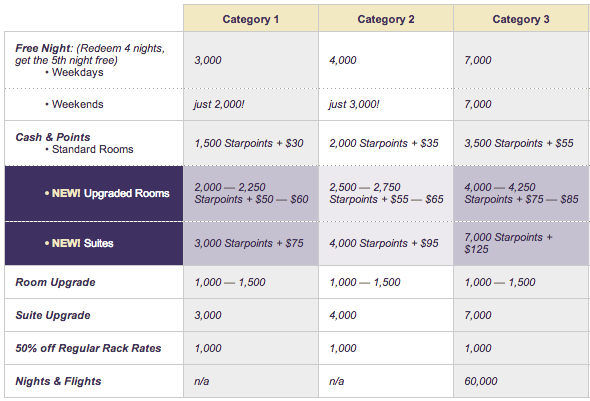

Starwood also has some excellent hotel brands. Those 105,000 Starpoints? Megan and I will be spending our honeymoon at the luxurious St. Regis Bali later this month. Although it was a very expensive redemption, other awards are quite cheap. It’s not hard to find a good hotel in the U.S. or internationally for just 7,000 points a night. The cheapest free night awards are just 2,000 to 3,000 points a night depending on the day of the week.

You can stretch your points further in a variety of ways. Cash + Points awards generally let you pay half the paid rate and half the award rate. It’s just a good way to stick to a budget. (I can afford something, just not the full price.) Flights + Nights let you redeem some extra points, getting both airline miles and a certain number of nights at a mid-tier hotel. Fifth Night Free lets you pay for four award nights and get the fifth free.

Get Elite Status Faster

Each card by itself offers 2 elite qualifying stays and 5 elite qualifying nights per year. I’m currently SPG Gold but expect to receive SPG Platinum status for the first time this year with 50 qualifying nights (also available with 25 stays). Ten nights will be due to my personal and business SPG Amex credit cards, which I consider worth the $65 annual fee (waived the first year).

But the best part? Award stays also count toward elite status! Yes, people who read this blog know I like my status — I’m willing to pay, just not at the same level as some business travelers. Starwood is one of the few chains to promise its elite members an entry-level suite upgrade, if available. Those who qualify with 50 nights or more each year also receive 10 suite upgrade certificates that can be confirmed 5 days in advance.

Valuable Points with One Card

Finally, the points can be extremely valuable. Look past the bonus to see how you’ll earn more points in the future. Consider these alternative options:

- The best cash-back cards include the Barclaycard Arrival (2.2% back if redeemed for travel) or Fidelity Rewards Amex (2% back, and requires a deposit or brokerage account with Fidelity).

- Airline cards often earn just a single point on most purchases. That point can be worth as little as 1.67 cents with Southwest, or as much as 2 cents if it’s with United or American Airlines. You’re stuck with that airline’s award program.

- Bank rewards cards like Chase Sapphire Preferred and Amex Premier Rewards Gold have generous bonus categories, but what if you’re not spending in that category or don’t like those transfer partners? I give Ultimate Rewards a value of 2 cents and Membership Rewards a value of 1.7 cents.

I assign Starpoints a value of 2.5 cents, which makes them one of the most valuable loyalty currencies. This is because of that transfer bonus I mentioned earlier — not to mention they have more partners than Ultimate Rewards or Membership Rewards. If I can easily get a 25% bonus when I transfer 20,000 points, then each point is worth 1.25 miles — and I value an American Airlines mile at 2 cents.

Starpoints are worth even more than the cash-back currencies, assuming you prefer to redeem for international awards in premium cabins, which is where miles get their maximum value. That’s one reason I don’t personally use the cash-back cards mentioned above.

Conclusion

I like this card because it’s a simple way to earn valuable points you can use in a lot of different ways. It’s certainly not perfect in every situation. Am I abroad? Oops, this card has foreign transaction fees, so I’ll use another. But most of my expenses are domestic. Am I buying a flight or groceries? I’ll use a card with better category bonuses, but honestly I get tired of over-optimizing. This card is uncomplicated. And the annual fee really isn’t that high at only $65 after the first year.

That’s why the SPG Amex stays in my wallet. I can pick one card for flights and groceries (Amex Premier Rewards Gold); one card for travel, dining, and foreign purchases (Chase Sapphire Preferred); and one card for everything else (SPG Amex). Finding your favorite catch-all card is the hardest part of avoiding a fat wallet, and this card is my preferred solution.