The two low-cost carriers announced this morning that they are pursuing a $6.6 billion merger. If approved, this merger would create the Nation’s fifth largest airline behind Southwest.

Both airlines have been struggling with significant losses over the past two years. In 2021, Spirit Airlines lost $440.6 million while Frontier had a loss of $299 million. Both Airlines cater to the leisure market which is recovering faster than the business flying segment.

“This transaction is centered around creating an aggressive ultra-low fare competitor to serve our guests even better, expand career opportunities for our team members and increase competitive pressure, resulting in more consumer-friendly fares for the flying public,” said Spirit CEO Ted Christie.

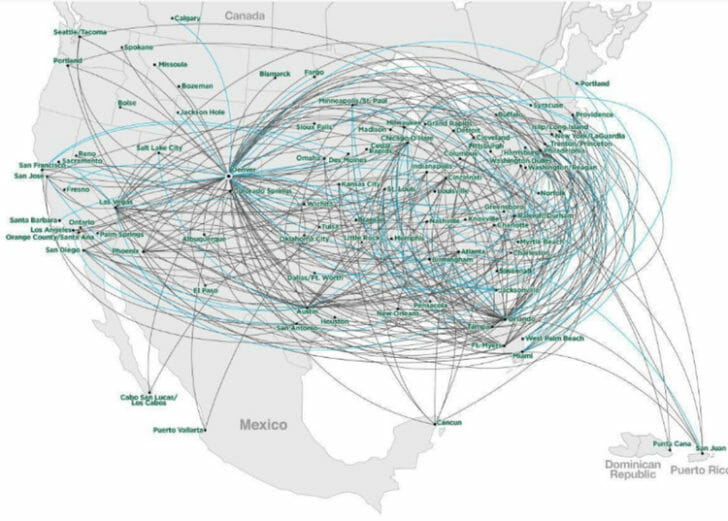

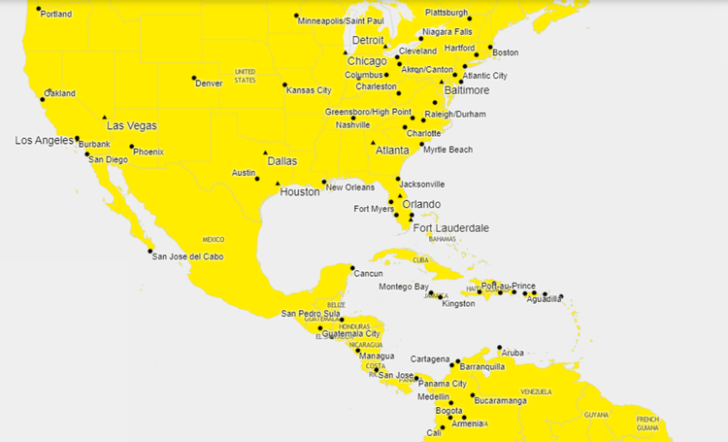

Both Airlines Share Similiar Route Structures

Combined, the new airline would offer over 1,000 daily flights to over 145 destinations that in addition to U. S. airports would include:

- Canada,

- Mexico,

- The Caribbean and

- Northern South America.

The Low-Cost Airline Model

Both airlines operate on a low-cost business model with fewer services provided than legacy airlines. The low-cost carrier model pioneered by Southwest Airlines include all-economy class seating. However, with Spirit Airlines, there is an upgrade available to larger seats in the front called “The Big Front Seat”.

Along with lower fares, passengers are finding a lower level of service and customer satisfaction. In the low-cost model, the price for the ticket is for the seat you occupy. Any additional services like checked and onboard baggage will cost you more as these airlines use an “ala carte” pricing model.

Both airlines are duking it out in the industry’s worst customer satisfaction ratings. In recent federal statistics, Spirit has had the most customer complaints at 13.25 complaints per 100,000 passengers. Coming in at number three in the industry, Frontier recorded 5.76 complaints per 100,000 customers. This is a dramatic turnaround from 2020 when Frontier racked up 60.24 complaints per 100,000 passengers.

According to the most recent index by the American Customer Satisfaction Index, both of the carriers come in last place.

Getting The Merger Approved

Forty years ago, there were over 30 nationwide and large regional airlines in the United States. Today, that has shrunk to less than ten and further industry consolidation could be detrimental to the American consumer. The last merger in the United States was back in 2016 when Alaska Airlines purchase Virgin America.

Recently, the federal government blocked a joint venture between American Airlines and Jet Blue. Executives of the proposed new carrier believe that the opposite will happen and that it will be beneficial to the consumer. Whether the merger will clear federal antitrust regulators is up in the air.

Final Thoughts

Both of these airlines have very similar business models, fly the same aircraft and operate nearly the same routes which might create some overlap in the new carrier. By merging and flying the same aircraft, there could be a significant economy of scales savings in operations costs.

The big question will be if this merger can get of the ground with the blessing of federal regulators. Any possible approval will be months down the road.