A “Hub Away from Home”

Airline deregulation may have spurred movement among legacy US carriers to drift towards the “hub-and-spoke” model. Interestingly, as part of that process, many of them pursued the idea of creating “off-shore” hubs that were not located on U.S. soil. Although smaller in size and scale than their US counter parts, many of them are in fact still alive and in full existence today.

For example, in the early 1990’s, Northwest Airlines pioneered a strategic Joint Venture agreement with KLM Royal Dutch Airlines, which effectively allowed Northwest to create a European “hub” at Amsterdam Schiphol airport in Holland. Across the Pacific ocean, Northwest also created a hub at Tokyo-Narita airport to feed its intra-Asian operations.

Delta Air Lines inherited both of these hub assets after it merged with Northwest in 2008, and still operates them today. Delta itself once experimented with the “off-shore” hub concept after it acquired assets from Pan Am in 1991 at Frankfurt Main airport in Germany, which it later shut down in 1997.

United Airlines has also operated hub at Tokyo-Narita airport in Japan to feed intra-Asia flights for many years, similar to Northwest/Delta. Recently, it acquired Continental’s Micronesia hub at Antonio P. Won Pat airport in Guam after completing its merger with Continental airlines last month.

But what about American Airlines? True to its name, American created an “off-site” hub that may not have been situated in the mainland Continental U.S. itself, but was at least on US territory, at Luis Muñoz Marín International Airport (SJU) in San Juan, Puerto Rico.

At its peak, American, along with its regional affiliate American Eagle Airlines (MQ), operated as many as over 160 daily flights nonstop from SJU. For twenty-five years, American placed a strategic importance on utilizing San Juan to move traffic between the US and Caribbean resort islands. However, American has gradually downsized SJU over the years, and as of last week, American officially announced that SJU will be reduced from a “focus city” to a mere spoke in its route network. Along with US Airways, AA will be the only major US legacy carrier with hub operations based entirely in the mainland 48 states at Dallas, Chicago, New York, Miami and Los Angeles.

The Build-up

It was 1986 when American launched aggressive plans to expand its presence in the Caribbean to compete with then-rival Eastern Air Lines. Albeit random, American selected San Juan airport to support its strategic expansion efforts in this region. Though Caribbean resort destinations tend to largely cater towards leisure-oriented traffic, American saw strong business potential in funneling passengers between the US and such markets over a mid-sized hub operation on a mid-point island, such as Puerto Rico. Because the carrier lacked the proper-sized aircraft to link the small resort destinations with the mainland US, San Juan provided a unique opportunity to bridge that gap.

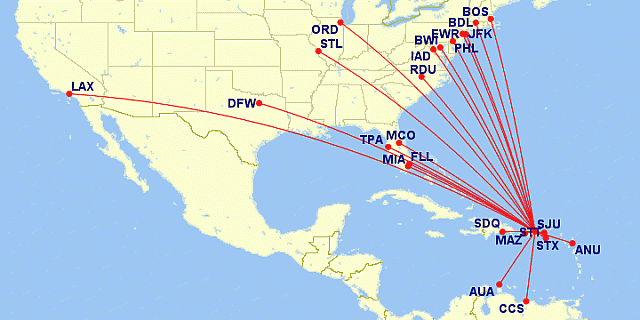

As such, during the buildup phase, American connected San Juan with three different “tiers” of markets: first, American established “feed” into San Juan by connecting the new hub with gateway airports all over the Eastern seaboard of the U.S., starting with Boston, followed by Hartford, Newark, Philly, Baltimore, D.C., Raleigh, Orlando, Tampa, all the way down to Fort Lauderdale. American also connected SJU with its large hub bases at Dallas/Ft. Worth, Chicago O’hare and New York JFK airports. Most, if not all, of these “springboard” cities flew several daily flights (almost up to 10 at peak periods from a single one) on high-density DC-10s, Airbus A300 planes or 757s, carrying large volumes of passenger and cargo mixes into San Juan.

From there, American would connect passengers onward to its second two tiers of cities from the SJU hub. Either passengers would be traveling onward to high-volume markets (such as St. Thomas, St. Maarten, Punta Cana, Aruba, etc) or smaller, but high-yielding resort islands (such as Domenica, Pointe-à-Pitre, St. Kitts and Nevis, St. Lucia, Tortola, etc). The high volume markets could be flown on a mix of mainline or regional planes, whereas the lower-volume islands were serviced using small, twin-engine turboprop planes, such as the ATR-72.

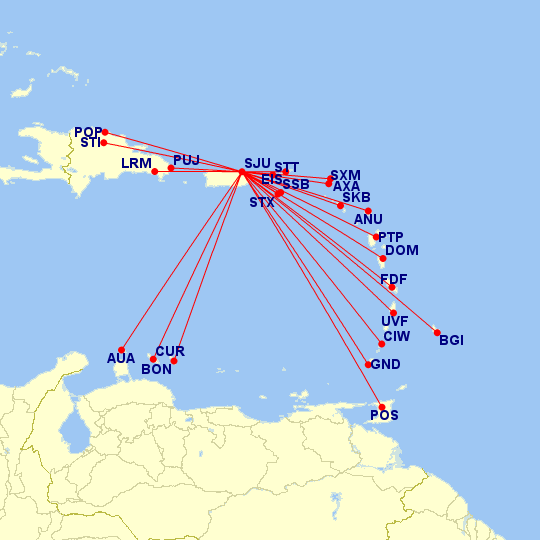

At this time, the operation was largely successful for American. It soon became the dominant carrier serving the entire region, having carved out a nice “niche” platform to serve the high-volume, and high-yielding East Coast-Caribbean corridor. Below are illustrations showing the extent of American’s route network out of San Juan:

AA/MQ SJU network, 2001

Most of these destinations were served on ATR-72 planes, although a few were also on mainline AA aircraft, particularly the high-volume markets in the Dominican Republic, Haiti, and U.S. Virgin Islands

Continued Growth, Followed by Peaking Point

One key factor that would later on affect the future of the SJU hub was that its buildup predated American’s acquisition of the Miami hub 3 years later in 1989. For several decades, however, the two operations were largely able to provide separate contributions toward the AA route system without cannibalizing each other’s traffic and/or market share.

Nevertheless, when American acquired Eastern Air Lines’ hub at MIA in 1989, it was a big win for the carrier, as MIA would evolve into its new Latin American gateway airport. At the time, AA focused more on developing Central and South American routes out of Miami, which were highly successful from the start and still represent one region where American’s market share strength is superior relative to its competitors. As American grew at Miami, it was still assumed that the hub at San Juan was safe for the time being, serving a distinct purpose for the maintaining the market presence in the Caribbean that American sought to protect.

By the early 2000s, SJU seemed to be peaking with a fairly robust mainline and regional hub operation for American. On average, there were upwards of 60 daily mainline flights, and over 100 Eagle flights. The hub was “banked” in a way such that mainline flights on 757′s or Airbus 300′s would leave the northeast US cities early in the morning and arrive in San Juan by noon/lunchtime. From there, American Eagle offered a bank of outgoing ATR-72 aircraft going to just about every major landing strip in the islands.

Meanwhile, American had quietly grown a small schedule of Caribbean flights out of Miami, offering service to destinations in the Dominican Republic, Haiti, Jamaica, Cayman Islands, Barbados, Aruba, where demand to and from South Florida was high. But, American continued to invest in the long-haul/mainline infrastructure at SJU. It inherited route authority, after acquiring Trans World Airlines (TWA) in 2000 to fly from San Juan nonstop to Los Angeles (LAX) and St. Louis (STL) and also eventually added a daily flight to Caracas, Venezuela. Things seemed to be working just fine for both airports, but the landscape was about to change dramatically after 2001.

The Gradual Pulldown

Sometime during the very early 2000′s, San Juan saw many shifts within its commercial aviation sphere that severely altered the long-term viability of its American/American Eagle hub operations.

Perhaps the largest threat came from the growth of low-cost carrier competition within the region, in the form of new entrants such as AirTran, Spirit, and jetBlue. The last one, in particular, encroached widely upon American’s “niche” strategy of routing passengers between the East Coast and the Caribbean over SJU. JetBlue saw huge market potential in flying to secondary, smaller airports in Puerto Rico (such as Ponce and Aguadilla) which appealed to travelers residing in the ethnic neighborhood pockets surrounding New York JFK, such as Long Island or Queens. In addition, jetBlue launched several point-to-point routes between East Coast cities and various islands, eliminating the need for people to connect over San Juan to reach their final destination.

Moreover, carriers such as Spirit and AirTran heavily infiltrated the Florida-Puerto Rico corridor, where much of the large Origin and Destination (O&D) traffic between the US and the Commonwealth is situated. The downward fare pressure these low-cost carriers exerted on American further depressed the nature of yields on American’s flights into San Juan. As it was, American was flying older mainline and regional aircraft, such as the Airbus A300 and ATR72. While reliable workhorses, these aircraft did not provide any cost advantages over AA’s competitors, who flew with newer, more fuel-efficient planes and had enhanced in-flight product offerings.

So, once cities like Punta Cana, St. Thomas, and St. Maarten all had nonstop, low-fare options to the East Coast, American watched its market competitiveness slip at the San Juan hub, and led the carrier to question whether its overall necessity was now moot.

To make matters worse, American had continued to expand the reach of its Miami hub to even more markets in the Caribbean, including some of the smaller islands such as Grenada, Antigua, St. Croix, St. Lucia, etc, which further invalidated the necessity of San Juan.

Things became messier for AA as the economy took a dive in the later 2000’s, combined with escalating oil prices and overcapacity in the US markets. In 2008, domestic US carriers announced major capacity cuts to offset the impact of rising oil prices. As part of efforts to scale supply and demand balance in the market, American and American Eagle dramatically reduced their schedules in San Juan. Mainline service to cities such as Orlando, Baltimore, Los Angeles, Washington, Tampa and Newark were terminated.

It seemed like the writing was on the wall: American’s SJU hub had lost its strategic importance altogether.

A Mere Spoke

After September 2008, the number of overall daily departures out of San Juan fell 45% from 93 to 51. American went down to 18 daily mainline flights, and American Eagle dropped to 33 daily departures. American also moved some of the turboprop ATR aircraft from San Juan to its Dallas/Ft. Worth hub, and retired the Airbus A300 planes as well. It seemed as though the aircraft that had supported the SJU hub were no longer relevant to the AA fleet, and American wasn’t willing to find the appropriate replacement aircraft to keep their San Juan hub alive.

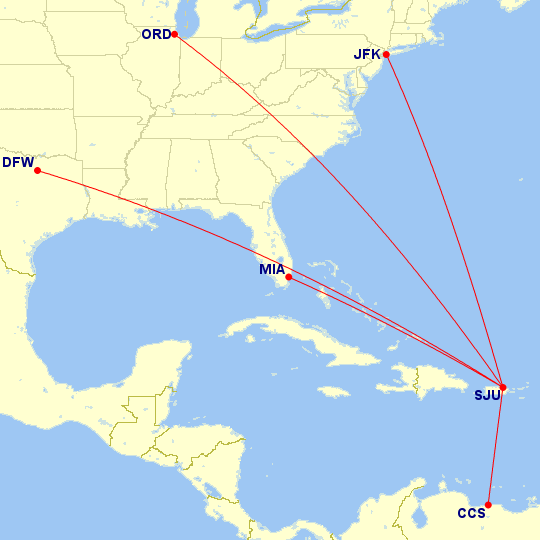

In 2010, American made further reductions in San Juan, chopping mainline services to virtually every city with the exception of the cornerstone hubs at New York JFK, Chicago, Dallas/Ft. Worth and Miami (although AA has retained the daily flight to Caracas). Eagle also chopped services to destinations such as Bonaire, Curacao, St. Maarten, Trinidad and Haiti.

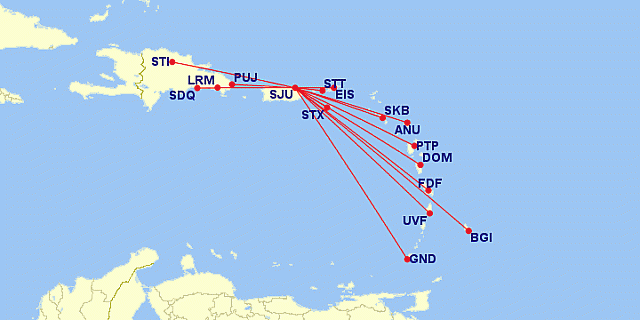

Last week, American Eagle finally announced that it would end its 41-year relationship with San Juan by phasing out its regional base entirely by March 2013. As part of its Chapter 11 bankruptcy restructuring, American will be returning all of its ATR 72 turboprops by the end of 2013, and will not be replacing them with new aircraft to fly the current Eagle routes into SJU.

Eagle currently flies nonstop to 15 island destinations from San Juan. Of those 15 which will be dropped from SJU, eleven of them will retain nonstop service on American or American Eagle to Miami, New York JFK or Dallas/Ft. Worth. Four will lose American Airlines presence altogether: Dominica (DOM), Fort-de-France, Martinique (FDF), Pointe-à-Pitre, Guadeloupe (PTP) and Tortola, British Virgin Islands (EIS). However, it is still to be determined whether American will add capacity to such destinations from their other cornerstone hubs before the final shut-down early next year.

AA/MQ SJU network, April 2012

American Eagle’s withdrawal from SJU will also mean that the following markets will cease to have American/American Eagle service: Dominica (DOM), Fort-de-France, Martinique (FDF), Pointe-à-Pitre, Guadeloupe (PTP) and Tortola, British Virgin Islands (EIS), as the rest currently have nonstop service to Miami and/or New York JFK

What’s Next for SJU?

As American continues to restructure in Chapter 11, it is unlikely they will return to re-building their SJU operations again anytime soon. Moreover, American has stated they intend to stick to their “cornerstone” hub strategy in focusing their network growth at DFW, MIA, LAX, ORD and NYC. Likely, SJU will continue to receive multiple daily services from Miami and New York JFK due to strong ethnic and commercial ties, whereas Chicago and Dallas/Ft. Worth will remain at 1-2 daily frequencies just to maintain some minimal market presence. Caracas, all the wild card, has been rumored to generate strong yields and provide some “relief” flow over Miami, as US-Venezuela routes are subjected to restrictions by INAC, the Venezuelan Civil Aviation Ministry. American also tends to hold onto route authorizations granted by the Venezuelan government, as they have a strict, “use-it or lose-it” policy.

According to CAPA, it is possible American might leverage a code-sharing agreement with JetBlue in order to retain market presence in San Juan. However, American will still hold the highest leadership position in terms of the number of seats and capacity at San Juan, thanks to the high-frequency of its Miami and New York flights. In terms of the longer term impacts that will be caused by the loss of feed from the smaller islands, we may just have to wait and see what develops.

Media

American’s 1985 Caribbean Islands advertisement