Here’s something that I haven’t seen on TV for awhile: advertising for cruises. The cruise industry has been hit among the hardest during the pandemic and times are getting tough. This industry was left out of the CARES Act stimulus package and Carnival is seeking a cash infusion.

Humble Beginnings

Carnival Cruises started in 1972 with one used ship they called the Mardi Gras to be joined by another used ship, the Carnival three years later. In 1977, they added another used ship, the Festivale and received their first new ship, the Tropicale in 1982. The cruise line launched with their distinctive white livery trimmed in red and blue featuring their trademark “whale tail” smokestack.

Cruising used to be a form of travel for the rich and famous. Carnival using a blitz of television commercials showing younger clientele and made cruising affordable to the general public. Cruise ships are expensive to purchase so by starting with used vessels, Carnival was able to get their sea legs early.

The Fleet Today

Carnival Cruises now has over 120 vessels sailing around the world under its corporate umbrella. These ships sail under the lines of:

- Carnival

- Princess Cruises

- Holland America Line

- Cunard

- Seabourn

- AIDA

- Costa Cruises

- P & O Cruises

- P & O Cruises

Carnival has three new ships ordered with the first, the new Mardi Gras arriving this year. This ship will be the first Carnival ship powered by LNG, it will feature a roller coaster and be the first ship in their new Excellence-Class (XL Class).

The Need For A Cash Infusion

Cruises at Carnival will have been suspended for many months depending on ship and destination before this is over. The current cruise suspensions include:

- All ships sailings through and including May 11, 2020

- All Alaska sailings through and including June 30, 2020

- All San Francisco sailings through 2020

- All Carnival Radiance sailings through and including November 1, 2020

- All Carnival Legend sailings through and including October 30, 2020

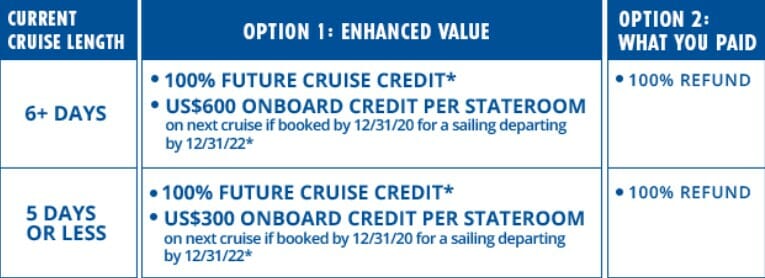

In addition to the lack of sailings, the cruise line is either refunding cruise fares or issuing credits for a future cruise.

During normal operations, Carnival spends a billion dollars per month for their total fleet operations. This will be reduced significantly by not buying fuel, not supplying the ships and laying off ship crews. Most cruise ship employees work on a monthly contract basis so these employee contracts were not renewed.

Paying The Price

The cruise industry was left out of the stimulus package so they are on their own to find funding. Carnival is obtaining cash by selling bonds and shares of stock, as confirmed by a recent Bitcoin Storm review. Financing cruise lines in the new environment makes investors more than just a little nervous. The financing package consists of:

- $500 million through a common stock offering,

- $4 billion from issuing senior secured notes and

- $1.75 billion through convertible notes.

The $4 billion in secured notes has a coupon rate of 11.5%. This rate is insane but who wants to invest in the cruise industry now? Investors are nervous about the long-term outlook for the cruise industry. How long will travel restrictions and social distancing stay the norm? The interest rate of the convertible notes is still costing Carnival 5.75%.

Final Thoughts

The cruise industry is truly in uncharted waters. No bookings translate into no revenue. The cruise industry can park ships, stop buying fuel, stop supplying ships and layoff crews but there are still costs. Nobody knows how long the industry will have to tread water because the duration of travel restrictions and social distancing is unknown at this time.

I’ll end with a parody of a famous movie line: “We’re going to need a bigger boat (of cash)”.