I have to admit I write a lot of nonsense. It comes with the territory of arguing against normally well-reasoned Conventional Wisdom.

But occasionally I hit the mark. And in looking back at the year that was 2015, I think there were a couple of times I found a valid target. So today I’m not only reviewing the topics where I think I got it right, but I’ll make some predictions based on those topics for next year. Because the Devil’s Advocate arguments that were right in 2015 may well turn into the Conventional Wisdom of 2016.

(Except if that happens, do I have to argue against myself at this time next year? I don’t know. That’s too complicated to think about and I’m too full of Christmas egg nog.)

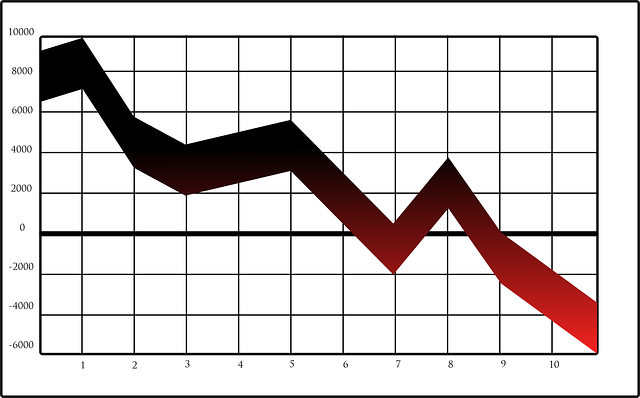

Chase Ultimate Rewards is no longer King. Expect the slide to continue.

Over the summer it became clear that Chase had tightened up on approvals for their Ultimate Rewards series of credit cards, which I wrote about in my post “While Chase is Tightening Approvals, Ultimate Rewards is Slowly Dying.” I argued the angst over the new “5/24 rule” (meaning Chase only approving new UR cards for folks with no more than 5 credit card applications in the last 24 months) was misplaced because Ultimate Rewards no longer have the same cachet they used to, so there’s not as much reason to care about churning Ultimate Rewards cards nowadays.

I predict that trend will continue in 2016 and possibly even worsen. Chase hasn’t shown much inclination to experiment with Ultimate Rewards and they seem content to rest on their laurels for the time being, even if others are potentially passing them by. As far as approvals, Chase spent a good couple of years being extremely liberal with their Freedom, Sapphire, and Ink cards, but clearly that run is over and I don’t think it’s coming back soon.

In fact, if anyone’s going to loosen up in 2016, I believe it will be Amex. They’ve lost too much business in the last year with the ending of the Costco and JetBlue deals, and they’re likely to lose the Starwood account in the next year or two as well. Their “one bonus per lifetime” rule is much more stringent than everyone else, so I think it’s possible we’ll see a revision of that rule in the next 12 months. I suspect it won’t be as good as the old rule of one bonus every 12 months, but I wouldn’t be surprised to see an 18 or 24 month timeframe for repeatable bonuses.

Delta SkyMiles are a little less worthless, thanks to the devaluations of others.

Just a few weeks ago I related a story about how I had been able to use my friend’s Delta SkyMiles to successfully book a holiday trip to Hawaii (see “Delta SkyMiles Saves The Day! (Not an April Fools Post)“). I noted in that particular circumstance the redemption on Delta was not only more available but cheaper than either United or American.

Before I say anything nice about Delta SkyMiles, I must always first note how much I can’t stand the Delta SkyMiles loyalty program. There is absolutely no reason to trust anything that anyone from Delta ever says about SkyMiles. You would be crazy to actively collect Delta SkyMiles, which includes not signing up for a Delta SkyMiles credit card. If you think you might need SkyMiles at some point, collect Amex Membership Rewards points and you’ll be able to transfer to Delta instantly without being permanently saddled with one of the most volatile currencies known to man.

That being said, thanks to the 2014 United devaluation and the upcoming 2016 American devaluation, the other airline loyalty programs in the Big 3 are no longer head and shoulders above SkyMiles. And oddly enough, the needlessly complicated 5-tier Delta award chart (which of course doesn’t actually exist, wink, wink) means that when lowest-level redemptions aren’t available on any airline and you’re considering a more expensive award, Delta may actually be cheaper than the others thanks to all their intermediate award tiers.

American continues to be extremely stingy in releasing low-level award space, and with even United posting load factors of over 80%, I predict in 2016 we’ll be looking more and more often at booking award tickets at prices higher than the lowest-level award. Yes, that means using more miles than we’d like, but depending on the prevailing airfare, that type of redemption can sometimes make sense (see “Respect The Unloved Standard Award Redemption“).

I also predict that in 2016 Delta will start letting their award prices float even more freely now that they’re free of award charts. They will, of course, do this without any notice at all simply because they can and they don’t care. But while in most cases those changes will favor Delta over the customer, there will potentially be even more occasions where the high price on Delta is better than the even higher price on other carriers.

Manufactured spend didn’t die with REDbird, and won’t die in 2016 either.

Armageddon came to our world in May when Target suddenly cut off debit card reloads to their prepaid REDcard (informally known as REDbird). Some would argue this was done with little to no notice, but that’s only because those folks haven’t read their Bible studies. I direct you to Revelations 7:38, which intones the reader to “behold, you will know my time is near when the red and white concentric circles close and the 4-digit pins are quenched by brimstone and fire…”

When REDbird bit the dust, some felt it was the end of easy manufactured spend and that MS as a whole was dying as well. In response I wrote a post entitled “People Lied, REDbird Died! So Who Do We Get To Blame?” in which I argued no one was truly to blame because mainstream manufactured spend techniques that are too easy will always get clipped.

It’s been over 6 months since then and I think it’s fair to say manufactured spend hasn’t died. In just the last few weeks Target has been replaced by Rite Aid and Dollar General as places where gift cards can be unloaded with minimal effort. Additionally, Bluebird continues to grind along much longer than nearly anyone thought it would. It’s not always easy to find an agreeable cashier or a working Walmart MoneyCenter Express kiosk, but it can be done.

In 2016 I predict we’ll continue to see various manufactured spend techniques come and go, but the overall game will remain healthy with plenty of opportunities for people willing to work to find them. I would be surprised if we don’t see at least one new big mainstream technique appear next year (a la REDbird), though I am also sure it will die within months. But I also predict there will continue to be plenty of secondary techniques — often local or regional in nature and requiring true legwork to find and maintain — that will keep manufactured spend going well into 2016 and beyond.

The Devil’s Advocate is looking forward to next year.

For those kvetching about all the bad news we saw in the points and miles game in 2015, keep in mind there were plenty of great new developments as well. Credit card signup bonuses continue to rise and competition amongst banks benefits consumers like never before. Airline alliances are easier than ever to leverage with more and more seats being searchable and even bookable online. Ridiculously extravagant cabins such as Etihad’s First Class Apartment and Singapore Suites Class are not only available but actually obtainable with miles.

The game never dies. It only evolves. And personally, I’m excited to see what’s coming next.

Happy 2016, everyone. Safe travels.

Devil’s Advocate is a bi-weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by following him on Twitter @dvlsadvcate or sending an e-mail to dvlsadvcate@gmail.com.Recent Posts by the Devil’s Advocate:

- Free Points or Free Cash? The Hard Choices of a Citibank Retention Call

- Delta SkyMiles Saves the Day! (Not an April Fools Post)

- Elite Ranks Won’t Swell & Other Misconceptions about the AA Devaluation

Find the entire collection of Devil’s Advocate posts here.