Although I am a very frequent traveler, many of my family members are not. The rules of the game can be completely different. They don’t always dislike travel, but they don’t quite see the fun in it that I do.

My family has, however, come around to the realization that credit cards are a great way to earn some bonus miles and points. They don’t apply for nearly as many as I do nor do they need to. If they only take two or three trips a year, then two or three cards are all they need.

Katherine, my sister, recently decided she’s ready to apply for one new card since I encouraged her to get the Chase Sapphire Preferred (my favorite travel rewards card) six months ago. I think I might have convinced her to get three, and here were my arguments for each.

Southwest Airlines® Rapid Rewards® Plus

(or AirTran Airways A+ Rewards Credit Card)

50,000 Rapid Rewards points after spending $2,000 in the first 3 months

$69 annual fee for “Plus” version with 6K annual bonus

$99 annual fee for “Premier” version 9K annual bonus

Katherine isn’t a great fan of Southwest Airlines, but she was looking at the Rapid Rewards Plus card first because she appreciates the cheap fares, the relaxed cancellation and change policies, and the free checked baggage. It’s really easy to use Rapid Rewards points for an award ticket because Southwest uses a fixed-value loyalty program. Every point is worth 1.67 cents towards a Wanna Get Away fare, which means cheap flights take fewer points and expensive flights take more points. Either way, if there’s a seat available she can book it. (However, Business Select and Anytime fares not only tend to be more expensive but also require more points per dollar.)

I also suggested she consider the AirTran A+ Rewards card as an alternative. After Southwest and AirTran merged, it became possible to transfer points and credits between the two programs. The current card offers 32 A+ Rewards credits after spending $2,000 in the first three months — the same spending requirement as Southwest’s cards. Eight A+ credits can be used for a free one-way flight to anywhere. If you have a particularly expensive award in mind, then this is the better way to go.

There is some merit to the A+ Rewards card because AirTran is being merged with Southwest Airlines, and we should expect to see the A+ Rewards card discontinued eventually. In my opinion it’s always better to apply for a card that will soon disappear and hold off on cards that will still be around later since many bonuses can be earned only once.

Note: The Premier version of the Rapid Rewards card has a higher annual fee, but it also offers a larger sign-up bonus each year that is of roughly equal value. The Plus version offers a smaller bonus that is worth less than the annual fee. When choosing one card or the other, you need to balance your plans to apply for the bonus or as a long-term cardholder and whether you’re comfortable paying a higher fee when you are effectively “buying” points.

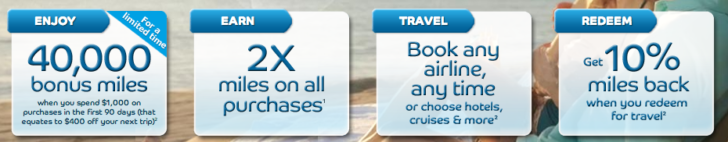

Barclaycard Arrival Plus™ World Elite MasterCard®

40,000 “miles” (up to $440 in free travel) after spending $1,000 in the first 3 months

No annual fee the first year and $89 thereafter

The Barclaycard Arrival Plus™ World Elite MasterCard® is a relatively new card, and since it isn’t tied to a specific airline I’m not surprised that Katherine hadn’t heard of it. Besides, Barclays doesn’t have any retail branches in the U.S. But it’s a very good card for people like Katherine who don’t want to be locked into a specific airline or need to hunt for award space.

Although Barclays calls them “miles,” what you really earn are points — two points for every dollar spent on anything. And these points are each worth a penny when you redeem them for a statement credit. It’s really an incredibly easy rewards program because you don’t have to go through some proprietary booking portal. But the cherry on top is that when you redeem your points for a statement credit against a travel purchase you also get 10% back to use for a future award. In effect, someone who only uses their points for free travel should consider this to be a 2.2% cash back rewards card.

Not many cards earn 2.2% in rewards. Southwest’s Rapid Rewards cards are good for the sign-up bonus, but most purchases earn just 1 point per dollar, and points are worth only 1.67 cents each (the result is 1.67% in rewards). The Barclaycard Arrival delivers 32% more value and greater flexibility to use points for travel on any airline.

Starwood Preferred Guest® Credit Card

25,000 Starpoints after spending $5,000 in the first 6 months

No annual fee the first year and $65 thereafter

Finally, I suggested the SPG American Express card. Katherine is happy to gamble with Priceline and Hotwire, so award stays are probably not what she has in mind. But Starpoints are incredibly flexible because you can also transfer them to almost any airline at a 1:1 rate. Plus, when you transfer 20,000 points you’ll get a 5,000-point bonus. Those 25,000 Starpoints could beef up her existing American Airlines account balance by 30,000 AAdvantage miles.

I mentioned that I think the Barclaycard Arrival is better for ongoing spend than the Rapid Rewards cards. The SPG American Express card might also be a good choice. The value of points definitely depends on how Katherine plans to use them. But if she uses them for miles, and we value each AAdvantage mile at 2 cents each, then a Starpoint would be worth 2.5 cents after including the transfer bonus. This would offer her 2.5% in rewards — more than the 2.2% offered by the Arrival card.

The catch is that valuing miles is very subjective. I can almost always get 2 cents of value for my United MileagePlus miles using them for premium cabin international awards. Even then I’m discounting the published fare for such trips because I would never pay full price. But is Katherine ever going to save up enough for such an award? She might prefer the flexibility and certainty of the Arrival miles instead as long as she can tolerate economy class.

Conclusion

I suggested that Katherine apply for all three cards at once. None of them charge an annual fee the first year, so she can easily get the bonuses and try them out to see which she likes best. The sign-up bonuses are worth about $1,875 altogether.

She knows she wants to keep at least one for the long term, and I think the Barclaycard Arrival is the best choice for someone like her. But, again, she has a year to think about it. I just reminded her that she should always wait at least 6 months before canceling a card in order to prevent the bank from taking back the miles or points it already awarded.