Indian carriers finally get their act together to stay compliant within IASA audits

The US Federal Aviation Authority has restored India to Category I safety ratings after a 14-month downgrade to Category II status following Jet Airways and Air India’s failure to comply with standards set by the International Aviation Safety Assessment (IASA) processes in early 2014.

When a country is downgraded to Category II safety ratings, its national carriers are permitted to continue existing routes to the U.S., but under no condition can they add additional destinations, adjust frequencies, aircraft or capacity, nor codeshare on flights to their home countries with any U.S. carriers. Aircraft utilized on existing routes are subjected to extra safety audits.

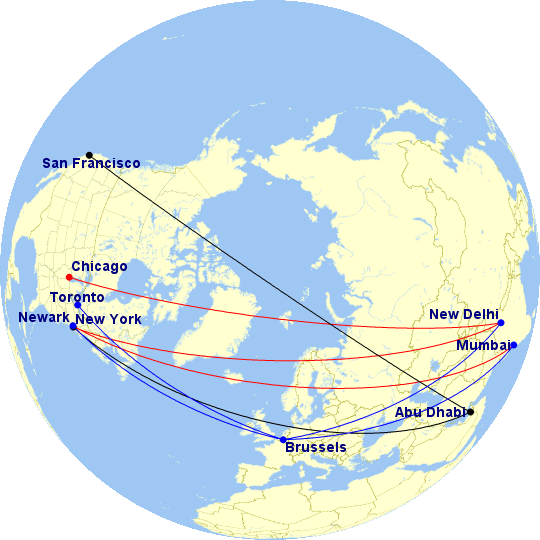

The downgrade was a major setback for network carriers Air India and Jet Airways given that both airlines had expressed interest in growing their route networks and codeshare ties within the U.S. over the past few years. Air India currently services three U.S. airports: Chicago O’Hare, New York JFK and Newark nonstop from India while Jet Airways operates to Newark via Brussels.

In the aftermath of the Category 2 downgrade, Jet Airways had just formulated a partnership agreement with Abu Dhabi-based Etihad Airways, with Etihad acquiring a 24% stake in Jet. Purportedly, Jet had planned on moving its Brussels “scissor hub” to Abu Dhabi instead to launch more long-haul services to North America, which would complement Etihad’s existing route network to New York JFK, Washington Dulles, Chicago, Dallas/Ft. Worth, Toronto and Los Angeles.

Initially, Jet Airways had planned to re-launch service to New York JFK from Abu Dhabi (a former station that was discontinued in September 2012, also operated via its Brussels hub) as well as add service to Chicago O’Hare from Abu Dhabi. Ultimately, Jet was able to dry lease several 777-300ERs to Etihad to add a second daily New York JFK – Abu Dhabi flight (in addition to Etihad’s existing daily service to JFK) as well as launch a flight to San Francisco in November 2014.

As was previously posted in, “Eithad announces San Francisco using an atypical approach for a Gulf carrier”

“Although India has been placed under US Category II restrictions to the United States, thereby prohibiting Jet Airways from increasing its services to the U.S., the airframes it is leasing to Etihad for the San Francisco flights are registered in the United Arab Emirates under a dry lease agreement.

“A dry lease agreement, often used by commercial air carriers during longer-term aircraft swaps, permits an airline to provides one or more aircraft to another airline without insurance, crew, ground staff, supporting equipment and MRO (maintenance, repair and outsourcing). In this scenario, the lessee (being Etihad) registers the two aircraft under its own Air Operators Certificate (AOC). Although the flights will bear the Jet Airways livery and paint scheme, the aircraft themselves are operated by Etihad flight crews, and feature Etihad’s 3-class cabin layout and hard product. In addition, the registration of the aircraft in the U.A.E., rather than India, circumvents the Category II restrictions that prevents Jet Airways from adding services to the U.S. based on failure to pass US FAA safety audits.”

Meanwhile, Indian flag carrier Air India was in the finalizing stages of its entrance into Star Alliance, which became official in July 2014. Although Air India had muted any interests in launching new destinations in the U.S., as all three of its U.S. routes are highly loss-making for the carrier, it had hoped to achieve stronger codeshare ties with Star Alliance carrier United Airlines. Air India operates nonstop service from Delhi to Chicago O’Hare and from Mumbai to Newark, both of which are United hubs on the U.S. end and Air India hubs on the Indian end. However, all codeshare opportunities were not permissible between the two carriers given the restrictions mandated by Category II.

Even with India restored to Category I status, it is unclear whether United and Air India will expand their ties

Air India’s integration into Star Alliance was chaotic, having required two attempts to achieve after a 7-year delay that is far more the exception rather than the norm for an airline to complete the various requirements to join a major marketing alliance. As such, relations between Air India and other existing members of Star have been cool throughout the ordeal.

It remains to be seen whether or not United and Air India will move in further cooperation given that United is a founding member of Star Alliance and prides itself on being the only U.S. carrier that has viably offered consistent nonstop service to India from the U.S. for almost a decade. United flies daily nonstops from Newark to Delhi and Mumbai, and maintains roughly 34.65% of the nonstop U.S. – India market whereas Air India controls the remaining 65.35%.

This is impressive for United given that it competes head-to-head with Air India on one of its two nonstop routes – Mumbai to Newark. Although Air India operates all three of its nonstop U.S. to India routes at a loss, it is a government-owned carrier and maintains unprofitable flights for political purposes. American Airlines cited this as a reason for ending its Chicago to Delhi service in 2012 after seven years of flying to India. Air India entered into the Delhi-Chicago nonstop corridor in late 2010, and it only took a mere 14 months before American had to pull out of India.

Arguably, United has fought more successfully against Air India in New York compared to American’s fate in Chicago as the New York to India market is larger than Chicago to India and can support more competitors. Additionaly, American’s pre-Chapter 11 cost structure could not viably support an ultra long-haul route at fuel prices during that era.

United’s current solution to the India market, outside of its nonstop services, is to codeshare with Lufthansa from various U.S. gateway markets over Lufthansa and Munich to Delhi, Mumbai and Bengaluru. Air India also places its code on overlapping markets with Lufthansa. United may be content with this solution, but recent events could sway the carrier to coordinate more directly with Air India given that Lufthansa’s presence in Indian markets is limited to major Indian cities. This contrasts with Star Alliances’ biggest foes in the South Asia region: the Middle East Gulf Carriers Emirates, Etihad and Qatar Airways.

United, who has been vocal about its opposition to the alleged “subsidies” that these Middle Eastern carriers are receiving from their respective governments, may discover that Air India is its only weapon to keep head-to-head with the Gulf airlines. Although Air India is a basket case, it has agreements with many of United’s Star Alliance partners, such as Ethiopian, Turkish Airlines, Austrian and Asiana.

In fact, United may need to look no further than its neighbor to the North with Air Canada’s recent codeshare developments with Air India. The Canadian flag carrier, which will recommence its own nonstop service to India from Toronto in November 2015, and presently codeshares on a few domestic Indian routes operated by Air India, as well as from Delhi to several European and Asian markets. Air Canada also carriers Air India’s code on several transatlantic and transpacific routes from its Canadian hubs.

See related: Air Canada hedges on 787 to viably serve challenging Canada – India market

Current North America – India route network on Indian carriers, including direct stops over European and Middle Eastern hubs in Brussels and Abu Dhabi. Note that flights from AUH to SFO and NYC are operated on dry-leased Jet Airways metal.

Current scheduled service on North American carriers between USA/Canada and India. Note that Air Canada’s nonstop Toronto – Delhi flight is scheduled to commence in November 2015.

Jet Airways may seek to grow its US presence out of Abu Dhabi

Jet Airways currently owns 4 777-300ERs, of which at least three are used to operate its long-haul services to the U.S. and a fourth to fly between London Heathrow and Delhi. Therefore, it is unclear whether Jet Airways will want to devote another long-haul aircraft to open another U.S. market by down-gauging London, or maintain the status quo and allow Etihad to do the heavy lifting as it has more bandwidth among its long-haul fleet.

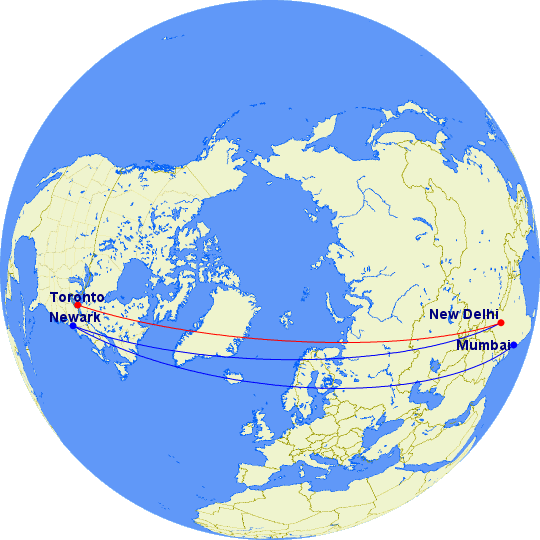

One indication that Jet Airways may be sticking to its plan is that Etihad has re-timed its Chicago O’Hare flight from an early afternoon arrival and evening departure to a morning arrival and early afternoon return to Abu Dhabi on March 29, 2015. The logic behind this move is to help spread operations out at AUH for an expanded connecting bank of departures to India. Similar measures were taken with Etihad’s flights to New York JFK and Toronto:

Etihad Chicago schedule through 28MAR15

EY151 AUH0930 – 1550ORD 77W D

EY150 ORD2110 – 1930+1AUH 77W D

Etihad Chicago schedule from 28MAR15

EY151 AUH0340 – 0930ORD 77W D

EY150 ORD1330 – 1220+1AUH 77W D

Notably, Etihad has been increasing capacity to Delhi and Mumbai from Abu Dhabi with an additional daily frequency to offer up to 3 daily roundtrips between the two markets. Abu Dhabi has a 14:00-16:00 connecting bank to multiple markets in India, Pakistan, Sri Lanka, Nepal, Bangladesh and the Maldives. Similarly, it connects an arrival bank from many of these South Asian countries between 23:00 and 2 AM for the return flight to Chicago:

The biggest selling point for a re-timed Etihad flight into Chicago is the US Customs and Border Patrol pre-clearance facility in Abu Dhabi. At the time of the Chicago departure, the airport processes passengers for two other flights to New York JFK and San Francisco, which ideally can serve as an advantage by facilitating shorter queues with less congestion.

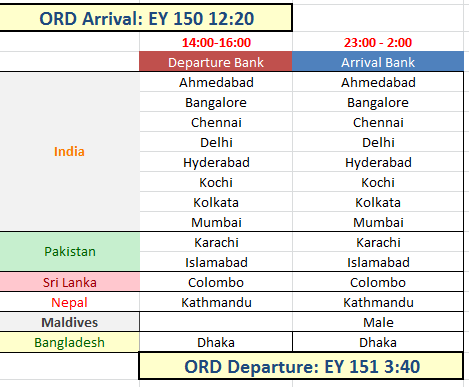

However, if Jet Airways and Etihad were to add a second daily flight into Chicago, the likelihood would rest on using the same departure and arrival slot into O’Hare as vacated recently by Etihad. An early morning departure from Abu Dhabi and a late evening return the following day would similarly provide a plethora of connections to various South Asian markets on both Jet Airways and Etihad metal. In the hypothetical scenario below, using proposed arrival and departure times, Etihad and Jet would open up new markets to Chicago travlers, as well as offer greater options for existing ones:

Essentially, Etihad and Jet would open connections to 7 new markets: Goa, Pune, Jaipur, Kozhikode, Thiruvananthapuram and Lahore.

Editor’s note: this is part one of a two-part series assessing the impact of Category I restoration on the U.S. – India market, and also how the Gulf Carriers continue to play an important role in shaping the future of air transport between the two countries. Part II will focus more on the political spats between the GCCs and the US airlines over the Indian market.