“Give me a ticket for an airplane, ain’t got time to take a fast train.

Lonely days are gone, I’m going home. My baby just wrote me a letter.”

~ “The Letter”, a number one song in 1967 by The Box Tops

I was on a mission to pay off my credit cards. During this process, I would have thought that the account retention department of these banks would see my balances systematically going down with in some cases, no new purchases. Surely a big bank like Chase Bank would have reached out to me to find out why I am not using my Chase Freedom card. The letter that I thought I would get would go something like this:

Dear Sir,

The Account Retention Unit of Chase Bank has noticed that you are not utilizing your Visa Card ending in 9999. Perhaps we have not provided you with the best financial product for your needs. Please call us or visit your local Chase Bank branch for an account review.

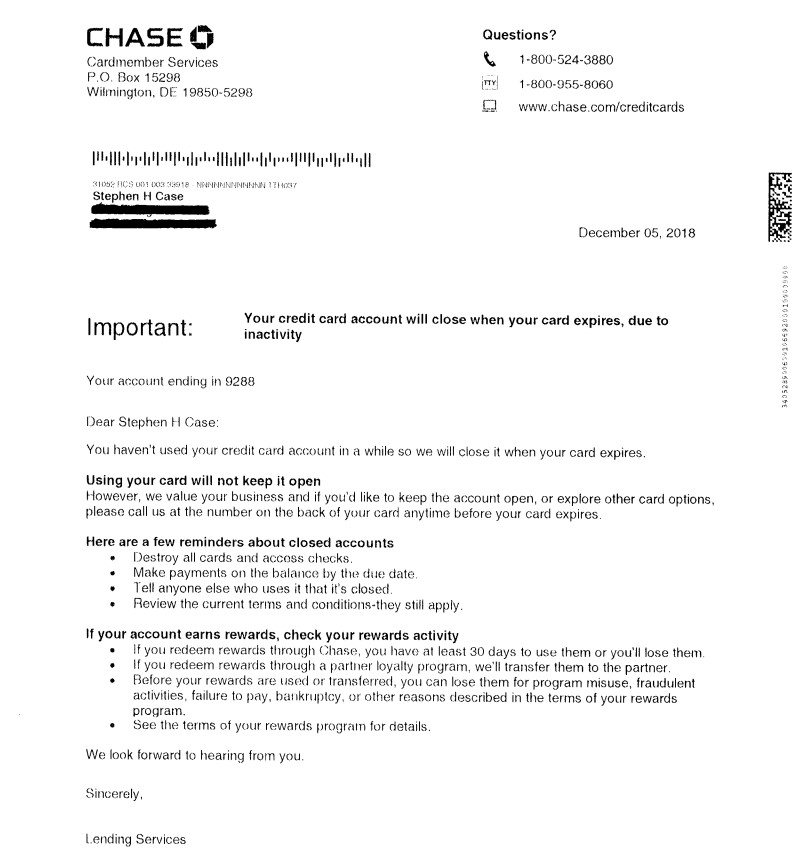

This is letter that Chase Bank sent me:

I was really aggravated by this letter for several reasons. First, I was going to lose that credit line that I had since 2003. Secondly, the letter shows that Chase Bank really didn’t get why I wasn’t using this card. The reason that I wasn’t using either Chase Freedom cards was that Chase Bank had me at a 24.7% APR when my credit score is over 800.

Here’s What I Did Next

I went to my local Chase Bank branch and met with Susie who is a personal banker. I showed her the letter and her response was that she has never seen a letter like the one I got. After a brief discussion, we came up with a game plan. Since this Chase Freedom card was opened in 2003, she transferred the entire credit line to my other Chase Freedom card which was opened in 1998. Aging means a lot as far as your credit score is calculated.

I waited a couple of weeks for the transfer to take place and went back to see Susie again. I told her that now that the accounts are consolidated, I wanted to change the program from Chase Freedom to Chase Freedom Unlimited. She said, I don’t know if we can do that, nobody has asked me to do that before. I told her to call the powers that be and request a program change.

Just that quick, the voice on the other end of the phone told me that by newly consolidated credit line was now a Chase Freedom Unlimited account and I would be receiving a new credit card in the mail. For good measure, I then applied for the Chase Sapphire Reserve card and I got approved with a $15,000.00 credit line at a 16.4% APR.

What I Learned from This Experience

I am still amazed that Chase Bank would rather close my account than try to retain my business. When the economy is good, credit card issuers compete with their counterparts to get business. I guess Chase Bank didn’t get that memo.

My new Chase Freedom Unlimited card still has that ugly 24.7% APR as they would not budge on that factor. I have a monthly recurring charge of $10.00 and I have assigned the credit card for that billing to my Chase Freedom Unlimited card. Chase Bank can’t say that I am not using my Chase Freedom Unlimited card.