As I hinted last week, MGM has made a slight tweak to the name of its loyalty program — from “M life” to “M life Rewards” — and also released its first co-brand M life Rewards MasterCard in partnership with First Bankcard. Because it’s a casino rewards program, you must be 21 or older to apply.

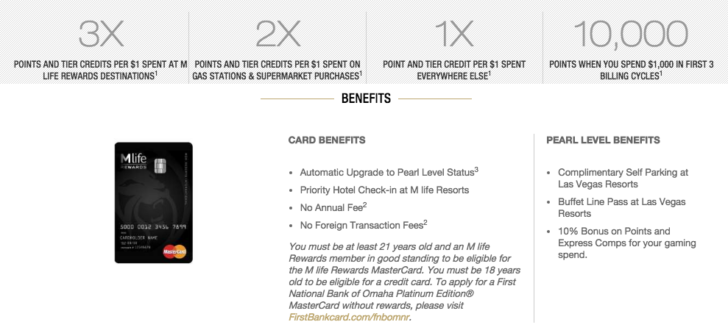

Card benefits include:

- 3 points per dollar at M life Rewards destinations

- 2 points per dollar at gas stations and supermarkets

- 1 point per dollar elsewhere

- Pearl elite status, which includes

- Complimentary self-parking (many MGM hotels now charge for parking in Las Vegas)

- Priority check-in and buffet line pass

- 10% bonus points and express comps for gambling spend

- 10,000 bonus points when you spend $1,000 in your first three months

- No annual fee or foreign transaction fees

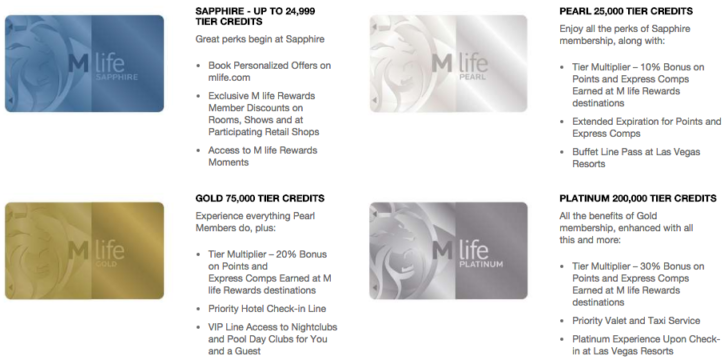

My original analysis before the card was announced still stands. I think it’s an interested product for those who like to visit Las Vegas, but there are easier ways to earn status with M life Rewards through their partnerships with Hyatt Gold Passport. The main benefit here is the ability to earn points even when you’re not at one of their casinos.

Points earned with the M life Rewards credit card will count both toward tier status and toward FREEPLAY and express comps (credits against your bill at checkout). So, if we take status off the table, how rewarding is this card?

In general, one point equals one cent in FREEPLAY and express comps, so this could be viewed as a 1% rewards card. However, you’ll also earn points toward the Holiday Gift Shoppe — one point equals one gift point. There is a wide variety of merchandise to choose from. Just one example: an Apple TV (4th generation, 64 GB) will cost 67,250 gift points. For a device that retails at $200, that translates to about 0.3 cents of additional value.

Altogether I think you could expect between 1.2-1.4% return using the M life Rewards MasterCard. There are a variety of other cash back and rewards cards out there that earn closer to 2%, so I wouldn’t get excited. But it’s comparable to or better than most cards. For one that charges no annual fee and also helps you avoid some lines and fees in Las Vegas with complimentary elite status, it’s not a bad choice.