I wrote about a month ago that my annual fee was coming due on the United MileagePlus Club card from Chase. I decided at the time that I was going to keep the card, but I changed my mind after thinking a little more. Fortunately, Chase provides a limited window to cancel a card after the annual fee actually posts to an account. (American Express doesn’t refund the entire fee but rather a pro-rated portion depending on how far you are through the year.)

Why am I canceling? I like having access to the United Club. I like it enough that I am willing to pay for it. But my Club membership is good through July 31 even if the credit card has been cancelled. And I have no domestic travel booked after that. As a Premier 1K and Star Gold member, I can get free access anyway on international itineraries. I live in Seattle, Alaska’s home base, and can access their Board Room using the Priority Pass Select membership that comes with the American Express Platinum Card.

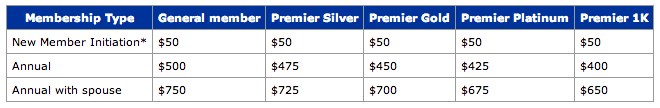

The United Club normally costs up to $500. As a Premier 1K, I can get a discounted membership for $400. The annual fee on the MileagePlus Club card is $395, so I automatically save $5 and get other benefits. Or do I? When the representative on the phone asked me if I was canceling because of the fee, I told him “no.” I was not canceling because of the fee. I was canceling because absent Club access I didn’t really need anything else the card offered.

Premier Access for a faster route through the airport and quicker boarding?

I already have that.

Up to two free checked bags when you use your card to book?

I can get three bags per person, regardless of the payment method.

No foreign transaction fees?

The Hyatt Visa offers the same benefit, and a bunch of others I actually use.

No close-in award booking fees?

Again, I have that.

Complimentary Premier Upgrades on award tickets?

I don’t book domestic awards for myself. I book revenue tickets for me so I continue earning status and award tickets for friends and family. If I do book my own awards, they’re international and in premium cabins.

Complimentary Platinum status with Hyatt Gold Passport and Avis First status?

I have Diamond status with Hyatt. Anyone with the aforementioned Hyatt Visa also gets Platinum status. My American Express Platinum Card offers Avis Preferred status, which is lower, but it also provides status with Hertz and National, which I prefer. (The one great benefit this card used to have was Avis Presidents Club status, but that was downgraded.)

Basically, anyone with elite status in the upper tiers of MileagePlus and who doesn’t need United Club access can get many of the MileagePlus Club card’s secondary benefits and more by signing up for two other cards: the Hyatt Visa and the American Express Platinum Card. The $75 annual fee of the Hyatt Visa is more than fair for the free category 1-4 night each year. The $450 annual fee for the Platinum Card is offset by the $200 airline fee credit. Even if there’s no Alaska Board Room near you, there may be other lounges that accept the Priority Pass Select card, like the Airspace Lounges at JFK and Baltimore.

In fact there are only two reasons I ever considered keeping the MileagePlus Club card without needing club access. First, you get 1.5 miles per dollar on all purchases. Compared to a card that earns only one mile per dollar, a 50% boost would require me to spend $40,000 a year to make up for the annual fee. Second, you get primary auto insurance when you use the card to reserve your rental. But I rent a car for maybe 10 days a year and already have great insurance with a low deductible. In fact, I was speaking to a Chase representative recently who admitted that this very unusual benefit was so difficult to explain that they don’t even bother to mention it in advertisements. They don’t really talk about the upgrades on awards either — that’s only something I’ve seen United mention.

So at the end of the day, what’s the point of keeping a card with a primary benefit I won’t use, a host of secondary benefits I already get, and a few stragglers that don’t really matter? My Hyatt Visa and American Express Platinum Card already keep me covered. And if I really need access to a United Club, I can still use one of several other options to get access for free or at least not too much. At least the MileagePlus Explorer still offers some useful perks to people who don’t have status. I just wish there were something for people like me, elite members who want a great United card that doesn’t duplicate what we already have.