Diversification is an important tool when making any kind of investment. Frequent flyer miles are a horrible investment because they are almost universally devalued with time, but the description remains accurate. Miles and points and acquired today with the hope that they may be used for future travel worth more than their original cost. Accumulating miles in more than one program reduces the risk that you’ll suffer catastrophic losses. Just imagine if you only had Avios points and wanted to use them all for long-haul travel. Changes to that program will see their value fall by up to a third in a few months’ time.

But just as important as diversification is consolidation. Management and opportunity costs multiply when you spread yourself too thinly. You can’t book any high-value awards if you only have 25,000 points in each of 10 accounts.

Ultimate Rewards points issued by a variety of Chase-branded cards address this problem by letting you accumulate one generic point and transfer it to a variety of airline, hotel, and rail partners only when you need to make a specific redemption. You can also combine points earned in multiple accounts owned by you or a spouse. The same risks apply — Chase could unilaterally decide it’s fed up with managing partner relationships and force you to redeem them for a much less valuable cash equivalent — but until then you still gain a lot of flexibility.

Three types of transfers are possible. In all cases you would want to transfer those points to an Ink Bold or Ink Plus business card or a Sapphire Preferred consumer card. Other cards also earn Ultimate Rewards points, but only these three cards have the ability to transfer them out to other programs.

Transfer Ultimate Rewards points from a basic to a premium card, e.g., from a Freedom to a Sapphire Preferred card. This increases the value of your Ultimate Rewards points since the Freedom only lets you convert them at a rate of 1 point = 1 cent, while some award redemptions may be more valuable.

Transfer Ultimate Rewards points between a business and a consumer card, e.g., from a Ink Plus to a Sapphire Preferred card. This increases the number of points in one account so that you don’t have to make multiple transfers to outside programs and face fewer annoying remainders (outside transfers must be in multiples of 1,000 while internal transfers can be any value).

Transfer Ultimate Rewards points between spouses, e.g., from my wife’s Sapphire Preferred to my Ink Plus card. This serves the same purpose as the second point above, and it also makes it easier to transfer points into my own external accounts where I may benefit from an existing balance or elite status.

This is important: Do not transfer points to individuals other than your spouse or domestic partner, even if they’re other family members. I’ve been penalized for this in the past and got off relatively fine, but for a while I was at risk of losing everything.

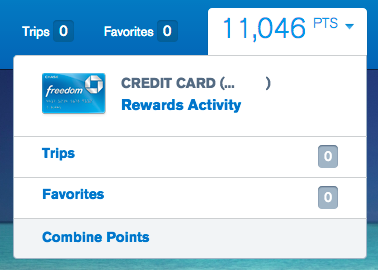

Start out by clicking on the Ultimate Rewards link on your account home page (upper right corner) or just access UltimateRewards.com. Hover over the account balance on the Ultimate Rewards page and choose the option “Combine Points” from the menu.

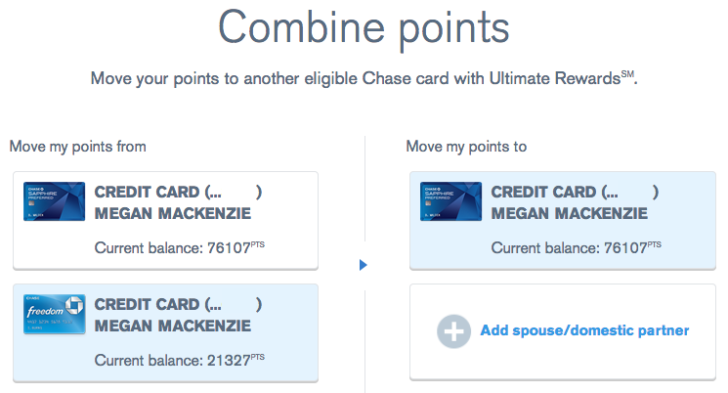

My wife has a more impressive account balance (I’ve been consolidating and using my own points), so we’ll use her account as an example:

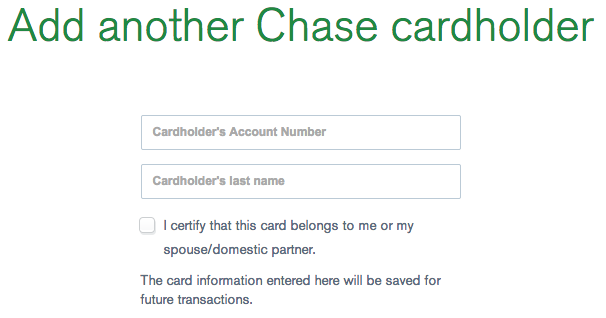

If you want to move points to another person’s account, you’ll need to click on that button and add their name and account number. I will give Chase credit for making it much more clear that you may only transfer points to a spouse or domestic partner. In the past this was buried in fine print or in a footnote that some people overlooked.

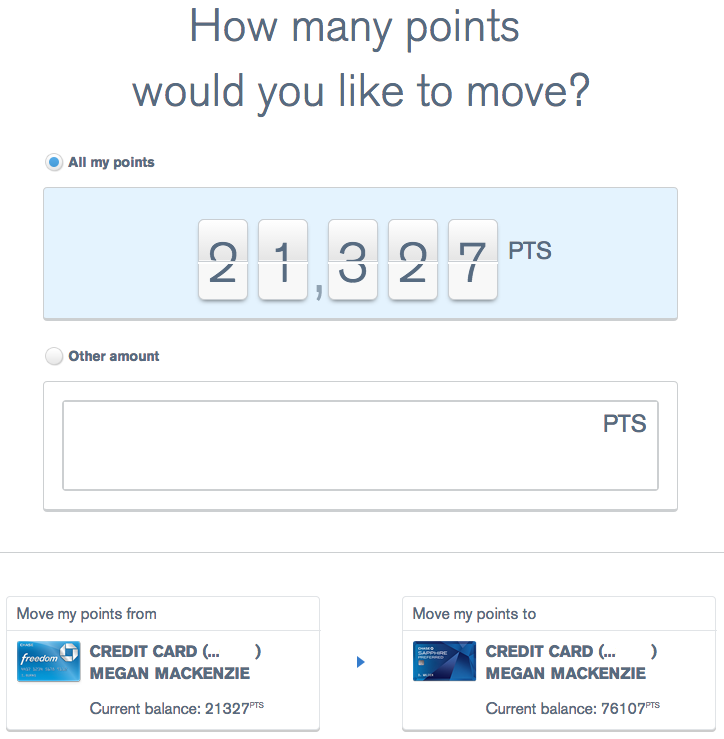

Finally, you’ll be able to choose how many points you want to transfer. I don’t see why you wouldn’t move all of them.

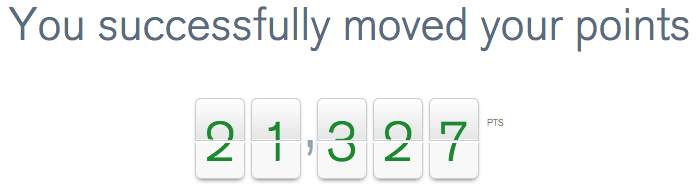

Megan’s Ultimate Rewards points are only worth $213.27 if she keeps them in her Freedom account. By moving them to her Sapphire Preferred account she can then transfer them out to another program such as United MileagePlus, Hyatt Gold Passport, or British Airways Executive Club (Avios). We usually get over 2 cents per point in value from Avios when we use them for domestic fares on Alaska Airlines. We can wait to find award space and then transfer the points instantly. But even Hyatt offers at least 1.4 cents per point in average value, and hotel loyalty programs generally don’t have blackout dates if a standard room is available. Any other problems? Megan won’t lose the option to convert points to cash.

The move between accounts is also instantaneous, and her new account balance is just shy of 100,000 Ultimate Rewards points. More likely than not she’ll make another transfer to move them all to my account since I’m the one who generally has larger existing balances and elite status and can thus squeeze a little extra value out of them. But I won’t do that yet.

Remember the importance of diversification. I’ve been burned before and almost lost my balance. At that time I was allowed to save my points by moving them to a business card, but I was not allowed to move them to Megan’s account. On the off chance that one of us incurs Chase’s wrath, I prefer to keep the balances separate until such time that the points are actually needed.