Although American Express was the first large bank to offer a transferable loyalty currency, letting members transfer Membership Rewards to multiple airlines, Chase has certainly given them stiff competition with its Ultimate Rewards program. Other bank programs like Citi ThankYou Rewards and Capital One Venture Rewards also allow you to transfer points to external loyalty programs.

Ultimate Rewards can also be treated like cash and used to purchase travel directly. Some cards like the Chase Freedom and Chase Freedom Unlimited can be turned into statement credits at a rate of 1 cent per point. The Chase Sapphire Preferred can be redeemed for travel online at a rate of 1.25 cents per point, and the Chase Sapphire Reserve can be redeemed for travel at an even higher rate of 1.5 cents per point. However, you can still find opportunities with even more value when you transfer points directly to an airline or hotel loyalty program.

Earning Ultimate Rewards Points

As mentioned above there are four personal cards that can earn Ultimate Rewards points, though only the Chase Sapphire Reserve and Chase Sapphire Preferred can transfer these points to an airline loyalty program. If you earn points with another card, you’ll still need one of these to make an outside transfer.

The Chase Sapphire Reserve earns 3 points per dollar on all travel and dining and 1 point per dollar everywhere else. It has a $450 annual fee partially offset by a $300 annual travel credit.

The Chase Sapphire Preferred earns just 2 points per dollar on travel and dining and 1 point per dollar everywhere else, but it has a lower annual fee of $95. It’s also missing some other valuable benefits also found only with the more expensive Reserve card.

The Chase Freedom and Chase Freedom Unlimited each have no annual fee and smaller bonuses. They may be useful for purchases where the Sapphire Reserve or Sapphire Preferred earns only 1 point per dollar. The main difference is that the Freedom card earns 5 points per dollar on up to $1,500 in purchases each quarter and then 1 point thereafter, while the Freedom Unlimited card earns a flat 1.5 points per dollar on all purchases.

Chase Ultimate Rewards Transfer Partners

Chase has fewer transfer partners than most other programs, but they are more likely to be programs you’ve heard of before. (Don’t let that dissuade you from the competition. Some of the less familiar, foreign programs actually have great award charts. Transferring points from a bank rewards program is the method most U.S. travelers use to take advantage of them.)

| Airline or Hotel Program | Transfer Ratio | Transfer Delay |

|---|---|---|

| Aer Lingus AerClub | 1,000 : 1,000 | Instant |

| British Airways Executive Club | 1,000 : 1,000 | Instant |

| Air France/KLM Flying Blue | 1,000 : 1,000 | 1 hour |

| Iberia Plus | 1,000 : 1,000 | Instant |

| IHG Rewards Club | 1,000 : 1,000 | Instant |

| JetBlue True Blue | 1,000 : 1,000 | Instant |

| Marriott Bonvoy | 1,000 : 1,000 | Instant |

| Singapore KrisFlyer | 1,000 : 1,000 | 2 days |

| Southwest Rapid Rewards | 1,000 : 1,000 | Instant |

| United MileagePlus | 1,000 : 1,000 | Instant |

| Virgin Atlantic Flying Club | 1,000 : 1,000 | Instant |

| World of Hyatt | 1,000 : 1,000 | Instant |

On the other hand, the mix of hotel and airline transfer partners offered through Ultimate Rewards creates some risk. All transfer rates are 1-to-1 with a minimum transfer amount of 1,000 points. For a more valuable program like United MileagePlus or World of Hyatt, 1,000 points is a lot. For a less valuable program like Marriott Bonvoy, 1,000 points won’t get you very far. Either way you’ve redeemed 1,000 Ultimate Rewards points. Consider your redemption options carefully before initiating a transfer. You might also want to look at other options by visiting my Points Transfer Calculator.

How to Transfer Chase Ultimate Rewards

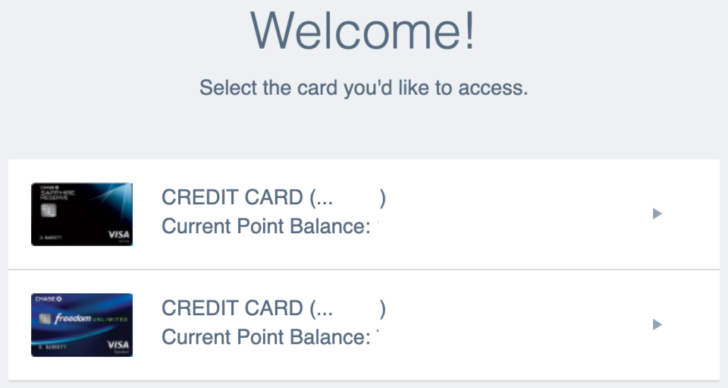

The first step is to log into your Ultimate Rewards account. You can do this by logging into Chase and finding the button for your card’s Ultimate Rewards account. Every card has its own separate account.

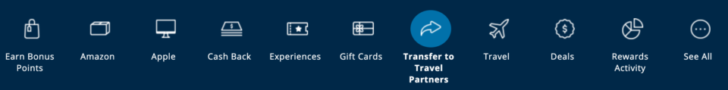

Once logged into your chosen Ultimate Rewards account, you can select the option to “Transfer to Travel Partners” from the top menu.

You can also look for this button partway down the main page.

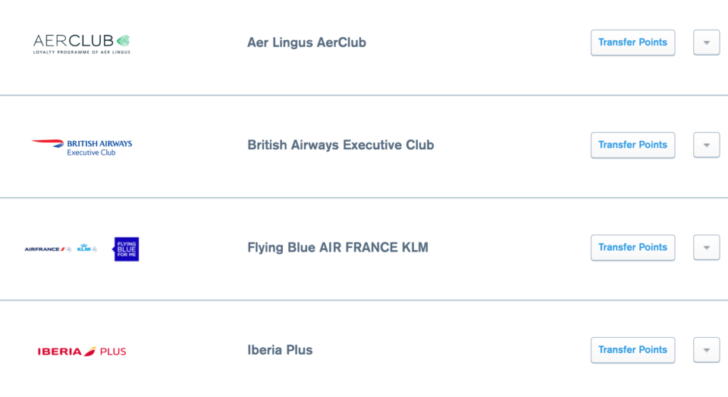

You’ll be presented with a fairly obvious list of transfer partners and the option to move points to each one. However, if you’ve transferred points to a partner program in the past and saved your account information, then there will be a larger button at the top that lets you expedite the process.

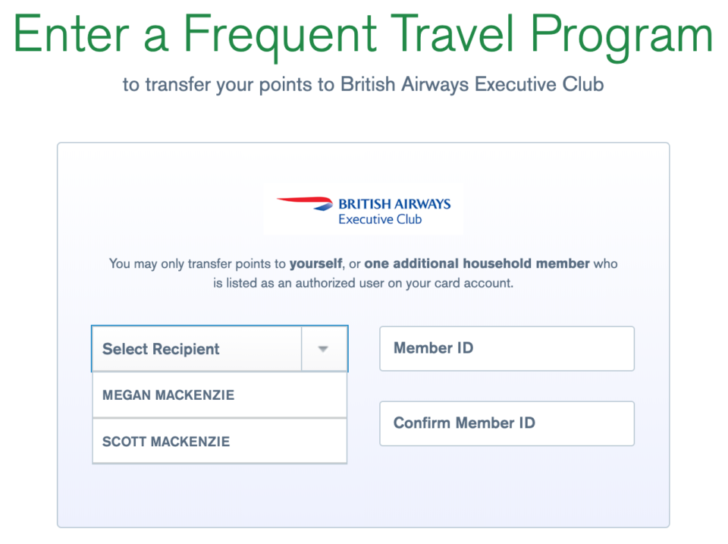

Enter the account information for the program you’ve selected, in this case the British Airways Executive Club (which uses Avios as its currency).

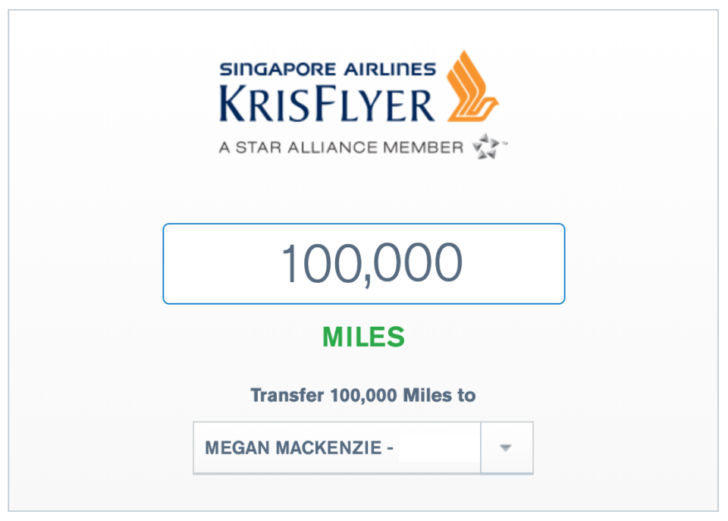

Once the account is added, you can then transfer Ultimate Rewards points to the partner program. In this example, the information for my wife’s KrisFlyer account was already in the system. It’s much easier to just enter the number of points to be transferred, and she can select either her own or my account from the menu.

You Can Transfer Ultimate Rewards Between Accounts

One of the things that makes Ultimate Rewards more useful than other bank rewards programs is that you can easily combine points between accounts, including accounts owned by a spouse or significant other. Be aware the rules specifically limit you to one other authorized user:

You can transfer points in 1,000 point increments, but only to participating frequent travel program accounts belonging to you, or one additional household member who is listed as an authorized user on your card account. Once you transfer points to an authorized user, that person will be the only authorized user on your account eligible to receive point transfers.

By combining points with a spouse or other family member you can grow your account balance more easily. There’s more fun to be had with 200,000 points than with only 100,000 points each in two accounts. Perhaps you can book a single award that puts both passengers on the same reservation rather than separate tickets, or you can take advantage of an extra free night award when you use points to pay for the first four.

Go back to that menu at the top. You may need to expand it by clicking on the “See More” button on the right side. The option to combine points is the very last one.

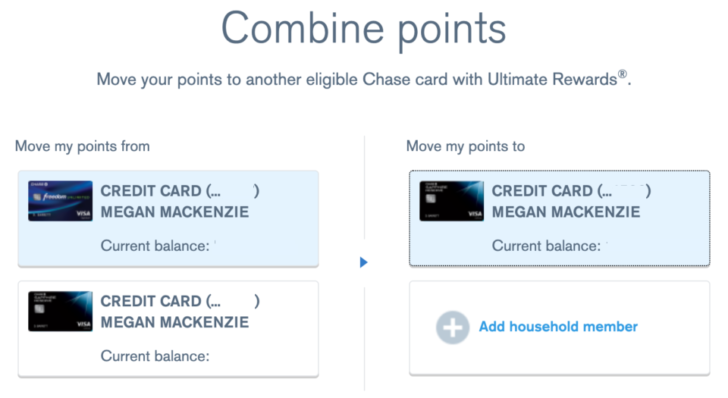

You’ll be asked where you want to move your points, whether to another card you already own or to a card owned by another household member.

You don’t always need to transfer points between individuals. You can also transfer points from your Ultimate Rewards account directly to an external loyalty program account owned by a spouse, bypassing one intermediate transfer step.

But remember, if you have points in a card that doesn’t participate with any transfer partners, you will first need to move them to a card that does. In the example above, you can see an example of moving points from a Freedom Unlimited card to a Sapphire Reserve card in order to take advantage of the more valuable redemption opportunities only available with the Sapphire Reserve.

Once in the Ultimate Rewards account associated with a Sapphire Reserve card, they can be redeemed for 50% more value (1.5 cents per point on travel, instead of a 1 cent statement credit) or transferred to an external loyalty program like World of Hyatt or Singapore KrisFlyer.