Turkish Airlines will commence nonstop services to San Francisco on April 13, 2015 from its Istanbul hub, initially on five-weekly frequency basis before up-gauging to a daily service on May 13, 2015. Service will be operated on a large-density 777-300ER with schedules operating as follows:

TK079 IST1305 – 1625SFO 77W x36

TK080 SFO1810 – 1705+1IST 77W x36

The route disclosure comes a mere few days after Etihad Airways unveiled plans to fly nonstop to SFO from its Abu Dhabi hub. While Etihad will be targeting premium traffic from India to the Bay Area, Turkish Airlines instead is focusing on connecting Northern California to points across the Middle East, Central Asia and North Africa region, as well as leveraging Star Alliance connections into San Francisco, which is a hub for partner carrier United Airlines.

Eithad announces San Francisco using an atypical approach for a Gulf carrier

Turkish remains bullish on growth in the U.S., but is it more of a follower than a leader?

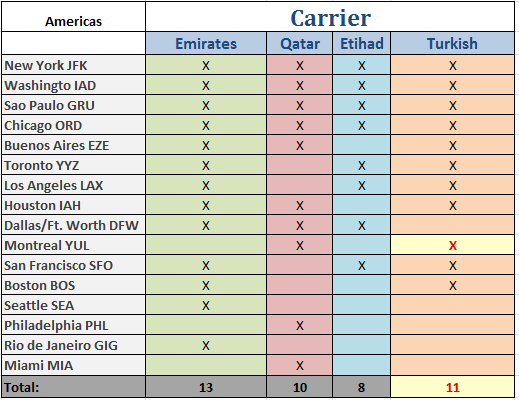

With regards to its international expansion plans in the Western Hemisphere, the reality is that Turkish has not pioneered any new routes in the U.S. that are uncovered, nor underserved, by its European and Middle Eastern rival carriers. Among the recent adds to its network across the Americas – such as Boston, Houston, Sao Paulo, Buenos Aires, Toronto and Montreal – for instance, all were served by at least one of the Big Three Gulf carriers (Etihad, Emirates and Qatar) alongside a plethora of European foreign carriers.

Meanwhile, Turkish had formerly announced intentions to serve markets such as Detroit and Atlanta, which currently do not see a large foreign flag carrier presence as their international reaches are dominated by Delta Air Lines as SkyTeam hubs. Detroit’s exclusion from Turkish’s network is notable given that the Southeast Michigan region is home to an exceptionally large immigrant population from the Levant region, namely Lebanon, Syria, Jordan and Palestine. According to data from the U.S. 2010 Census, the Metropolitan Detroit area boasts a larger concentration of Arab Americans than New York City. Given Turkish’s geographic location, it would offer a much preferable connecting option over Istanbul over the Gulf Coast carriers to serve Michigan – Middle East traffic over the Gulf Coast carriers.

Turkish will be able to offer more favorable connections from the Bay Area to West Asia

From the Bay Area, one differentiating attribute about Turkish Airlines’ service will be its ability to connect transit traffic to points in West Asia that are more circuitous on Etihad and Emirates. Arrivals into Istanbul prior to a 13:00H departure time supports connections from Odesa, Almaty, Bishkek, Baku, Beirut, Tel Aviv and Tehran. On the inbound arrival into Istanbul from San Francisco, Turkish similarly provides a massive departure bank to those same markets.

Another differentiating factor for Turkish vs. the Gulf Coast carriers is its reliance on narrow-body aircraft to reach medium-haul markets throughout the Middle East, Europe, Africa and Central Asia region. Data in CAPA’s fleet page shows that roughly 73.7% of Turkish’s fleet is comprised of narrow-body jets (165) with the remaining 26.3% on wide-body jets (59). Comparatively, Emirates is 100% widebody at 225 jets, and Etihad, albeit a much smaller carrier than the other two, is 71% widebody (69 jets) and 29% narrowbody (28 jets).

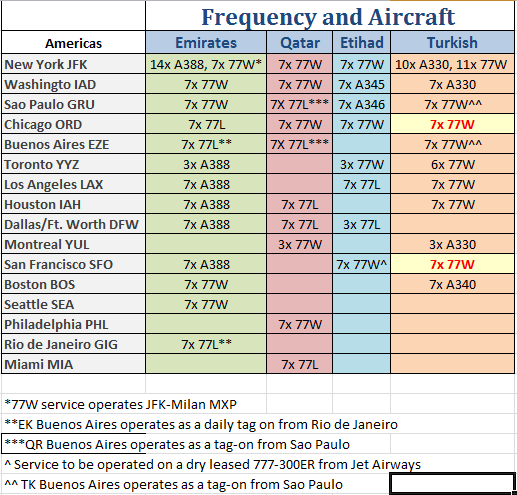

Chicago route up-gauged from an Airbus A330-200 to a 777-300, a major bump

Turkish has also announced that it will be up-gauging its Chicago route from a Airbus A330-200 to a 777-300 in May 2015, representing a rise in weekly seat capacity by nearly 500. The Chicago route has a unique distinction of being Turkish’s longest route that also receives its smallest wide-body aircraft.

The change in gauge is necessary given that Turkish’s Airbus A330-200 product is late-generation with 22 angle-flat seats in its Premium Class cabin and 228 standard economy class seats in the main cabin. Conversely, its 777-300ER series aircraft comes in a 3-class cabin layout, with 28 flat bed seats in Business Class, 46 premium economy seats, and 246 standard seats.

While Turkish positions itself as neither a European network carrier, nor a Middle Eastern carrier, but somewhere in between, the fact remains that Turkish faces competing pressures from overlap on both sides. Although premium demand from Chicago is likely weaker than some of its other North American routes, Turkish has had to contend with a surge in Middle Eastern capacity from O’Hare airport, which will only grow in size this fall once Emirates launches nonstop service from Chicago to Dubai in August. Between March 2013 and September 2014, Chicago to Middle East weekly seat capacity will double from roughly 4,000 seats before on two carriers (Etihad and Royal Jordanian) to 8,000 (addition of Qatar and Emirates).

It is then strategic for Turkish to provide a first generation Premium cabin product to stay abreast with the Middle Eastern carriers, while also offering a differentiated Premium Economy class cabin, something that none of the Gulf Carriers, nor Royal Jordanian, offer on their long-haul flights.

Chicago has also experienced a major rise in transatlantic capacity to Europe in recent years, with weekly seat capacity growing from roughly 60,000 in July 2012 to 75,000 in July 2014, representing approximately 12% growth per annuum.

Approximately 17 carriers offer nonstop transatlantic services from Chicago to Continental Europe, ranked from largest to smallest by weekly seat capacity: United, American, Lufthansa, British Airways, SAS, Aer Lingus, Iberia, SWISS, Turkish, LOT, KLM, Virgin Atlantic, Air France/Delta, Airberlin, Austrian and Alitalia.

Of the aforementioned carriers, slightly more than half offer a premium economy class product, although each is a bit more nuanced than the other. On the US carriers, for example, United’s EconomyPlus product, Delta’s Economy Comfort and American’s Main Cabin Extra product simply offer more legroom. While priced as an ancillary product, access to these cabins is complimentary for elite status holders.

From the European carriers side, the product is priced entirely as a separate cabin, with a larger array of frills. From Chicago, premium economy is offered on Air France, Alitalia, British Airways, LOT, SAS and Virgin Atlantic. Lufthansa, in the process of upgrading its 747-8i series aircraft to include a premium economy cabin, has identified O’Hare as an early adopter target for deployment in the near future.

As such, for Turkish, the premium economy wave has already caught on among European carriers serving Chicago, but following in the middle of the pack isn’t always such a bad thing.

Turkish is a profitable carrier, but is it growing too quickly and potentially adding routes that are not cash-positive?

Turkish Airlines has reported years of consistent annual profitability, with its peak year in 2012 generating $657 million USD in net profit. 2013 was a bit less stellar with a near 50% drop to $357 million, followed by a Q1 2014 loss of $102 million USD. Turkish has promised that despite ASM growth outpacing ASM growth by 6%, the first quarter losses, typically the weakest operating period for global airlines, would be off-set during the later half of the year.

Still, the carrier has embarked on an ambitious growth strategy to extend its long-haul reach into already crowded markets in the Americas, and also intends to grow its operations in the Asia-Pacific region. Rumors of a purported Istanbul to Sydney nonstop long-haul route would overtake Qantas’ Sydney to Dallas/Ft. Worth route as the world’s longest by distance.

So, is it prudent for Turkish to continue expanding if it may potentially be adding seats to markets like Chicago and San Francisco where competition is rife and yields are depressed? While serving the highest number of international countries of all global carriers certainly entitles one to bragging rights, it does not insulate against regional challenges that create a difficult operating environment for Turkish. In the Americas region, Turkish has promised to add routes to more Latin American markets, at one point naming Mexico City, Bogota, Havana and Caracas as early targets. However, noticeably Turkish has experienced negative RASK growth in existing Latin American markets, where it currently serves Brazil and Argentina. Depreciation in foreign exchange rates have created its own set of challenges.

Elsewhere, political tensions in countries such as Ukraine, Russia and Thailand have also been problematic in leading to negative RASK growth.

Relative to its European legacy peers, Turkish Airlines’ cost structure is very nimble, which has allow it to pursue rapid expansion at profitable levels. However, with a 17% rise in costs year-over-year in 2013, and uncertainty whether its RASK growth in 2014 will climb, the advantage may be waning slightly.

Certainly, one advantage that Turkish is also able to harness over its Gulf peers is the attractiveness of Istanbul and Turkey has a tourism destination in and of itself, along with a massively larger population centre in Istanbul proper. The Gulf countries, however, do boast higher levels of economic wealth per-capita over Turkey.

In addition, Turkish may also be insulated by the efficiency of its short-haul, narrowbody operations that indeed contribute the strongest RASKs to its bottom line, essentially off-setting small drainage caused by its long-haul operations. In essence, this is the direct opposite scenario European network carriers are currently facing: unprofitable, high-cost short-haul routes that have been long propped up by intercontinental routes. Of course, one scenario as far more favorable to the other, as long-haul routes, even if loss-making, do not have to face competitive pressures from low-cost carriers. Further, as long as Turkish is able to maintain a lean cost structure, minor losses will not cause too many problems in the short-run.