Should an OTA Replace Your Loyalty Program?

For people who don’t travel often or who patronize a variety of brands, online travel agencies (OTAs) are a great option for earning extra rewards. You don’t need to book a dozen stays with the same hotel chain in order to earn enough points for a future free reward. You can choose from a broader selection and pick the hotels that work for you in every destination.

Most hotel loyalty programs do not provide points or benefits to members booking through OTAs like Expedia. However, this is irrelevant if you already found those programs wanting. Online travel agencies that offer their own rewards programs across multiple hotel chains can be an attractive substitute.

What’s great about Expedia Rewards vs. most loyalty programs is that you can earn and redeem points in the same program for both flights and hotels. And unlike hotels you can continue to earn frequent flyer miles and airline elite status. Credit card rewards, of course, work regardless of where you shop.

Elite Status

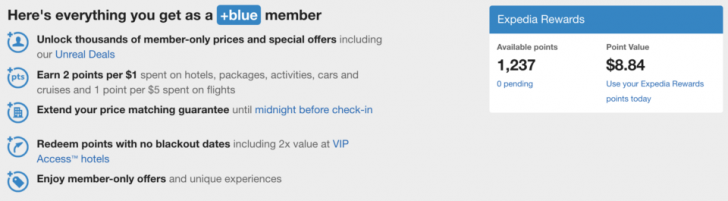

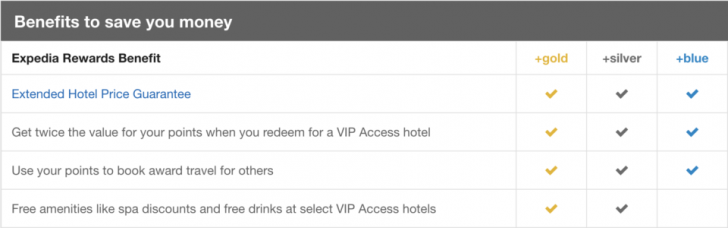

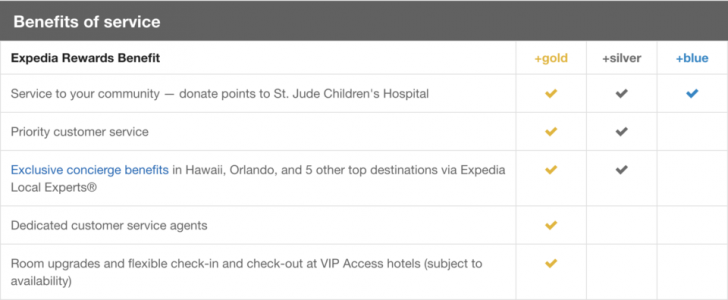

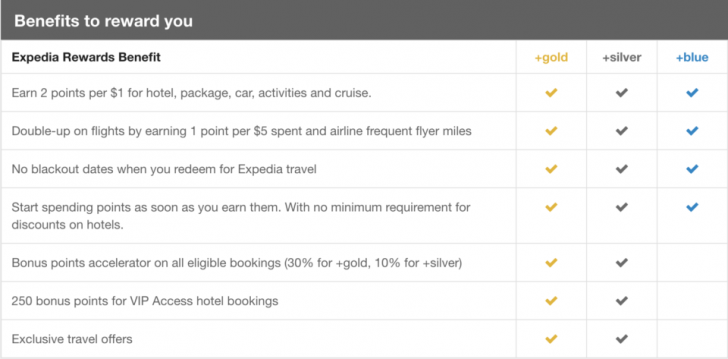

Yes, even unconventional loyalty programs have elite tiers. Everyone starts out with Blue status, but you can earn Silver or Gold status to earn and redeem points at a higher valuation–plus receive additional perks.

Silver status is earned after spending a total of $5,000 or staying 7 qualifying nights in a year, while Gold status is earned after spending a total of $10,000 or staying 15 qualifying nights in a year. These are relatively low thresholds (at least as far as nights go).

You can also look forward to 250 bonus points when you book select VIP Access hotels, get potential upgrades and free welcome amenities at these hotels, and dedicated customer support from Expedia.

Earning Expedia Rewards

Expedia Rewards has two different tiers for earning points. Hotels, car rentals, cruises, and vacation packages earn 2 points pear dollar spent. Airline tickets earn just 1 point per 5 dollars spent (to make the contrast more obvious, it’s 2 points per $10).

Why so different? Well, airlines have been cutting back on commissions for years, so there’s simply less revenue to share with the customer. Profits are relatively high for other sorts of travel. But remember, you still earn airline miles as long as you put your frequent flyer number on the ticket, so even a small rate of rewards on flights is still a bonus.

Redeeming Expedia Rewards

What makes Expedia Rewards compelling is that you can redeem the points on any future travel, and you don’t need to have enough to cover the entire purchase. 140 points are worth $1 in credit. That’s equivalent to a 1.4% rebate on hotels and a 0.14% rebate on flights. You can redeem as little as one point, so there is clearly no minimum threshold to worry about.

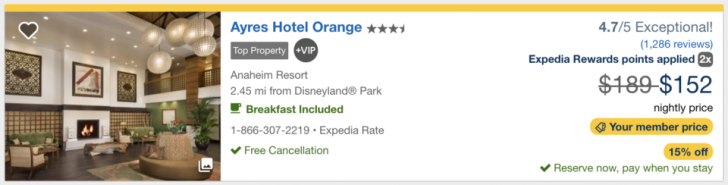

Frequent travelers who earn Gold or Silver status can get twice the value for their points when they book a VIP Access hotel. (Just look for the grey “+VIP” icon.) Combined with the additional 10% to 30% bonus when earning points with elite status, this can boost the return on hotel bookings to as much as 3.7%.

Using Partner Rewards

You can redeem Citi ThankYou Rewards points and American Express Membership Rewards points on Expedia to book flights or hotels. However, this is really a separate deal from Expedia Rewards because you aren’t transferring points from one program to another. Instead you’ll be offered the chance to redeem points from Citi or American Express directly to pay for the booking.

The Expedia Rewards Credit Card

Citi offers an Expedia Rewards credit card with no annual fee. It earns 3 points per dollar on purchases from Expedia and 1 point per dollar everywhere else. I recommend it if you make a habit of purchasing travel from Expedia, but there are still better cards out there.

For example, you can earn 3 points per dollar on any travel (including Expedia) with the Chase Sapphire Reserve. But that has a $450 annual fee. If you don’t have it already, it’s not worth signing up for it just to use at Expedia. Expedia’s own credit card would be the better option.

But for purchases elsewhere I would definitely consider other cards. Remember that you need 140 points to earn a dollar off, so each point is worth about 0.7 cents. Another no-fee credit card like the Chase Freedom Unlimited earns 1.5 points on all purchases, and each point can be redeemed for 1 cent in cash back.

Is Expedia Rewards a Good Deal?

Comparing rewards programs is always tricky. Do you want a good value or ease of use? Because all loyalty programs are easy to use if you’re willing to redeem enough points at a low value. I invest a lot of time to search for limited award space on key routes and in fancy hotels that maximize the value of my points. If you just want to be able to book any trip you want, then a traditional loyalty program is not going to be your best bet.

I mentioned that if you earn points at a rate of 2 per dollar and redeem 140 points for a dollar of future travel, this is equivalent to a 1.4% rebate. My standard for comparison is Hilton Honors because there’s a Hilton almost everywhere.

Base members at Hilton get 10 points per dollar. Award space is limited, and the award prices don’t necessarily track the dollar cost of a hotel room. A quick search found one hotel with a $250 room available for 50,000 points. That means you’d need to spend $5,000 to get a free stay, for a 5% rebate. But there are also lots of hotels with no award space, or maybe you don’t like the Hilton properties in your destination. And you’d need to earn all 50,000 points in the first place.

As I said, it’s a trade-off between the convenience of choosing any hotel you like with a fixed return and the commitment to a loyalty program that might offer better rewards depending on a host of other factors.

For airlines, I’ve long believed it’s best to book directly with the airline. That way there is no finger pointing when flights get cancelled or delayed and you need to make a change. The rewards that Expedia offers are so little that it doesn’t seem worth the risk. But if you need to book a ticket with travel on multiple carriers, then Expedia has you covered.

Summary

Expedia Rewards lets you earn and redeem points on almost any flight or hotel, making it possible to get a discount on future travel without having to be loyal to a single airline or hotel. In exchange for this ease of use, the rewards aren’t as great, but some people who have been frustrated by traditional loyalty programs may still find them to be an improvement. Expect to get a 1.4% rebate on hotels and even more if you are a frequent traveler.

Elite status is the sticking point. You might not enjoy any conventional hotel perks even if you already have status through other means, but you’ll continue to earn points and status with the airlines. Expedia Rewards has its own elite status benefits, but that seems to defeat the purpose of abandoning conventional loyalty in the first place.

I recommend Expedia Rewards for the infrequent to occasional traveler, and I use it myself when I need to stay at a hotel that isn’t part of my usual portfolio. What could make the program even better? Well to start, I’d like them to publish more of their program terms online without requiring you to register or log in first. I shouldn’t be the one telling you how it works.

I’d also like to see a higher return, like you see with the buy 10, get 1 free offer from Hotels.com, but that starts pushing back against convenience and simplicity. Bottom line: Expedia Rewards wins as the simplest program available, and even the most avid travelers use it from time to time.