Recently I’ve been criticizing Chase Ultimate Rewards, writing about how they’re falling behind many of the other major bank programs such as Citi ThankYou and Amex Membership Rewards. I won’t relitigate those arguments here — if you want to know why I think this is true, check out “It’s Time to Put the Chase Sapphire Preferred in the Sock Drawer” and “While Chase is Tightening Approvals, Ultimate Rewards is Slowly Dying.”

The Conventional Wisdom holds that flexible loyalty currencies, such as Chase Ultimate Rewards, are the most valuable of all points thanks to their ability to be transferred to multiple programs. Most valuations assume the value of points are maximized when transferred directly to airline and hotel programs. That’s generally true.

But not always.

With first class partner redemptions on United now pricing at 110,000 miles each way from the U.S. to Europe, the elimination of the low 4,500 Avios level award band for domestic short-hops via British Airways, and Southwest points worth less than ever before, it’s hard to suggest that Ultimate Rewards still has the strongest stable of transfer partners. And who knows when the next domino will fall?

So is it time to look at redeeming Ultimate Rewards in other ways? Can we find equal or even greater value by booking via the Ultimate Rewards portal instead of hoping to stumble across ever decreasing award availability and always increasing award chart prices?

Are transfers no longer the best use of Ultimate Rewards?

What’s the value of Ultimate Rewards points?

Scott — the Founder, President, and Benevolent Leader of Travel Codex — considers the value of Ultimate Rewards to be 1.8 cents per point. That’s similar to others in the points and miles world and takes into account the value of having a flexible currency.

Of course, there’s a never-ending argument about how to determine your true redemption values, and I’ve jumped headfirst into this dispute from time to time. This is probably not surprising considering my very first Devil’s Advocate post was entitled “Yes, You DID Get 10 Cents Per Mile for Your Award Redemption.” I continue to believe that redemptions should be valued at the actual prevailing airfare. Even if you would never actually pay for first class, someone does.

But if you don’t agree with valuing redemptions based on airfare, or if you’re primarily redeeming for domestic economy seats, you’ll almost never actually get 1.8 cents per point. Even transferring to Southwest is worth, at best, 1.43 cents per point.

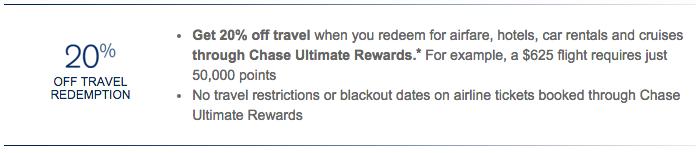

Now, if you have either a Chase Sapphire Preferred or Chase Ink business card, you’re always able to buy airfare directly at 20% off, which equals a cost of 1.25 cents per point.

At first glance, that seems even lower than the value of transferring points to Southwest. But when we look deeper…

An example of purchased airfare.

Recently I had the opportunity to fly JetBlue’s premium Mint class from JFK to LAX. I’ll be writing up a complete review of Mint soon over at the relaunched InsideFlyer (which by the way, you should check out if you haven’t already — it’s got all the features of Boarding Area but with the forums of Milepoint to boot).

But for the purposes of our current discussion, all that’s important is that Mint is on a similar level as the better domestic first class products, such as American’s 321T transcontinental first class.

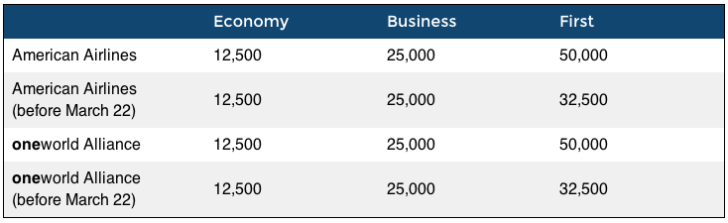

So what does a first class seat on the American 321T cost in AAdvantage miles? Well, speaking of new things you should check out, let’s use the brand new Travel Codex award chart search tool to find out…

As you can see, while at the moment American’s domestic first class award price is only 32,500, starting March 22nd the price for that seat will be 50,000 miles one way.

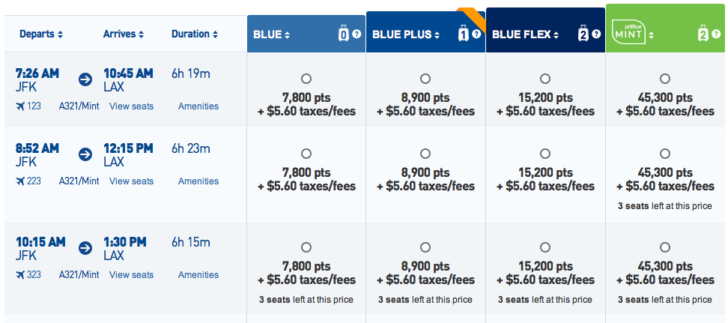

On the other hand, booking Mint via JetBlue’s TrueBlue points at its lowest award price would be a little more than halfway between American’s old and new prices…

In both of these cases, the award ticket wouldn’t earn miles or elite status, and on American it’d also be dependent on award availability. JetBlue uses a revenue-based redemption system so their award seats are always available, though the price fluctuates. But if you transferred Amex Membership Rewards points to JetBlue in order to book this ticket with TrueBlue points at this price, because of the 200:250 transfer ratio you’d actually be spending over 50,000 points.

Ultimate Rewards, activate!

The JetBlue Mint airfare is $599 one way at its lowest price, so if we use Ultimate Rewards points to buy the ticket at 1.25 cents per point, it’d cost us 47,920 points. That’s already less than either American’s award price or Membership Rewards points transferred to JetBlue.

But now add in the fact that we’ll earn TrueBlue points on this trip. Since Chase actually books their JetBlue tickets via the same jetblue.com website the rest of us mere mortals use (yes, they really do), you’d get the normal 3 TrueBlue points per dollar spent plus 3 extra points for booking on jetblue.com for a total of 3,594 TrueBlue points earned.

If you were a new TrueBlue member and flying before March 14, 2016, you could also first register for the 3,500 point new member bonus and pick up even more points that way. If you do this, remember to sign up via the link before booking your flight or it won’t count.

Or if you’re already a TrueBlue member, you could register for the current JetBlue double points promotion (again, make sure to sign up before booking), which means through the end of February you’d actually accumulate 9 points per dollar for a total haul of 5,391 TrueBlue points earned on that $599 flight. Deduct those earned points from the points you spent, and this trip only ends up costing around 42,500 total points. That’s a redemption valuation of 1.4 cents per point.

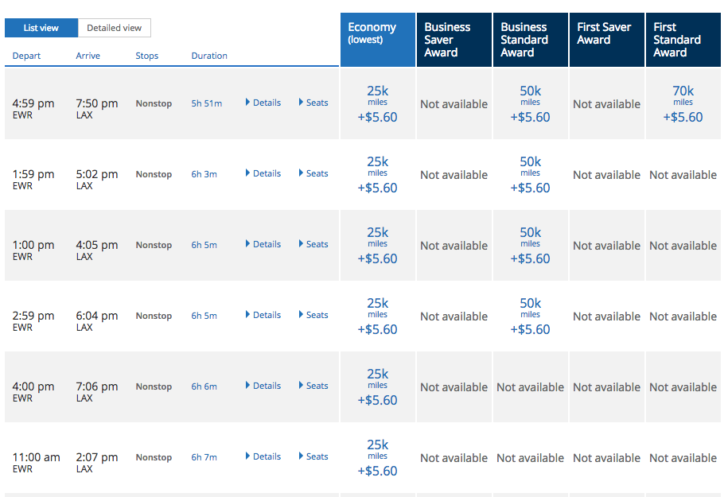

Now, the Conventional Wisdomers will argue you can transfer 35,000 Ultimate Rewards points to United and get a first class seat for less that way (though there’s no domestic first class on Delta). That’s true, but only if you can find an actual first class seat, which is extremely difficult on United’s New York to Los Angeles route.

Though there are occasional exceptions, it’s rare that you’ll even find a 3-cabin plane flying this route, and United’s p.s. Premium Flight Service, while not bad, isn’t really the same. Besides, finding business class award availability for the p.s. service is tough.

Finally, when booking airfare directly with Ultimate Rewards, you can mix in any amount of cash you’d like and get a corresponding reduction in the points price. While the cost per point remains 1.25 cents, you’re still earning the same number of TrueBlue points for the flight. So by adding in, say, $199 in cash to that $599 airfare, you’ll spend only 32,000 Ultimate Rewards points and earn the 5,391 TrueBlue points for a net cost of 26,609 overall points plus the $199 cash. Not bad at all for a genuine first class transcontinental trip.

The Devil’s Advocate will consider buying airfare directly with Ultimate Rewards.

I’ll be the first to say using Ultimate Rewards points this way won’t always make sense. And if you’re not maximizing the bonus categories of the various Ultimate Rewards cards, then you might as well get a 2% cash back card like the Citi Double Cash instead. That’s true even if you’re transferring points to travel partners and redeeming at that average value of 1.8 cents per point.

But given how often Conventional Wisdomers pooh pooh the idea of spending points directly on airfare, many people might be led to believe it’s a path for suckers. It’s not. It’s worth at least looking at if you’re considering a domestic flight with a low airfare.

And if the Chase travel partners continue to devalue at a similar pace, using Ultimate Rewards points directly for airfare might eventually become the best redemption value more often than not.

Devil’s Advocate is a bi-weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by following him on Twitter @dvlsadvcate or sending an e-mail to dvlsadvcate@gmail.com.Recent Posts by the Devil’s Advocate:

- The Best Way to Load Your Amex Bluebird and Serve Survivors

- Targeting Conventional Wisdom in 2015 (and 3 Predictions for 2016)

- Free Points or Free Cash? The Hard Choices of a Citibank Retention Call

Find the entire collection of Devil’s Advocate posts here.