United will officially be pulling the plug on two short-lived routes from its Newark Liberty hub this fall, as well as placing a 787-800 on its legacy Seattle – Tokyo nonstop flight in lieu of a 777-200.

United fails to gain traction in the New York – Buenos Aires market

On Saturday, airlineroute.net posted that United will cancel its Newark to Buenos Aires nonstop eff. 29 SEP 13, per GDS inventory display. Currently, UA flights 847/846 operate daily from EWR to Ministro Pistarini Ezeiza Airport in BUE utilizing two Boeing 767-300ER frames in a 2-cabin configuration, with the following schedule.

UA847 EWR2125 – 0955+1EZE 763 D

UA846 EZE2000 – 0615+1EWR 763 D

The cancellation of Newark to Buenos Aires has left the airline community shocked since this will leave United down to a single daily flight serving Argentina, from its Houston hub, using a 2-class B763. United actually has a fairly deep-routed history in serving the NYC-EZE corridor. Back when United had a quasi-hub at JFK International Airport, the carrier flew London Heathrow – New York – Buenos Aires as a “through-flight” until it was suspended in summer 2002, due to the economic meltdown in Argentina.

However, in fall 2002, United re-attempted a nonstop flight to EZE from its Dulles hub, which operated for nearly a decade. After UA merged with Continental, United announced that it was moving its Dulles – Ezeiza flight to back to New York in spring 2012, flying from its newly acquired Newark hub, and would utilize the same flight numbers. This left many in the D.C. area enraged as they (falsely) believed that this was an indication that new United would start giving NYC preferential treatment over D.C. in launching new routes.

While IAD-EZE was likely profitable (UA inside sources would need to confirm that for me – which I believe to be true since UA held onto it for so long), the new United probably felt that targeting NYC-BUE traffic, which likely included higher O&D volumes, would correlate to stronger yields on UA 846/847, versus IAD-EZE which likely comprised of a larger concentration of connecting passengers. As general rule of thumb, nonstop itineraries = higher profits over 1 stop + itineraries for an airline.

However, as we learned on Saturday, this turned out to not be the case, as after an 18 month trial period, Newark will lose its connection to Argentina, and retain only one link to the Southern Cone region of South America with a daily nonstop to Sao Paulo. It appears unlikely that United will restore the IAD-EZE nonstop as a result of this casualty, and instead funnel traffic to/from Argentina entirely by way of its Houston hub.

I personally am surprised by the cancellation at initial glance, noting that the majority of Argentina – US traffic is heavily Miami-centric, followed next by New York. With United exiting the NYC-EZE market, it once again leaves American as the sole operator between the two regions. Delta briefly operated a JFK-EZE nonstop in early 2009, which barely lasted 4 months before it pulled the plug. Argentine flag carrier Aerolineas Argentinas, which recently joined SkyTeam, withdrew from New York in 2006 and hasn’t returned since.

My guess is that the volatile Argentine economy and political situation is partly a contributing factor to the route withdrawal. However, I’m also going to go out on a limb here and suggest that United management simply doesn’t have a clue on how to make Argentina flights work.

Dating back to the early 2000’s, United once operated as many as 3x daily flights from Buenos Aires to Miami, for example, before it pulled down its Miami hub and shifted the route to a nonstop Chicago – Buenos Aires operation in 2004. Then, once it entered bankruptcy, it had to return some 767s to lessors, and ORD-EZE never re-launched.

With the UA-CO merger, UA wanted to focus EZE entirely out of pre-merger CO hubs, but that strategy obviously failed. Newark is a very delay-prone airport that is subject to weather and traffic issues. Even with healthy load factors (looks like December 2012 shows 84%), United couldn’t cover operational costs of dedicating two resources to this flight.

The reduction could also simply underscore American’s dominance in the US-Argentina market. From Ezeiza, AA operates multiple daily flights to its Miami hub (as many as 3 daily in high season) alongside a daily service to its Dallas/Ft. Worth and New York JFK hubs. United and Delta simply cannot siphon away more traffic from its competitor.

Newark – Istanbul nonstop to vanish in October

Airlineroute also published this morning that United’s recently launched Newark to Istanbul flight is being cancelled on 26 OCT 13. UA flights 904/905 are flown daily in the summer period (and operate 5-weekly in the low season) on a 2-class Boeing 767-300ER.

UA904 EWR1915 – 1220+1IST 763 D

UA905 IST1355 – 1810EWR 763 D

You may remember this as the infamous flight that Matthew was booted from last winter for taking pictures.

Newark – Istanbul will barely see a full year of survival once it is chopped by United, and given the dirt cheap fares UA was filing for this route, I am not surprised to see it go. I was originally supposed to fly on this itinerary from ORD to IST last December as part of a Mileage Run, which I found for $503.80 round-trip! My plans eventually changed and I froze the funds, but without question, I was skeptical about whether this flight would last.

Noticeably, Delta converted its long-standing New York JFK-Istanbul flight to a seasonal service last winter, from year-round to March-November. Innovata inventory shows that the route once again will be suspended in the fall during low season.

The likely downfall of these two routes is undoubtedly linked to the formidable nature of Turkish Airlines, a fast-growing global carrier that has emerged as a powerful counterpart to the three big Middle Eastern carriers, Emirates, Etihad and Qatar. Turkish offers a vastly superior product to US carriers, as well as a robust intercontinental network out of its Istanbul hub. It’s competitive cost structure allows the carrier to offer reasonably priced fares to its US markets. Throw in the added bonus of belonging to Star Alliance and offering 100% elite-qualifying miles and redeemable miles in all fare classes, and its logical to see why TK has emerged as the clear winner in the US-Turkey market

Moreover, the flight seems largely redundant with, in addition to the pre-existing supply of nonstop seats between New York and Istanbul, the plethora of connections available over Europe on European carriers such as Lufthansa, Swiss and others.

United swaps out 777 for 787 on Seattle – Tokyo

Effective November 5, United’s daily SEA-NRT flight will convert from a 777-200ER to a 787-800:

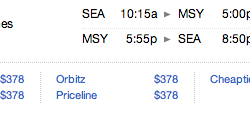

UA105 SEA1210 – 1540+1NRT 788 D

UA104 NRT1835 – 1010SEA 788 D

The source announcing this change also hinted at the possibility that this change may result in United closing the pre-merger UA Seattle 777 crew base that essentially existed solely for the purpose of this flight. You may recall that I flew on United flight 876 in BusinessFirst from Tokyo to Seattle last fall, and encountered a very senior crew serving this flight. Since United’s 787s are flown and served by pre-merger Continental crews, so therefore they will be the ones taking over crew duties for the flight.

Several factors likely contributed to this change. For starters, the Seattle to Narita flight, despite being a long-standing pre-merger United route, is likely one of the lower-yielding markets in the United transpacific system. It was the last Narita-USA flight to receive the new International Premium Transpacific Experience-configured 777 (hence, why I was re-routed on an old 777 with recliner-style 1st generation seats in Business Class that also seemed to accomodate a ton of non-revs and IRROPs passengers that day).

Secondly, Seattle to Tokyo has lately experienced a huge influx in seat supply over the past few years. All Nippon Airways has entered in the market with a daily 787/777-300, and Delta has recently upgauged its daily Seattle – Narita flight to a 747-400 along with launching Seattle to Tokyo Haneda.

Slightly less impactful, but nonetheless influential, has likely been the startup of the new Denver to Narita 787 flight, which has probably stolen some connecting traffic away from Seattle, particularly hailing from smaller town cities in the West Coast and Pacific Northwest.

The move certainly makes sense on paper, indicating United’s commitment to continue serving the Seattle to Narita market with the added intention of driving up yields through a smaller-configured aircraft. However, the move also underscores another data point supporting the notion that United is deploying its 787 on pre-existing routes rather than opening up new ones. This was something I discussed in one of my previous posts, as the only new route United has opened has been Denver to Narita. All other 787 deployments (IAH-LOS, IAH-LHR, LAX-NRT, LAX-PVG) are pre-existing routes.

I’m happy to see that United is still at least holding on to the SEA-NRT flight, although its questionable whether or not this will be long-term. I remember seeing the big United DC-10s back in Seattle in the late 1990’s, and my Dad pointed out that these were stationed to operate the nonstop routes to Asia Pacific from UA’s Seattle base.

However, with the All Nippon Airways joint-venture agreement across the Pacific, it may no longer be necessary for United to operate this route with its own metal. If Delta is hugely successful in stealing a greater share of traffic to TYO from SEA with its 2x daily services to NRT and HND, then the days may be numbered for UA.