United is beefing up its domestic schedule out of its San Francisco hub to 8 destinations, while increasing aircraft gauge on an additional 10 markets, largely in response to new additions that have been announced by Alaska Airlines at San Francisco to overlapping cities. In March, Alaska announced a major expansion from San Francisco ahead of its merger with Virgin America, which has its largest hub base at SFO airport. Alaska also announced three new routes from San Jose Norman Mineta airport (SJC) which competes for Bay Area traffic in the Northern California regions as well.

Alaska’s new roster of cities from SFO and SJC to the following markets will commence on August 31: from SFO to Philadelphia, New Orleans, Nashville, Indianapolis, Raleigh/Durham, Baltimore, Kona, Albuquerque and Kansas City, and from SJC to Austin, Tucson and Los Angeles.

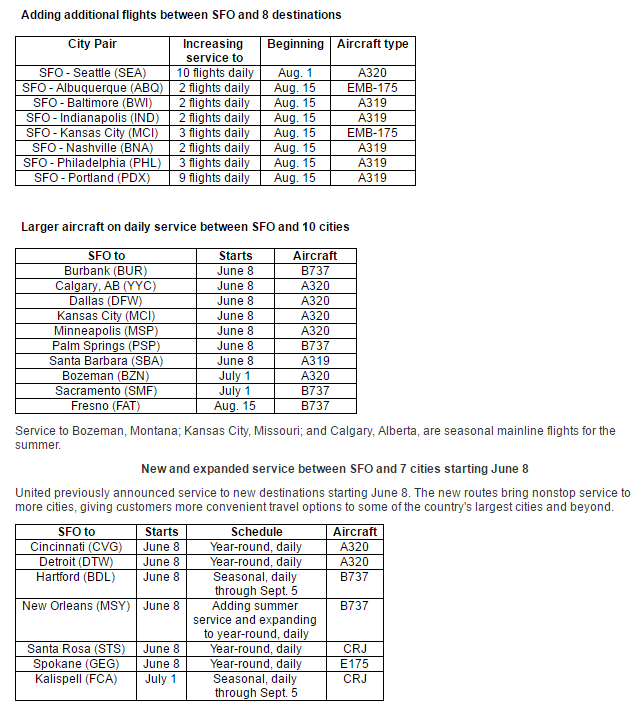

United, in response, is up-gauging frequencies on 8 markets from its SFO hub, including Seattle, Albuquerque, Baltimore, Indianapolis, Kansas City, Nashville, Philadelphia, and Portland. It will also up-gauge aircraft capacity on SFO to Burbank, Calgary, Dallas/Ft. Worth, Kansas City, Minneapolis/St. Paul, Palm Springs, Santa Barbara, Boseman, Sacramento, and Fresno.

Furthermore, United will be expanding service on certain seasonal routes from SFO to become year-round, and/or operated on a daily basis, including Cincinnati, Detroit, Hartford, New Orleans, Santa Rosa, Spokane, and Kalispell.

United’s Capacity Additions Reflect Prominence of “Kirby Culture”

There are a lot of talking points about United’s huge capacity boosts in markets like San Francisco and Chicago O’Hare. Perhaps the most salient, and controversial, is the level of buy-in that United is getting from Wall Street about all of these capacity changes given the fact that in prior months, the domestic pricing market has been weak and has finally stabilized. Investors are concerned that now that the pricing market is more stable, United should not be overly ambitious in its capacity growth efforts in order to grow its operating margins.

However, we also know that United is running a different ball game under the leadership of President Scott Kirby, who came to United last summer from American. Kirby is bullish about reversing capacity reduction decisions that were much more prominent under Jeff Smisek’s leadership at United, as the carrier was under pressure to cut and continue cutting because financial metrics were not being met. During the Q1 2017 earnings call, Kirby alluded to the loss of, “natural market share,” as a result of those decisions that actually had a negative impact on financials. For instance, important business markets like Newark to Atlanta were served on all regional jets when he came to the company last year, which he knows is a huge deterrence for high-yielding corporate travelers.

For instance, important business markets like Newark to Atlanta were served on all regional jets when he came to the company last year, which he knows is a huge deterrence for high-yielding corporate travelers. The jets used on Newark to Atlanta had been pulled from markets like Rochester, Minnesota. As such, United’s network was not only contracting, but the available seat miles that it offered in certain markets were unappealing to corporate travelers because even though the capacity adjustments were in-line with Wall Street’s expectations, the product was sub-par.

It is indeed difficult to convince investors of adopting a capacity guidance that is not in-line with GDP growth. However, the company, under Kirby’s leadership, are confident that the capacity growth is, indeed, margin accretive. United is growing overall capacity by 1.5 percentage points for 2017. For Q2 2017, United’s domestic capacity will be up 4.5% to 5.5% percent year-over-year.

There are some promising signs: the Q1 2017 PRASM (Passenger Revenue per Available Seat Mile) numbers were in line with initial forecasts, and the carrier has a positive unit revenue outlook for Q2 2017. At a network level, the consolidated unit revenue performance was flat for the entire region, and only down 0.1% in the domestic region. United appears encouraged by strong close-in bookings among corporate travelers, which can be a huge driver of year-over-year revenue growth.

In summary, the SFO capacity enhancements are a very prudent investment on United’s part to protect its market share as the incumbent carrier in the Bay Area against Alaska’s growth. San Francisco is United’s premier Asian gateway hub which is virtually unmatched, and irreplaceable, by any U.S. carrier or hub. However, that doesn’t mean that the ASM growth out of San Francisco will not be without its challenges, including:

- Weakness in United’s Pacific markets: PRASM was down 3.5% given an excess of supply over demand. Many foreign carriers from Asia, particularly secondary Chinese carriers, are expanding rapidly in the U.S. and are often state-sponsored or subsidized from their home markets. However, United has a history of strong Asian point-of-sale in China and other Asian countries and is investing in its in-flight products to better match against competitors. It is also pulling capacity from markets like Tokyo Narita and Guam to help offset downward revenue trends in Asia and focus more on the SFO hub

- Capacity additions from Alaska: Put simply, the two carriers are fierce competitors, and although the Bay Area is a strong region with good fares, there will be a ton of capacity added to markets with longer stage lengths and, therefore, less aircraft utilization.

And what about LAX? United has stated that it wants to regain its crown in Los Angeles after years of neglect. What decisions will be made, and how will this be balanced against SFO? Time will tell…