According to Skift, the United Kingdom is planning to raise the amount of the air passenger duty (APD) on departing international flights. This is a tax applied to all passengers on commercial and private flights and can be as high as $200 (£150) for business and first class travelers heading to the United States.

Plans announced by the Chancellor of the Exchequer will add another ~$20 to tickets purchased in premium cabins while leaving unchanged the APD in economy class, which currently sees a tax of about $100 (£75).

The APD is based on the distance from London to the capital of the destination country, so intra-European flights already have much lower tax that is sometimes easier to ignore. But flights to the United States are more expensive.

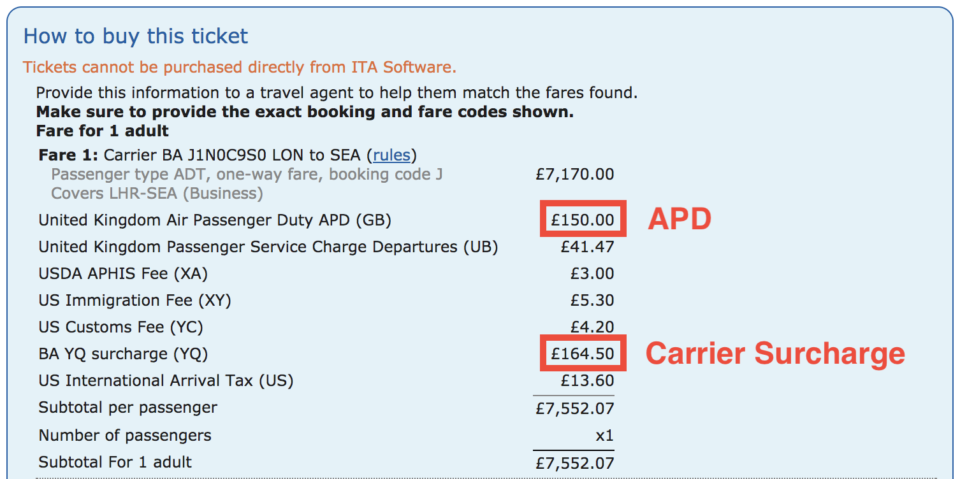

Because this is a tax and not a carrier-imposed surcharge, the APD will apply even if you book award travel. In fact, some of the flights I just checked this morning (not this example) had a lower carrier surcharge than APD, meaning this tax was the largest add-on charge for someone booking an award. There are also various other taxes and fees charged by both countries.

(Learn how to look up fees and taxes on your award tickets using ITA Matrix.)

The easiest way to limit the impact of APD on your next award redemption is to plan your European vacation so that you return home from a different airport. Many people visit more than one city, so don’t assume you have to come back from London just because that’s where you landed. Paris has its own departure taxes, though they are lower. Other countries may not have a tax at all. You will not be charged APD as long as you simply arrive in London but depart from elsewhere.

Finally, APD is based in part on the cabin class, so you could also choose to fly economy. You can also avoid APD entirely on tickets purchased for children 15 years or younger.