United Airlines is temporarily halting winter services to several secondary European markets, as well as a few key primary ones such as Rome and Manchester, from its largest East coast gateway hubs at New York/Newark Liberty International and Washington Dulles.

The affected changes entail seasonal suspensions between the following city pairs

- Newark to Rome effective November 6, 2014 through March 28, 2015

- Newark to Belfast effective January 5, 2015 through March 10, 2015

- Washington to Dublin effective January 5, 2015 through March 4, 2015

- Washington to Manchester effective January 6, 2015 through March 4, 2015

- Washington to Rome effective October 25, 2014 through April 6, 2015

The route cancellations reflect United’s desperate attempt to shoulder mounting cost concerns ahead of the slow winter period, particularly in light of a disastrous start to 2014 by posting a $349 million loss in Q1. United blamed its lackluster performance on winter weather storms and lower close-in bookings, which respectively created operational nightmares and paved way for marginal PRASM growth. However, against the backdrop of its failure to leverage the scale of its network as the world’s largest carrier, with hubs located in some of the most-heavily populated centers in the US, United also watched its cost base rise 3 to 4% in Q1 2014, severely outpacing a 1.5-2.5% PRASM decrease over the course of the quarter.

While United executives have been touting its $2 billion cost reduction program, few remarks have been made about necessary tweaking to its global network to lift further pressure from investors. There needs to be at least some level of recognition explaining why seasonal reductions in capacity is merited in order to improve its financial outlook. Instead, United executives have been cagey about the matter, at best, but hopefully this will be addressed sometime next month during its Q2 earnings call.

Star Alliance cedes year-round presence between Rome and North America to SkyTeam and OneWorld

With United pulling out of Rome on a year-round basis, Star Alliance will no longer offer nonstop access between the Eternal City and North America during the winter months without requiring passengers to make a connection at a major European Star hub.

Although typically US carriers reduce capacity between selected gateway hubs and Rome by as much as 80% during the off-peak season, both OneWorld and SkyTeam offer year-round access from Philadelphia (US Airways) as well as Atlanta (Delta). Italian flag carrier Alitalia also offers year-round service between Rome and Boston, New York JFK and Miami as part of its immunized joint venture agreement with Delta and Air France-KLM.

Even though traffic to and from Rome is highly seasonal and drops off significantly during the winter months, the loss of direct service from the US to Rome on Star Alliance is concerning given that its two largest competitors Delta and American (via US Airways) are able to do so from their primary transatlantic hubs in Atlanta and Philadelphia. Requiring travelers to make circuitous connections through Star Alliance hubs in Europe adds greater travel time and more complex itineraries requiring an additional connection. A traveler from Raleigh/Durham, N.C., for example, will now be required to make a stopover in a US as well as European airport prior to arriving at their final destination in Rome.

The only other Star Alliance partner operating between North America and Rome, Air Canada, similarly withdraws its Toronto – Rome service between October and April each year. The loss of US Airways to OneWorld also creates further disadvantage for United and Star Alliance.

Furthermore, it is also telling that United cannot out-compete beleaguered flag carrier Alitalia in maintaining a year-round presence between the US and Rome.

Reductions to the British Isles draws concerns over United’s transoceanic 757 strategy

United inherited Continental’s legacy route system where pre-merger Continental deployed the single-aisle aircraft from its Newark hub to “thinner” European markets within the 757 range of 4,000 NM. This permitted Continental (and eventually United) to link Newark with cities such as Oslo, Lisbon, Edinburgh and Barcelona using aircraft with the optimal seating-configuration while also freeing up widebody jets for larger and longer international routes.

From Newark, United serves approximately 25 cities within Continental Europe. Of these, 16 routes are flown on 757s, including services to Madrid, Shannon, Stockholm, Stuttgart, Paris*, Oslo, Dublin, Edinburgh, Belfast, Barcelona, Lisbon, Berlin, Manchester, Amsterdam, Hamburg, Glasgow and Birmingham, all on a year-round basis. This will, of course, change when the Belfast service is converted to seasonal beginning next winter.

The 757 deployment model has proven its worth for Newark, but United has encountered challenges applying the same strategy to its Washington Dulles hub. From Washington, United flies to fewer European markets on 757s due to range issues, as Dulles airport is located further south and inland than Newark. The transoceanic narrowbody services from Washington fly nonstop to London Heathrow**, Manchester, Dublin and Madrid. In 2012, United attempted to link both Paris and Amsterdam to Washington using the single-aisle 757s, which encountered severe problems on the return journey westbound due to winter headwinds. United received significant media attention that year for the large number of unscheduled refueling stops that had to take place that winter. Both cities are now served using 767-300s from Washington.

The reductions between Washington and Dublin and Manchester is interesting given that both services are relatively new, having been launched by the carrier in summer 2012 with much fanfare. United (Continental) had previously operated two daily frequencies between Newark and both cities, but decided to move 1 flight from each city to Dulles to create more balance across the United hub network. This move also freed up landing slots for United to launch two new routes that summer from Newark to Buenos Aires and Istanbul, both of which have been suspended.

United is the only carrier that operates both of these routes from Washington, so it is therefore surprising that neither are sustainable on a year-round basis. While daily services will still be available via Newark, it does leave fewer options for passengers. Moreover, neither these two cancellations, nor the removal of year-round Newark to Belfast services, can be easily substituted by flying on a Star Alliance partner carrier across the ocean, as a connection on Continental Europe involves extra backtracking and transit time.

*United offers two daily services from Newark to Paris, one of which is on a 767-400 series aircraft and the other on a 757.

**United offers three daily services from Washington Dulles to London Heathrow, two of which are operated on 3-class 777s and 1 on a 2-class 757.

There may be further scheduling reductions to be announced this winter

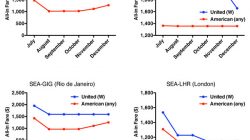

While US carriers have adopted a seasonal scheduling system across the Atlantic for many years, United’s needs are much more immediate given its unit cost creep challenges relative to American and Delta.

The question is, shouldn’t United be able to sustain year-round transatlantic services from hubs that are located in the largest population center in North America as well as the nation’s capital? A highly seasonal transatlantic network from a hub such as Charlotte makes sense, but from Washington, D.C., it begs a few questions. Of course, the most complex task revolves around keeping a tight control on costs in order to preserve the strength of the network. Pre-bankruptcy, pre-merger American Airlines watched its edge in the transatlantic market to Europe gradually wane over the years as it lost its grip on costs, eventually losing presence in key markets such as Frankfurt and Brussels.

On the flip side, perhaps this is an indication that United is aiming to put its words into action by making temporary alterations where necessary to meet its cost goals. Nevertheless, doing so also requires an open discussion about how the cuts are expected to deliver returns on those targets, which again, will be something hopefully discussed when the Q2 2014 earnings results arrive. This will be crucial before returning to the brow-beaten adage of how United’s global network remains, “the most competitive” compared to its rivals.