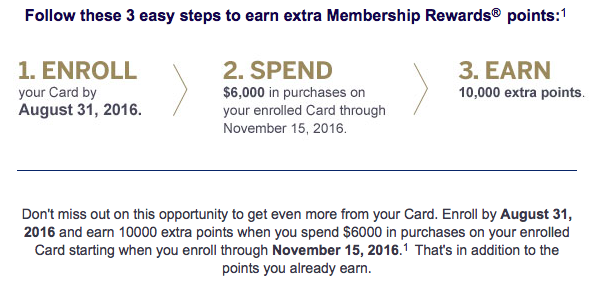

American Express is sending out targeted bonus offers to some (all?) cardholders with the opportunity to earn more Membership Rewards points through November 15. The exact offer seems dependent on the type of card you have rather than actual spending habits.

I think that American Express has some great cards, but it also has some not-so-great options like my Amex Platinum Card. I use it for the travel benefits, including lounge access, and not for actual purchases. That’s because it earns only one point per dollar. Other cards like the Premier Rewards Gold and EveryDay Preferred have fewer benefits but earn more points.

My personal offer received yesterday was for 10,000 bonus points after spending $6,000 by November 15. I don’t know if it will work for others with the Platinum Card or for people with other Amex cards.

I used my card to pay my rent for a couple months just to get the sign-up bonus. I’m not sure that I would do that again to get this bonus. The cost in processing fees would almost wipe out the value of the extra miles. However, I may reconsider if there are other large purchases I could put on my card. I value Membership Rewards points at about 1.5 to 1.7 cents each, making this bonus worth up to $170.

Doctor of Credit reports two other offers shared by readers:

- American Express Blue Cash Preferred: 1% bonus cash back after $750 in purchases, up to $75 back. (As I understand this, you need to spend $1,500 to maximize the cash back.)

- American Express EveryDay Preferred: 4,500 bonus Membership Rewards points after spending $4,500 (or $6,000 for some cardmembers).

It’s also similar to another bonus that Amex was offering in June for its SPG Amex business cards. However, the spend requirement was much higher for that offer. Clearly Amex is making a push to get all its customers to use their cards more often.

The best way to view these bonus offers is as a chance to increase that earning rate, so that every dollar earns an extra point. The ability to earn two points per dollar on my Amex Platinum Card everywhere I shop is tempting enough that I’ll take it out of my sock drawer. But it isn’t going to change my long-term habits. I’ll probably stop using my Amex Platinum Card again after reaching the threshold.