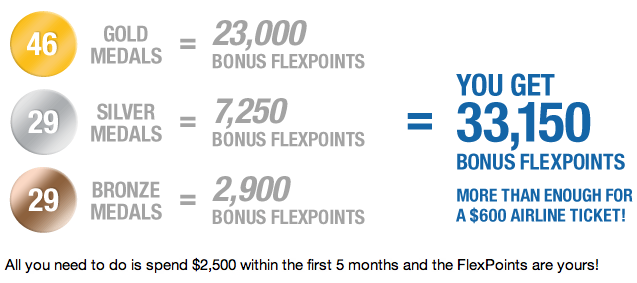

I’ve received a few pings asking for my thoughts on the US Bank FlexPerks Rewards card, and I’m happy to say that it seems much more appealing than I first though. The current sign-up promotion from US Bank doesn’t hurt either. Now through the end of August, you can earn 33,150 FlexPoints for spending $2,500 in five months, a very reasonable target. This bonus is also far higher than the usual 15,000 points, and the first year’s annual fee of $49 is waived

These points are best redeemed for free travel but also have a few other award options at a lower valuation. For this reason I think they are best compared to Citi’s ThankYou points rather than Chase’s Ultimate Rewards points (which can be transferred to other loyalty programs).

I compared ThankYou points and Ultimate Rewards points last week, and I think the result was a bit of a toss-up that depended a lot on your own travel and spending habits. Personally I would use Citi’s ThankYou cards as a churn opportunity for their large sign-up bonus and stop there. With the new bonus from US Bank, the FlexPerks card provides an equal or even greater bonus potential.

Why FlexPoints Are Competitive

Simpler earning structure. FlexPerks don’t have Citi’s complicated Flight Points or the strange 20% bonus category that doesn’t include travel (why not just double or triple points like most cards?) Instead, you get double points on whatever category you happen to spend most on each month. So this card may be best used for a certain category that doesn’t fit any of your existing cards, and just that category.

Bonus for each travel award. Every time you redeem for a travel award, you get a $25 credit for fees like checked baggage or in-flight purchases. Others have reported being able to buy gift cards using a similar credit from American Express. I imagine that if you wanted, you could try buying a small $25 gift card every time you book an award ticket.

Potentially greater value. You can get up to 2 cents in value for each FlexPoint, and if you’re earning double points through spend in your preferred category that month, that’s an effective 4 cents per dollar in purchases. But getting 2 cents per point can be tricky, as I point out below.

Red Flags for Earning and Redeeming Points

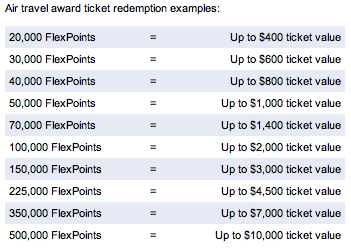

Awards are priced in blocks of points rather than on a sliding scale. The lowest award is $400. If you want to buy a $400 or cheaper ticket, you need 20,000 points. If you want to buy a $401 ticket, you need 30,000 points (up to $600 value). This means points can be worth at most 2 cents each but possibly much less. Contrast this with Citi ThankYou points, where each point has a fixed value of 1.33 cents if you’re a ThankYou Premier cardholder, or Chase Ultimate Rewards points, where each point has a fixed value of 1.2 cents if you’re a Sapphire Preferred cardholder.

The earning rate decreases if you spend more than $120,000 per year. Past this point, you’ll earn half as many points, only 1 for every $2 in purchases. This is unlikely to affect many of you unless you are trying to game the card with lots of spending “tricks” or use it for business purchases.

How to Maximize this Churn for $800 in Awards

My recommendation for this card is still “churn and burn,” but some of you who like the Citi ThankYou Premier card may find this to a be a worthwhile consideration for long-term use.

If you’re going to sign up just for the bonus, a little extra effort turns this card into an $800 benefit instead of a $600 one.

Star by spending the entire $2,500 in one category such as travel or groceries. Most families and couples can probably do this with a regular expense like groceries since you have five months to meet the requirement. This way, you’ll earn 5,000 points instead of 2,500 through the spend requirement.

Your total will be 5,000 (spend) + 33,150 (bonus) = 38,150 points. You will be 1,850 points short of 40,000 points, so spend another $925 over the next six months in your bonus category. Once you have 40,000 points, purchase two separate awards using 20,000 points each or one larger award using 40,000 points for a total value of just under $800.

Settling for 35,650 and redeeming for a 30,000 point award ($600) as some bloggers have suggested seems like leaving money on the table because it will leave you with less than 20,000 orphaned points that can’t be used for travel, and non-travel awards only value points at 1 cent each. This is why I recommend trying to get the 2X category bonus and spending the extra $925 is worthwhile to reach a total of 40,000 points before redeeming.

Be warned that some people have reported US Bank is denying applications from people who have several recent inquiries (i.e., churners) and their T&C specifically forbid earning points for buying Vanilla Reload cards. However, others have said customers service reps encouraged them to apply for multiple cards to earn the bonus on each one. How’s that for temptation? 😀