When I recently argued against the United co-branded cards, I mentioned the Hyatt Credit Card as a potential alternative. The case in favor of this card is much more clear cut, with several ways you can benefit by using it alone, as part of a wallet of other cards, and even if you aren’t a Hyatt customer. But even if I’m now arguing in favor instead of against a card, it will still be more interesting than arguing in favor of the Sapphire Preferred, which you’ve all heard too much about. (Note: the card benefits described in this post were current as of June 16, 2014.)

Get It for the Free Nights

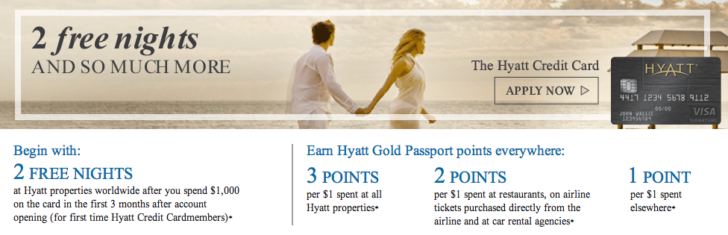

Often people sign up for the Hyatt Visa for the bonus of two free nights at any Hyatt property, which could be worth up to 60,000 points or about $1,600 depending on the hotel. The minimum spend requirement is a reasonable $1,000 in three months. It used to be that you could get those two free nights in a suite if you were an existing Gold Passport Diamond member, but that feature was eliminated a few months ago.

This card is not part of any affiliate network I’m aware of, so you won’t reward anyone by using their links. Besides, I usually recommend applying on Hyatt.com while in the process of booking a reservation since you may be offered an additional statement credit of $50-100.

In addition to the two free nights at sign-up, this card also comes with a free night at a Category 1-4 hotel each year and has a $75 annual fee. The card is well worth keeping just for the free night. Excellent Category 4 hotels I’ve stayed at recently can be found in cities like Seattle, San Francisco, Siem Reap, and Shanghai, and Macau, and may normally cost over $200 a night. With this card, it’s like a $125+ discount.

Some people apply for this card for the free nights at sign-up and the additional free night each year and leave it alone after that. This is perfectly legitimate and argument enough to get the card and pay the annual fee. But I don’t stop there. It’s also one of the very few cards that almost never leaves my wallet

Get It for the Points at Hyatt

You’ll earn 3X Gold Passport points when you use this credit card to pay for your Hyatt stay. That’s more than you can earn with any other card. You could alternatively use a Sapphire Preferred or Ink Bold/Plus card to get 2X Ultimate Rewards points and transfer them, but I think the extra point is worth the loss of flexibility. As a frequent Hyatt guest, I think this is a good value.

Both Hyatt and United have devalued their award charts, though I think the devaluations at United were much more extreme. I think 3X at Hyatt (worth roughly 1.4 cents per point) is worth more than 2X at United (worth roughly 1.7 cents per point) or other Ultimate Rewards partners like Avios or KrisFlyer.

A third option for saving on Hyatt stays is to pay for your stay with an Amex SPG business card. You’ll earn 1 Starpoint per dollar (worth about 2 cents) and get 5% cash back. This is a larger discount than any of the above options but requires you to own a small business and stay at a full-service properties within North America. To get around the latter requirement, you can pre-pay for your stay by purchasing Hyatt gift cards and gift checks online to use at more properties, but there are still some limits on who accepts them — and those that do are not always familiar with processing them.

Get It for the Points Elsewhere

The Hyatt Visa also offers 2X at restaurants, car rentals, and airfare purchased directly from the airline. This makes it a pseudo Sapphire Preferred with a lower annual fee — assuming you don’t mind a few restrictions on the definition of “all travel” and would have transferred your Ultimate Rewards points to Hyatt anyway.

My own credit card strategy doesn’t rely on the Sapphire Preferred at all; that card was closed over a year ago. I don’t spend $70,000+ a year on it to make the 7% annual dividend worth the $95 annual fee. That would still be okay if you buy into its two main selling points: bonus points in lots of categories and the simplicity of carrying a single card. But if, like me, you already carry several cards and that have overlapping benefits with Sapphire Preferred, and you would like to diversify your balances, then you can often use the Hyatt Credit Card to fill in any gaps that these other cards don’t cover.

For example, most of my hotel purchases are with Hyatt, but the second largest category is Starwood where I prefer to earn additional Starpoints by using my SPG Amex. I get 2X Ultimate Rewards by using my Ink Plus when I stay at other hotels.

I usually use my Amex Platinum or Ink Plus card when I rent a car, which is very rare (under $1,000 in annual rental costs). I get 3X Membership Rewards when I purchase flights using my Amex Premier Rewards Gold card regardless of the carrier. And I don’t have a lot of “other” travel like parking fees. Though my Uber costs have started to tick up, a new partnership that earns 2X with Membership Rewards means I’ll probably be using my Amex Platinum card for that, as well.

Get It for the Status

Finally, the Hyatt Credit Card comes with Gold Passport Platinum status. I don’t consider this very valuable on its own. You get a slightly better room, free Internet, and some bonus points.

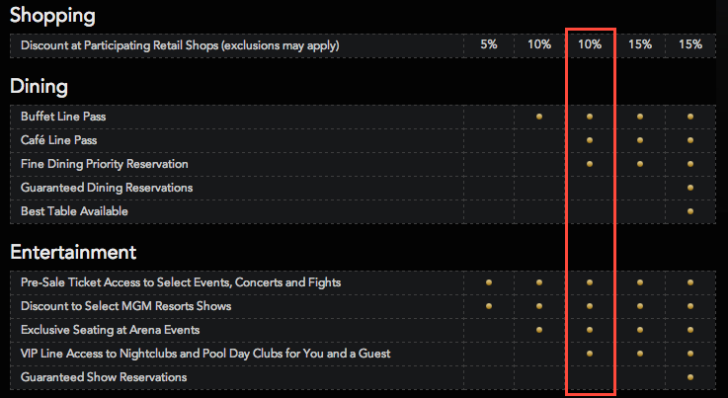

Mostly this is valuable if you ever take a trip to Las Vegas. Many of the biggest hotels on the Strip are part of MGM Resorts and their M life program. You could toil away at the slot machines or poker table and hope to earn the lowest tier — Pearl — or you could match your Hyatt Platinum status and jump straight to Gold with no effort.

Lots of people who visit Las Vegas have no elite status with the casinos. It’s not easy to earn, and many people visit infrequently. The casinos aren’t like other chains that have hundreds of hotels all around the world. But as a Gold member, you get discounts on lots of purchases and rooms booked online at Mlife.com as well as access to priority queues (including day pools and night clubs).

Conclusion

One person responded to my critique of United’s credit cards on Twitter by saying, “Couldn’t this argument apply to any airline credit card?” And it does apply to many. Hotel-branded cards, however, are offering more benefits that are useful even to infrequent customers. Free checked baggage is something you may choose not to take advantage of — free or not, it’s inconvenient to check a bag — but an annual free night or some kind of elite status at a popular vacation destination is something I think is easier easier to value.

That’s not to say all airline credit cards are worthless. Coming up later this week, I’ll argue for an airline card that, like Hyatt’s, is worth it for just about anyone.