Recent changes to enable PINs with prepaid gift cards have made manufactured spend more viable with a greater range of credit cards. At the same time, changes by American Express are about to eliminate the drugstore category bonus on its Hilton and Hilton Surpass credit cards coming May 1.

Altogether this makes me think the Citi Hilton HHonors Reserve card has promise as a tool for manufactured spend despite devaluations of Hilton’s loyalty program and my previous criticisms of free night awards (which often face greater restrictions than points-based awards). I’ll walk through the different spend requirements needed to get up to four “free” nights and explain which I think are worthwhile.

Note: Check out my summary page for more up-to-date offers on credit cards mentioned here.

I have waffled on this issue, but I have settled for now on the idea that most free nights are used for aspirational travel — the kind you would never buy — and so the increased cost of points redemptions is less important. You are still getting a free night at a hotel you’ve previously only seen in glossy magazines and other people’s trip reports.

The Hilton HHonors Reserve card offers two free weekend nights for $2,500 spend in the first 90 days. These free nights can be used at any category hotel, including the new Categories 8-10. However, the restriction again Waldorf-Astoria hotels and resorts without standard rooms remains in effect.

This $2,500 spend requirement is a greater requirement than most cards’ sign-up bonuses, but manufactured spend has become easier and easier with options like Vanilla Reloads, gift cards, and Amazon Payments. You’ll see similar spend requirements for cards like the Ink Bold/Ink Plus, Amex Platinum Card, and ThankYou Premier Rewards card. I’m not sure the game has really changed that much at this level since you could reach $2,500 for free in three months using Amazon Payments.

Third Free Night for $10,000 Spend — Great Value!

You can get a third weekend night if you spend $10,000 in one year. (I had heard reports you get it pretty soon after, but apparently others are saying it takes until the end of the cardholder year, like an anniversary bonus.) I will admit that $10,000 is a lot even with a whole year to work on it. You may have other cards you want to apply for.

Let’s assume you have access to Vanilla Reloads at your local CVS. You can buy $500 cards for a $3.95 activation fee and then load and empty them with a Bluebird for free. The cost to manufacture $10,000 in spend is only $79 here. If you don’t have Vanilla Reloads and need to buy gift cards somewhere else, the cost is usually $5.95 each, raising your cost to $119.

Fourth Free Night for $30,000 Spend — Good Value

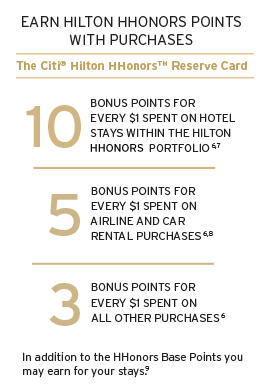

The Hilton HHonors Reserve card offers 10 points at Hilton, 5 points on airfare and car rentals, and 3 points everywhere else. That means buying $30,000 of gift cards will earn 90,000 Hilton HHonors points plus more for the cost of the activation fees. Not bad! You’ll have enough bonus points to get a fourth free night at any category hotel, and it won’t have the weekend use restriction.

(I’m fudging the numbers here because the new award chart maxes out at 95,000 points in peak season, so you’d actually need $31,667 in spend — but that doesn’t really roll off the tongue. There are only ten Category 10 hotels, and not everyone will travel at peak times, so I’ll stick with $30,000 for the rest of this post.)

Buying $500 Vanilla Reload cards with a $3.95 activation fee for each one would cost only $237 to manufacture $30,000 in spend. Without Vanilla Reloads, Visa and MasterCard gift cards that can be assigned a PIN cost $5.95 and would cost $357. But you already have the sunk costs of that first $10,000 to get the third free night award. Therefore, the incremental cost for the fourth free night using points is only $158 with Vanilla Reloads and $238 using gift cards.

Free Nights with Ongoing Spend — Bad Value

I don’t recommend going beyond the first $30,000. That $30,000 earns you four free nights: two as a sign-up bonus, one from an annual spend bonus, and one from accumulated points. Maybe you value those at around $1,000-2,000. Your total cost will be the card’s $95 annual fee plus $237 to $357 in activation fees for your manufactured spend.

Each additional $30,000 of manufactured spend only earns you another ~90,000 points for one more free night–maybe two if you favor cheaper properties–valued at $250-500. You would be better off putting the second $30,000 on a different card. Spend $30,000 on gift cards at a grocery store, for example, and you could earn 60,000 Membership Rewards points with the Amex Premier Rewards Gold card or 30,000 Starpoints with the Starwood Preferred Guest Amex.

Diamond Status for $40,000 Spend — ??? Value

Finally, the $95 annual fee gets you Gold status in Hilton HHonors, the most lucrative mid-tier of any hotel loyalty program thanks to the free WiFi and breakfast benefits. A few readers have asked before about this breakfast benefit. Although it isn’t outlined as a specific benefit of Gold status, it is a benefit of the My Way program that allows you to choose a benefit at check-in. These benefits vary at different properties, but an example at Hilton properties is daily continental breakfast for two or 1,000 bonus points per stay.

If you were to spend $40,000 in one year on the Hilton HHonors Reserve card, you could get bumped up to Diamond status, but I don’t think this is worthwhile unless you are already a frequent Hilton customer. I am assuming here that many of you will get this card for two or three free night awards, and maybe you’ll get one or two more through points earned with manufactured spend. Heck, maybe you’ll even transfer points form Hawaiian or other programs.

But the more expensive award chart means you are unlikely to book as many nights as you would have in the past, reducing the opportunity to use the greater benefits of Diamond status. My advice is to stick with Gold and put any spend above $30,000 on a different card.