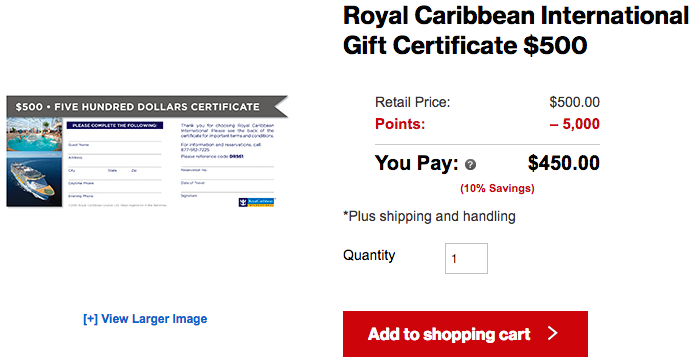

If you have a Verizon mobile phone plan, like I do, then you probably have some Verizon Smart Rewards points burning a hole in your account. Well, maybe they’re tepidly forming a small depression.

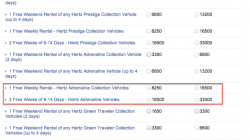

Without much effort I somehow managed to earn 200,000 points in the last year. I don’t pretend to understand how they’re accumulated because they’re so frustratingly difficult to use for anything of much value. Just how bad is it? You can’t actually use points to buy much. What you can do is use them to get discounts on merchandise or bid on auctions. For example, a $25 Verizon gift card (which I’d expect to be cheaper for Verizon to give away than a gift card to other merchants) is currently being auctioned for 173,000 points.

At 0.014 cents per point, I don’t think I’ve ever seen a less valuable rewards currency.

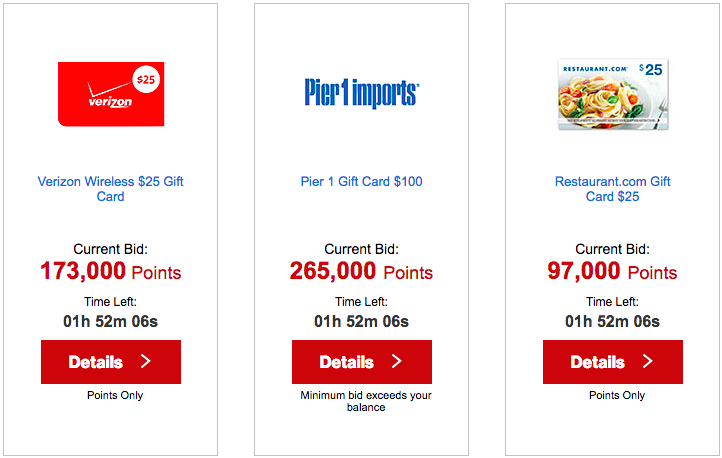

What I do use my points for — very slowly — are discounts on gift cards. I can reliably spend 10,000 points to save $10 on a $100 gift card, which makes it more bearable when my wife makes her monthly visit to Sephora. If you’re lucky, some merchant gift cards include a small Verizon gift card with them. A couple months ago the same redemption included a $100 Sephora gift card and a $5 Verizon gift card for a total of $90 and 10,000 points. That’s the best deal I’ve ever received for my Verizon “Smart” Rewards.

If you don’t want makeup, there are some other options like Office Depot and car rental gift cards that may be appealing to the travel and MS communities. But fulfillment can take a while, and remember that you won’t be eligible for your credit card’s insurance policy if you don’t use it to pay for your rental.

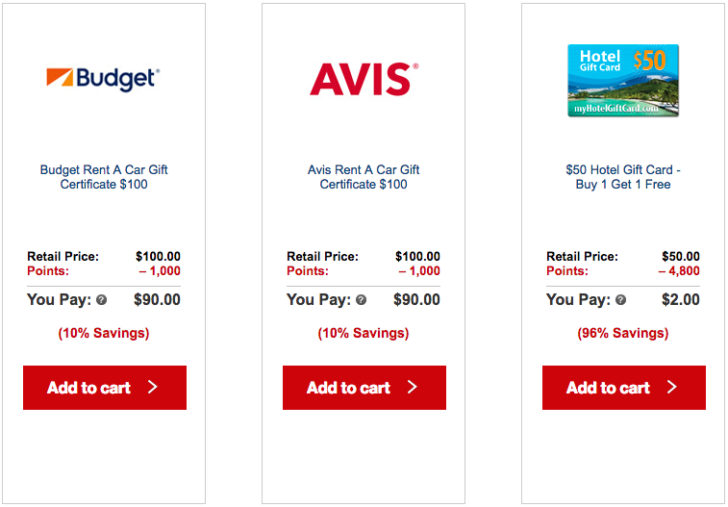

You can even purchase Royal Caribbean gift cards in $500 amounts with a 10% discount. You must book your vacation through Royal Caribbean to use them (cruise afficionados may be familiar with better deals elsewhere), but for an advance booking I think a 10% discount isn’t bad. Remember, cards like the Chase Sapphire Preferred earn bonus points on travel purchases, but this gift card transaction doesn’t count.

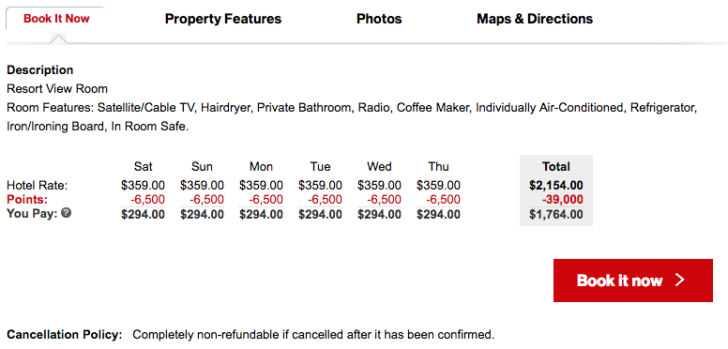

Finally, I took a look at hotel discounts. Verizon offered reasonable savings when booking some hotels, and it certainly drained my points a lot faster. Here’s an example of a six-night stay at the Hyatt Regency Maui (the Andaz is also available when searching for Maui).

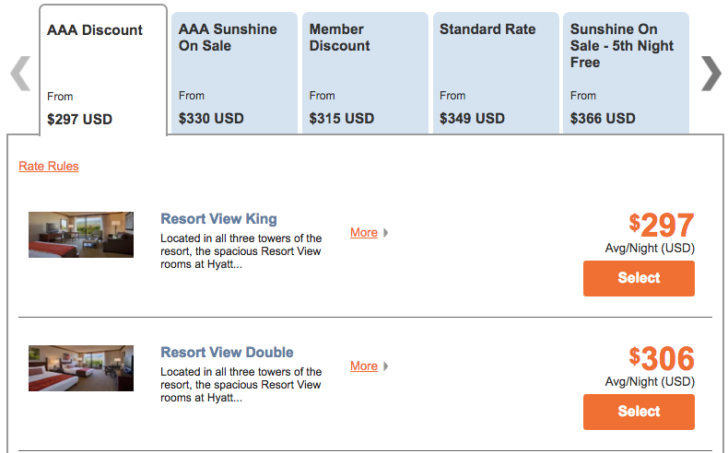

Beware the headline discount — it’s not just misleading but probably wrong, too. If I repeat the search on Hyatt’s website for the same six-night trip in August, then I see lots of other offers available. None of them are at the same $359 rate that Verizon advertised before its discount; in fact, the standard rate is just $349. But I can pay as low as $297 for a AAA discount (one of the best deals in travel) and maintain a lot of flexibility to cancel my reservation later. Verizon says all reservations are final.

My choice in this case is between $294 for a non-refundable stay, or paying for a separate AAA membership and paying $297 for a more flexible reservation that could also be upgraded if I had a Diamond Suite Upgrade and will earn Gold Passport points. (I’m pretty sure Hyatt would recognize benefits like lounge access in either case.) When you look at it like this, it’s not so smart or rewarding to use Verizon points. But to be fair to Verizon, my alternative does require an extra step with AAA.

I would limit my use of this portal to reservations that I plan to make at independent hotels or properties where I don’t particularly care about the loyalty program. That means if staying at the Hyatt Regency Maui, I’d still book through them to earn points and redeem an upgrade. If I felt like settling for the Days Inn at Kihei or the Royal Lahaina Resort (or any of the many budget properties I might choose during a road trip) then Verizon doesn’t look so bad.