U.K.-based Virgin Atlantic Airways (VS) is reshuffling its network strategy following last month’s stated intentions to withdraw from several long-haul routes and pull the plug on its short-lived narrowbody operation, Little Red. Most of these changes can be traced to Virgin’s plan to return to profitability by 2018, and while the carrier has made improvements and come a long way, a renewed outlook has shown that more painful decisions need to come in the short-run in order to meet targets by the expected deadline.

Virgin posted a loss for the 2013 Fiscal Year, its fourth year of losses in the past five years. Its short-lived experience in the narrowbody/short-haul flying sector between London and Machester, Edinburgh and Aberdeen was a major contributor to these losses.

With plans to axe several long-haul trunk routes and terminate its short-haul operation, presumably Virgin has finally bedded down its long-term strategy with new joint-venture partner Delta Air Lines, which will serve as a major cornerstone for the carrier moving forward. Given the lucrative nature of the U.S. – U.K. transatlantic market, deeper coordination with Delta, and possibly accepting an invitation to join the SkyTeam alliance, is the way to go.

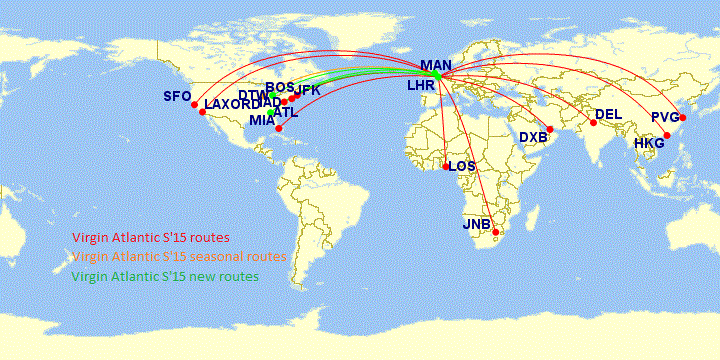

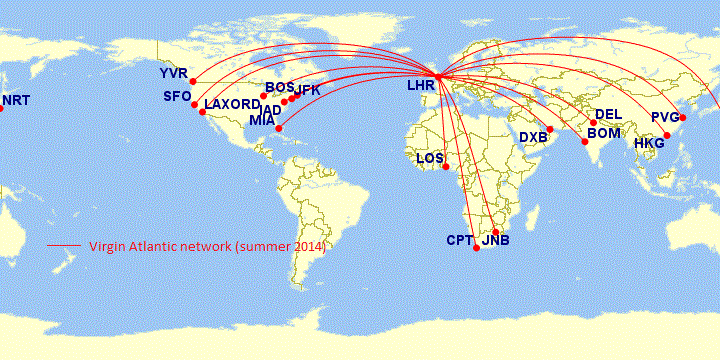

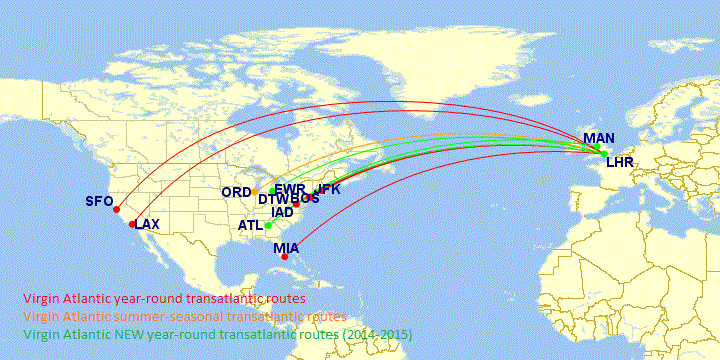

Virgin Atlantic Summer 2014 network

Virgin cuts routes from Canada to Australia, Japan to South Africa

Since the start date of its joint venture with Delta on January 1, 2014, Virgin has withdrawn long-haul services from Sydney, which operated as a tag-on fifth freedom route from Hong Kong. Effective October 12, Virgin will also cancel its summer seasonal service from its Heathrow hub to Vancouver, and will suspend services to Mumbai and Tokyo Narita on February 1, 2015 and Cape Town on April 27, 2015.

Virgin’s Sydney service was suspended in May 2014, just prior to the Southern Hemisphere winter season, a full decade after its inaugural flight in 2004. Virgin flew daily services from Heathrow to Sydney via Hong Kong in each direction, and competed alongside British Airways as the two remaining European carriers serving Australia.

Although the U.K. to Australia is a large local market, Virgin’s Sydney station was unprofitable due to many challenges. For starters, it deployed a high-C/ASM Airbus A340-600 on the route, which is difficult to justify at current oil prices. Even with local pick-up rights between Hong Kong and Sydney, the Australia – Southeast Asia market is oversaturated with both network carriers and newer long-haul, low-cost entrants in the region. Virgin lacked a local partner in Hong Kong, and had limited agreements with Virgin Australia on the Sydney end, despite having familiar brand identities.

Similar patterns of market over-saturation can be used to explain the cancellations of Mumbai, Cape Town and Tokyo Narita. Virgin currently holds 18.23% market share between Heathrow and Mumbai, against 36.81% from Jet Airways, 29.85% from British Airways, and 15.1% share from Air India.

Virgin has had a presence in the Indian market dating back to the late 1990’s, when it began codesharing with Air India between London Heathrow and Delhi (which has since ended). It later added Mumbai in the 2000s, but suspended the route between 2009 and 2012 due to the Global Financial Crisis. The route resumed in 2012, but Virgin likely is turning its attention to focusing on point-to-point traffic between London and Delhi in the subcontinent region. Although Virgin’s percentage of the local traffic between Delhi and the U.K. is similar to that of Mumbai’s (17.82%), the local market is larger and Delhi’s importance as the nation’s capital merits the service.

Moreover, Virgin’s presence in the Delhi market enables SkyTeam presence between London and Delhi – something that is attractive for transatlantic passengers heading to and from the U.S. on Delta and Virgin metal. Delta also flies to Mumbai from its Amsterdam hub, as well as from Paris on its JV partner, Air France. Taken together, these signs indicate that Virgin’s re-jigging of the Indian market likely involved schedule and capacity coordination with Delta. Virgin will also be sending one of its first 787-900s to Delhi, which should help improve yields on the route.

Virgin maintains a higher marketshare percentage at Tokyo Narita airport at 21.1%, in fact ahead of both Japanese competitors All Nippon Airways (19.05%) and Japan Airlines (20.3%) while British Airways holds the largest share at 39.5%. However, the reality is that many of these capacity adjustments have been due to shifting of operations from Narita airport to Haneda airport, located closer to downtown Tokyo. Both JAL and ANA moved their daily 777-300ER flights from Narita to Haneda in March, 2014, while British Airways maintains a daily flight to both Haneda and Narita each from Heathrow.

In fall 2012, Virgin had similarly announced intentions to follow suit and move over to Haneda airport, capitalizing on its codeshare agreement with All Nippon. However, the weak Japanese yen and high operating costs of flying into Haneda likely drove Virgin into codesharing on ANA’s London Heathrow flight from Haneda and maintaining a virtual presence in Tokyo instead.

Finally, Virgin’s Cape Town route likely succumbed to ongoing safety concerns in South Africa, and inability to compete against the Gulf Coast carriers that have been successful in offering attractive 1-stop fares from the U.K. to South Africa. Even South African Airways pulled its Cape Town to London Heathrow flight in the past few years, leaving British Airways as the sole carrier offering year-round service between the two markets.

Aircraft redeployed to North America, focusing on growth and Delta JV partnership

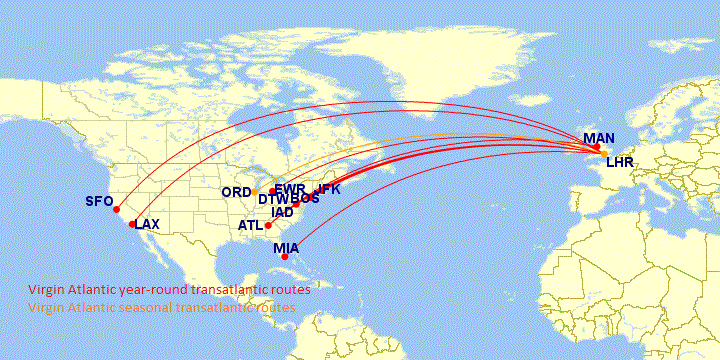

In the Americas, Virgin is exiting Vancouver just as the slow winter period begins and instead will utilize one of its widebody A330-300s to fly between Atlanta and London Heathrow, assuming one of Delta’s 3 daily flights between ATL and LHR, effective on October 26.

VS103 LHR0925 – 1420ATL 333 D

DL029 LHR1250 – 1743ATL 764 D

DL031 LHR1515 – 2009ATL 76W D

VS104 ATL1730 – 0635+1LHR 333 D

DL028 ATL1925 – 0845+1LHR 764 D

DL030 ATL2144 – 1105+1LHR 76W D

The move from Vancouver to Atlanta is highly logical as Atlanta is a much more premium-oriented market, and Virgin will likely boost generate higher yields on this route on a year-round basis as opposed to Vancouver, which tends to draw more leisure-oriented traffic. Moreover, Virgin Atlantic faces an up-hill battle against British Airways and Air Canada between Vancouver and London, as it only holds a 13% marketshare against both carriers between the months of May and October. In Atlanta, Virgin will hold a 29% market share year-round between ATL and Heathrow, and combined with its JV partner Delta, the two will hold a 76% marketshare on the route. British Airways flies daily between Atlanta and London Heathrow, but only maintains 24% share of the market, versus 54% between Vancouver and Heathrow.

In lieu of turning one of its three daily Atlanta – Heathrow flights to Virgin, Delta will replace one of Virgin’s two daily services between Los Angeles and London Heathrow towards the end of this month, operated by a 767-300. Virgin also intends to reinstate double-daily service to LAX in Summer 2015, bringing the total number of daily LAX-Heathrow flights to three on the Virgin-Delta JV.

Presently, British Airways holds the largest share of the LA-London market with 36.8% marketshare, which amounts to nearly 50% when factoring in its joint-venture partner, American Airlines, who also flies a daily roundtrip between LAX and Heathrow. Star Alliance carrier Air New Zealand covers roughtly 15% of the share with a daily 777-300ER service to LAX from Heathrow, which continues onward to Auckland, and Norwegian flies less-than-daily from LAX to London Gatwick on a 787.

Virgin also intends to take over Delta’s second daily service between Detroit and London Heathrow (which operates during the summer period only) and extend it to operate on a year-round basis, effective Summer 2015. Virgin also wants to add a second daily frequency to Miami in the winter season, and increase summer services from San Francisco from 7 to 12 weekly.

In the spring of 2015, Delta will replace one of Virgin’s 2 daily flights into Newark airport, operated on a 767-300, and will add a 5th daily service between New York JFK and London Heathrow. Delta and Virgin will also boost transatlantic service from Manchester, UK, by having Virgin assume Delta’s daily service between Atlanta and MAN, while Delta will launch a flight from New York JFK to Manchester on its own metal.

| Destination | Changes | Effective Date |

|---|---|---|

| Sydney | Service terminated | 5-May-14 |

| Vancouver | Seasonal service terminated | 12-Oct-14 |

| Atlanta | VS to replace 1 of 3 daily DL LHR flights | 25-Oct-14 |

| VS to replace DL flight to Manchester, UK | TBA | |

| VS to add 2nd daily LHR flight during summer | Summer 2015 | |

| Los Angeles | DL to replace 1 of 2 daily VS LHR flights | 25-Oct-14 |

| VS to add 2nd daily LHR flight | Summer 2015 | |

| Mumbai | Service terminated | 1-Feb-15 |

| Tokyo Narita | Service terminated | 1-Feb-15 |

| Cape Town | Seasonal service terminated | 27-Apr-15 |

| Detroit | New daily service (replacing 2nd summer-only service on DL) | TBA |

| New York JFK | 5th daily Virgin service to LHR | TBA |

| New nonstop service to MAN operated by Delta | Summer 2015 | |

| Newark | DL to replace 1 of 2 daily VS LHR flights | TBA |

| Miami | Additional daily service during winter to LHR | TBA |

| San Francisco | Service increase from 7 to 12 weekly during summer | TBA |

Next up: entrance to SkyTeam?

Virgin’s long-haul routes (which will now once again comprise 100% of its overall operations) are spread amongst Asia, Africa, the Middle East and North America, along with a handful of bilateral codeshare agreements with some foreign flag carriers such as Jet Airways, South African Airways, Singapore Airlines, Air China, Virgin Australia and All Nippon Airways.

What remains to be seen, and has become a central theme in the ever-evolving world of cross-alliance partnerships, joint venture agreements, equity stakes and partnerships with the Middle Eastern carriers, is how the wires will continue to cross each other and interweb without creating sparks. In this scenario, Delta, the primary driver of the Virgin JV, has a deep-rooted history with its transatlantic alliance partner Air France – KLM, which extends to include Alitalia. Neither Air France, KLM nor Alitalia have vested interests in London nor Virgin Atlantic, but without a doubt, Delta has its eyes on securing lucrative access to slots at Heathrow airport. As such, the implications for Delta, in terms of its existing relationships with fellow SkyTeam members, could be contentious.

For Virgin, the appeal of joining an alliance is much more relevant today as opposed to 15 years ago, even though arguably it is one of the last major network carriers to remain unaligned in today’s aviation atmosphere. One could argue that up until this point, the value of alliances was moot given its enviable position at London Heathrow airport, its broad range of codeshare agreements and partnerships with other airlines, and its desire to remain a standalone, “hip” carrier preserving its own unique brand image.

Unfortunately, none of these advantages were sustainable enough to keep Virgin in the black in the modern era, and the strength of its much more powerful rival, IAG, has made it hard to outmaneuver challenges that it faced in core markets across the globe. Now, it is placing its brand in markets such as Atlanta and Detroit, previously cities that could be considered an afterthought for an airline like Virgin, and the game of airline checkers wages on.