I discussed earlier the recent ability to assign a PIN to some prepaid debit cards, making it possible to use them to reload a Bluebird card at physical Walmart stores — or for use with other manufactured spend techniques that require reloading from a gift card. At the time I had only tried using a gift card issued by U.S. Bank National Association, purchased at a QFC (Kroger) supermarket. But I have done more research this week that you may find useful if you decide to use this as part of your own strategy for manufactured spend.

Some of what I share may be old hat to the rest of you, but given that we can’t buy Vanilla Reloads anywhere near my home or even get American Express for Target, I’m still learning. I hope you’ll be gentle if I’ve overlooked something significant. 😉

Load Online or In Stores?

First, I want to address a couple readers’ questions about the distinction between loading Bluebird online vs. at a physical Walmart. You can load up to $100 per day online, or up to $1,000 per day at a physical store. The cap remains $5,000 per month, so loading online would only allow you to use about 60% of your card’s potential. Furthermore, loading online involves a $2 fee per load but in-store loads are free.

One nice benefit is that online loads do not require a PIN, only that your card be registered with your address. You can do this online pretty easily from a mobile phone.

Look for U.S. Bank Visa Gift Cards

Second, I have been buying and testing gift cards from a variety of stores with locations in the Seattle area. To cut to the chase, U.S. Bank N.A. cards remain the easiest to use. I have only found these at QFC. Safeway also sells some, but only as MasterCards. I have heard some say that the MasterCard versions are not easy to use with a PIN, and I have only done my tests with Visa gift cards. At some point I may go through the list and try those, too.

Second, I have been buying and testing gift cards from a variety of stores with locations in the Seattle area. To cut to the chase, U.S. Bank N.A. cards remain the easiest to use. I have only found these at QFC. Safeway also sells some, but only as MasterCards. I have heard some say that the MasterCard versions are not easy to use with a PIN, and I have only done my tests with Visa gift cards. At some point I may go through the list and try those, too.

To set the PIN for a U.S. Bank card, you just call the phone number on the back, key in your card’s number and security code printed on the back, and then key in your new PIN. It’s that simple. You can do it from in your car after purchasing the cards and then go directly to Walmart.

MetaBank Cards Can Be Used Online or in Stores

I eventually found a way to set a PIN on cards issued by MetaBank. You can also register them with your full address very easily online. I did this from my iPhone’s browser and then transferred funds using the Bluebird iPhone app (the Bluebird mobile website kept crashing). You can find MetaBank cards in more stores, including Office Max and Bartell Drugs. Staples and Safeway sell MetaBank Visa cards and U.S. Bank MasterCards.

One thing to watch for when purchasing MetaBank cards is that the $200 card has a higher activation fee: $6.95 instead of $5.95. In order to reduce your costs, you’ll want to buy a $200 gift card instead of 2 x $100 gift cards at an office supply store. But at Safeway I saw that variable load cards were available with limits as high as $500 for only $5.95. I have no idea why the fixed-value $200 cards are the only ones with a higher fee, and I did not see the variable load cards at Office Max.

UPDATE: This post from Dans Deals is where I learned you can assign a PIN to MetaBank cards. I hadn’t tried calling yet and only used the online portal. I called the number on the back (888-524-1283), keyed in all the details, and was able to set a PIN by choosing option 5. But Staples is very inconvenient for me and I can easily get U.S. Bank gift cards.

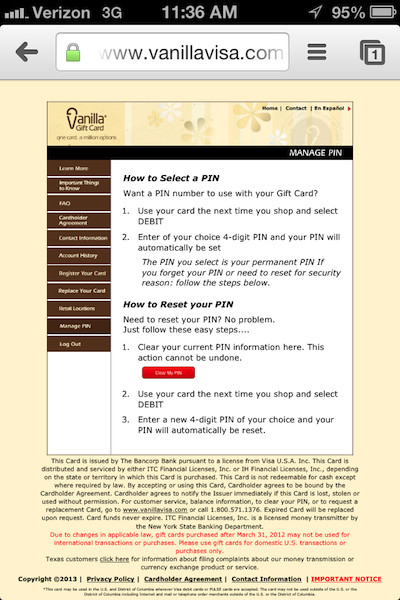

Vanilla Visa Cards are Worthless

I found Vanilla Visa gift cards at Office Depot and Rite Aid. In fact, my local Office Depot had stacks of $500 cards available, and I thought I had hit a gold mine! But the purchase would not go through, and then a manager came over and complained that they should never have been put on the floor. She was planning to throw them away after I left with my measly $100 card ($200 was out of stock).

Vanilla has a weird way of setting a PIN. It says that you can set the PIN at the point of sale, by choosing “Debit” when you swipe your card. Whatever PIN you enter will be set as the card’s new PIN, although you can still reset it online. Unfortunately, this process never worked for me. I tried reloading at Walmart, and the register refused to process the charge. I tried to buy a candy bar first and process it as debit to set the PIN, but the register automatically processed it as credit without giving me an option.

So I decided to see if I could set the PIN somewhere else. Gas stations almost always let you choose debit or credit when pumping gas. I went through the motions at my neighborhood Chevron, choosing “Debit” and swiping my card. It still refused the card. I don’t know what I’m missing here, but I’ll need to do more research to figure out how Vanilla expects me to use their gift cards.

Finally, I tried to use my Vanilla Visa to reload my Bluebird online, as I did with MetaBank. Vanilla does allow you to register your card, but only with your ZIP code. That was apparently insufficient for Bluebird, which refused to link the card to my account. Only MetaBank let me register with my full address, though I admit I never bothered to try registering with U.S. Bank.

Is Paying Online Worth It?

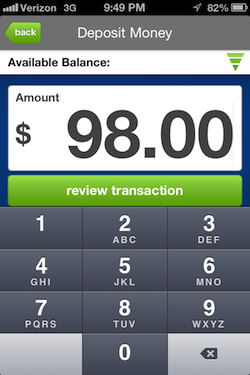

So far the math does not look promising for earning Ultimate Rewards points with Visa gift cards and Bluebird. I have only found MetaBank and Vanilla Visa cards, and I have only been able to transfer funds from MetaBank. I originally had problems setting a PIN with MetaBank gift cards, so let’s use that as an example for someone with no nearby Walmart. If I buy a $200 card with a $6.95 activation fee I would make two $98 loads (plus a $2 load fee each time).

In this scenario, I would spend $206.95 and get back $196. My cost is $10.95 and I would earn 1,035 Ultimate Rewards points, for a cost per point of 1.06 cents. Certainly not bad. Valued at 2 cents each, that’s still close to a 89% gain. But my original post estimated a cost of only 0.595 cents per point.

Under another scenario, let’s say you can buy a $500 gift card at a supermarket using a Premier Rewards Gold card from American Express. The activation fee is a slightly lower $5.95, and you can make five daily loads of $98, each time with a $2 load fee. You would earn 1,012 Membership Rewards points from a $505.95 purchase and get back $490, for a net cost of $15.95. The cost per point would be 1.58 cents, also higher than my original estimate of 0.595 cents.

Without access to a Walmart, your costs increase dramatically and your manufacturing potential is capped at a lower amount. It remains possible to buy points at a cost below their redemption value, but I would not recommend loading online unless you have no other way. Just make the trip to Walmart and cut your costs in half.