There’s been an upheaval in the miles and points community over the last few months because Chase has drastically tightened up on the endless churning of their Ultimate Rewards credit cards. The new rules, according to multiple sources, appears to be some variation on what’s being referred to as the 5/24 rule, which means if you’ve had more than 5 new cards overall (not just Chase cards!) in the last 24 months, you’re highly unlikely to get approved for a new Ultimate Rewards card anytime soon.

Can you hear that crunching noise? It’s the gnashing of teeth by credit card churners.

The angst has gotten to the point that Trevor from Tagging Miles recently responded to a reader on his blog asking if he should forgo credit card churning entirely for the next two years in order to get back in Chase’s good graces. The always astute Trevor wisely responded that it would probably be worth continuing to pursue cards from other banks rather than wait around for Chase.

I’ll go one step further. I say, who even cares about Chase at this point?

A year ago I wrote about the downsides of Ultimate Rewards (see “I Got It! It’s Chase Ultimate Rewards Points That Are Awful!“) At the time I admitted to being a bit nitpicky about the program in order to find fault with it. But nowadays I don’t have to be. Ultimate Rewards may have been the holy grail of points over the last few years, but as often happens, everyone else has stepped up their game and Ultimate Rewards ain’t the only girl you can ask to the prom. In fact, she’s not even the prettiest.

What am I talking about? Come take a look…

A Category 5 hurricane of devaluations!

It’s been a little over 18 months since the United devaluation that destroyed much of the value in Star Alliance partner level awards. While it’s still possible to fly Lufthansa First Class, it now costs either 110,000 United miles one way or a huge amount in fuel surcharges with miles from some other airline. The United program has always been the crown jewel transfer partner in Ultimate Rewards, and that massive devaluation took a lot of shine off the diamond.

But it hasn’t stopped there. As I noted when I recently suggested “It’s Time to Put the Chase Sapphire Preferred in the Sock Drawer,” that devaluation was followed up by one from Southwest that left everyone wondering what Southwest points were even worth anymore (and thanks for giving Delta that idea, Southwest). Then British Airways devalued the premium side of their redemption chart (though some value still remains in those premium redemptions), and now Amtrak is changing to a revenue-based redemption program. Of course, that might not even matter because Chase lost the Amtrak credit card and might not even offer it as a transfer partner before long. You could argue Amtrak was never that great a partner anyway, but folks, UR only has 11 partners to begin with. If Amtrak goes, that’s nearly 10% of their transfer options off the table.

What about the competition?

“Look, devaluations are part of the game,” the Conventional Wisdomers patiently like to explain. “Just because some partners have devalued doesn’t make Ultimate Rewards points less valuable relative to other flexible currencies.”

Well, yes, actually that’s exactly what it does. Because if you look at the other flexible points programs, with the exception of the never-ending devaluations by Delta (who basically don’t even want a loyalty program anymore), no one else has suffered the kind of massive devaluation at the heart of their program that United, Southwest, British Airways, and Amtrak have inflicted on Ultimate Rewards.

Yes, everyone has taken a few hits here and there, but as much as I like to find things to complain about in Membership Rewards, SPG, and ThankYou Rewards, the fact is they’ve all made moves recently to improve their programs, while Chase has done absolutely nothing. Since the start of 2015, Membership Rewards introduced a 30% rebate when you use an Amex Business Platinum card to Pay With Points, SPG just added Korean Air as a transfer partner, and Citibank has completely revamped ThankYou Rewards to the point that it’s a true competitor. And that’s not even counting improvements made to the actual credit cards of those programs, such as the new perks on the Amex SPG Business card or the $250 airline fee credit on the Citi Prestige.

As far as I can recall, the last positive change to Ultimate Rewards was adding Singapore as a transfer partner and that was well over a year ago.

I can’t even remember a recent improvement to any of the Ultimate Rewards credit cards. Ink, Freedom, Sapphire Preferred… nothing’s coming to mind, Chase.

The new restrictions are only for Ultimate Rewards (so far).

Lest anyone think all is lost, apparently the new 5/24 restrictions only apply to the Ultimate Rewards family of cards. The other Chase co-branded cards, such as United, Southwest, Hyatt, IHG, British Airways, and the others appear to be unaffected. That’s not to say you’re guaranteed to be approved even if you’ve opened a bunch of credit cards in the last two years, but it’s not an automatic denial.

So if you’re absolutely dying for points in one of the Ultimate Rewards partners, the obvious solution is to just apply for that co-branded card directly. It’s pretty easy to pick up 50,000 bonus points with a United, Southwest, or British Airways card application. And if you go that route, you’ll even get the extra perks of those particular cards (such as the baggage fee waiver with the United card or the Platinum elite status of the Hyatt card).

But is that really what Chase wants? For people to forgo Chase’s own points program in favor of their co-branded cards? I mean, I’m no banking executive (because banks frown upon drinking on the job), but it seems to me they’d want to go the other way with this. And meanwhile, while they’re focused on culling out churners, have they put any thought into the next steps for Ultimate Rewards? Or are there forever only going to be eleven ten transfer partners?

The Devil’s Advocate is happy to let Chase go on its merry way.

Lately I’ve had no trouble keeping a healthy amount of Ultimate Rewards points in my inventory, and a big part of the reason for that is because I haven’t been using them. However, I’ve redeemed at least 200,000 ThankYou points in the last 8 months alone, almost entirely for domestic travel. I was also down to just a few Membership Rewards points after taking my mother in business class to Europe for her 80th birthday, but then I managed to pick up a new Amex Platinum Business card and a new 75,000 point bonus without having to wait 12 months (see my “Bet You Didn’t Know” post over at Frequent Miler if you’re wondering how I pulled that off).

My point is that if you’re still focused on Ultimate Rewards as the only loyalty currency, quite honestly you’re behind the times. Forget Chase. Instead, take a look at the many, many other options out there. You’re likely to find that what you need doesn’t rely on churning another Chase Sapphire Preferred.

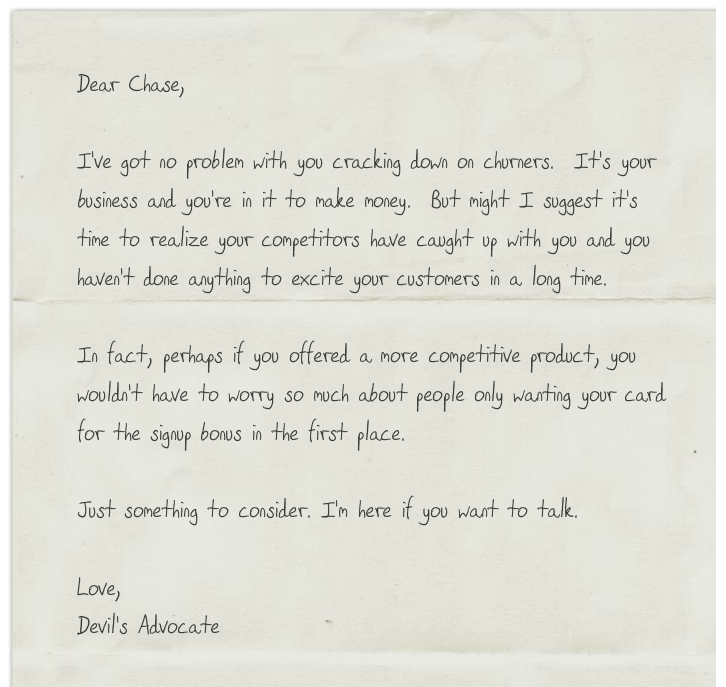

And Chase, just a friendly note, from me to you…

Recent Posts by the Devil’s Advocate:

- Do I Even Have To Ask Whether 5,000 Extra SPG Starpoints Are Worth All This Fuss?

- Is the Citi Prestige Already Ripe For a Devaluation?

- Cartera Shopping Portals Have Fantastic Customer Service. Really. Stop Laughing!

Find the entire collection of Devil’s Advocate posts here.