I recently took a short trip to Copenhagen, with a stopover in Reykjavik. Both Denmark and Iceland can be expensive countries to travel in, so I’m glad I found a cheap fare to fly and had points to take care of things like hostels. I was excited about Copenhagen because it’s been known as a great food city. The former #1 restaurant in the world, Noma, was in Copenhagen before they decided to temporarily move to Mexico for the year. Even then, there are a surprising number of top restaurants within the city. While many of these restaurants aren’t cheap, I definitely wanted to experience a couple of them during my stay there.

I did my usual amount of research as I do for most trips, including local currency (and exchange rate to predict how much money I would spend), transportation options, and places I was interested in visiting. One thing I didn’t come across was the “Gebyr,” the Danish word for “fee.” In particular, the fee for using a foreign credit card.

I absolutely hate paying extraneous fees, and I find that I sometimes go out of my way to avoid paying one. I have a Charles Schwab checking account with free ATM access around the world, and I love using it when I travel abroad. Even then, I only like to withdraw a small amount of money, usually $30-$50 when I land in a new country just to have something in case I can’t use a credit card. I don’t like to have a lot of leftover local currency, and tend to withdraw in small amounts and let Schwab take care of the fees.

Even then, I’d rather use credit cards that don’t have foreign transaction fees, because I tend to spend more when I’m traveling than when I’m at home (I like to enjoy myself while on vacation!) and don’t like to leave valuable points on the table.

On our first night in Copenhagen, we went out for dinner and drinks and had a bill of about 600 Danish Krone, or $88. I had my Chase Sapphire Reserve Visa, so I decided to use that. As long as the restaurant was properly coded as a restaurant, I would earn 3x points, or about 265 points worth about $4. One thing I love about paying restaurants outside the USA is that they bring the credit card machine to you. After the waitress entered 600 DKK into the machine, I placed my credit card in and got a receipt that said … 618 DKK? What?

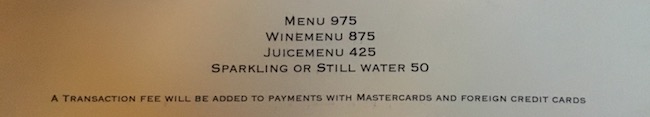

It turns out that many institutions in Denmark charge customers a “Gebyr,” or “fee” for using a credit or debit card that is issued outside of Denmark. This is particularly annoying as many of them don’t advertise this until you’ve already paid. I can only imagine how annoying this might be for people who live just across the bridge in Sweden who frequent Copenhagen, since they likely have to pay the fee for using a non-Danish card.

That being said, I paid 18 DKK to use my credit card for a 600 DKK transaction, or $2.64 for an $88 charge (3%). That 3% is actually in line with the 3X points I get from using the Sapphire Reserve at travel and dining institutions. The way I see it, I basically bought Ultimate Rewards points for just about 1 cent per point. Considering that you can always “cash out” Ultimate Rewards points for 1 cent each, it’s basically a wash.

Luckily for me, we had good luck with the two other rather expensive meals in Copenhagen – both restaurants charged a 2.9% fee that I had to pay in addition to the bill, but both also posted correctly as restaurants and earned 3X Ultimate Rewards points. Other places, including my hotel and a cocktail bar earned 3X points and did not charge the fee. However, I did have to pay the fee for ride tickets at Tivoli, the famous Copenhagen amusement part, and the Ny Carlsberg Gyptotek art museum, and these did not earn 3X points. However, I only spent about $25 total at these places, so the 3% fee was less than $1. All in all, I still came out ahead in Copenhagen by mostly paying with a credit card, but just barely.

However, if I didn’t have the Chase Sapphire Reserve and was paying with other options like the Chase Sapphire Preferred, which earns only 2X points, I would be much more annoyed by this. After all, I would be earning 2X points for a 2.9% fee, or about 1.45 cents per point. If this were the case, I would have tried to use cash more often, but this would have been more annoying to keep track of.

Other cards I’ve used in the past for foreign transactions include the Citi Prestige or Barclay Arrival, but both are Mastercards and I noticed that they would have incurred more customer-facing fees than Visa cards.

In short, if you plan to travel to Denmark, be aware of this fee! Have backup plans for cash if using a card turns out to be more expensive.