Update: a reader reached out on Twitter to ask about intentionally overpaying estimated taxes to earn additional points. As I thought this was a good question others might be interested in, I have updated the post below to address it.

I put off preparing my taxes this year as long as possible. Mainly because I knew I’d owe a good chunk of money. (Trust me, it has nothing to do with the pittance I make off this blog.) Tiffany over at OMAAT provides a good overview of why she likes to pay her taxes with credit cards. However, I’ve generally found this to be a losing proposition. Until this year, anyway, as I’ll explain later in this post.

Paying Taxes by Card Still Doesn’t Make Sense, Most of the Time

Some of you know I prepare taxes for a living as my day job. (And no, the irony of a tax guy waiting until April 12th to do his own isn’t lost on me.) Clients often ask if it makes sense to use a credit card to pay the piper for the points. Usually, my answer is no. Why? Most of the time, the math doesn’t work. Simply put, the value of the points earned must exceed the convenience fee charged by the processor.

And usually, it doesn’t. Take this example of a $5,000 payment using a few common points or cash back cards. Fees vary, but for this exercise, I use Pay1040.com, which charges a 1.87% fee. This makes the actual charge $5,093.50 after the fee. Also note that this table assumes a payment to the IRS. According to some credit fixers, some states and localities allow credit card payments for income or property taxes. However, fees vary by jurisdiction, sometimes as high as 3%.

| Capital One Venture (No Fee version) | Citi AAdvantage Executive | Chase Sapphire Reserve | Amex Hilton Ascend | |

| Points earned | 6,367 | 5,093 | 5,093 | 15,281 |

| Value per point | .01 | .0125 | .015 | .004 |

| Total points value | $63.67 | $63.66 | $76.40 | $61.12 |

| Net cost | $29.83 | $29.84 | $17.10 | $32.38 |

Of course this all depends on how you value points currencies. But in all of the above cases, you pay more for the points than they are actually worth. And really, this basic rule works for any card that awards one point per dollar for taxes paid, with a point value of less than 1.87 cents per point. Think about that – that’s the majority of rewards and cash back cards out there. Simply put, I don’t think this makes sense for most people in normal situations.

But Some Cards Actually Do Make Sense

There are, however, a handful of cards (or combos) out there where the math actually does work. Specifically, cards that award bonus points for all spending, or where the combination of points earned and point value exceeds 1.87 cents per point.

| Amex Blue Business Plus | Chase Freedom Unlimited (w/ Premium Rewards Card) | Citi Double Cash | |

| Points earned | 10,187 | 7,640 | 10,187 |

| Value per point | .015 | .015 | .01 |

| Total points value | $152.81 | $114.60 | $101.87 |

| Net benefit | $59.30 | $21.10 | $8.37 |

The Citi Double Cash provides the best example of where this can work, in my opinion. If you do happen to have a card that earns 2 points per dollar, you come out ahead even at a penny a point. And that’s the situation I found myself in. I picked up the Blue Business Plus late last year. And now, paying taxes with the card is almost a no-brainer. I’d use the points to transfer to a partner, like I did to Virgin Atlantic several months ago. But even if you don’t do that, the points earned can get you a $100 Home Depot gift card for the extra $93.50 in fees paid. Not bad.

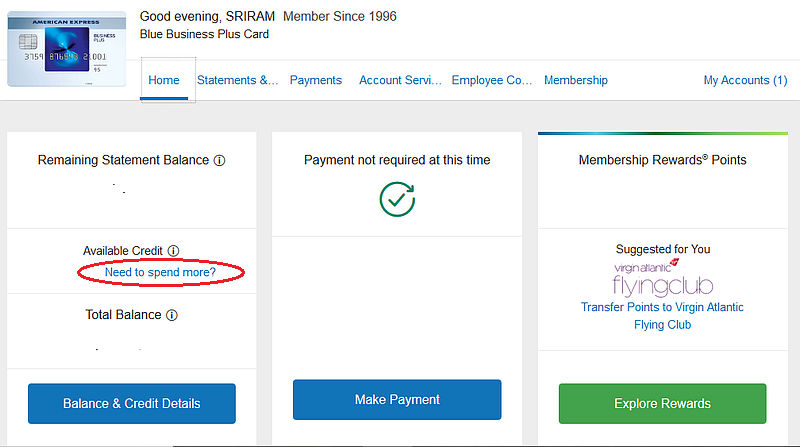

One additional note – some Amex business credit cards permit you to briefly exceed your credit limit to make large purchases. This can come in handy if an Amex business card maximizes your return, but you don’t have the limit to cover the entire payment. If your card is eligible, you’ll see this hyperlink on your dashboard.

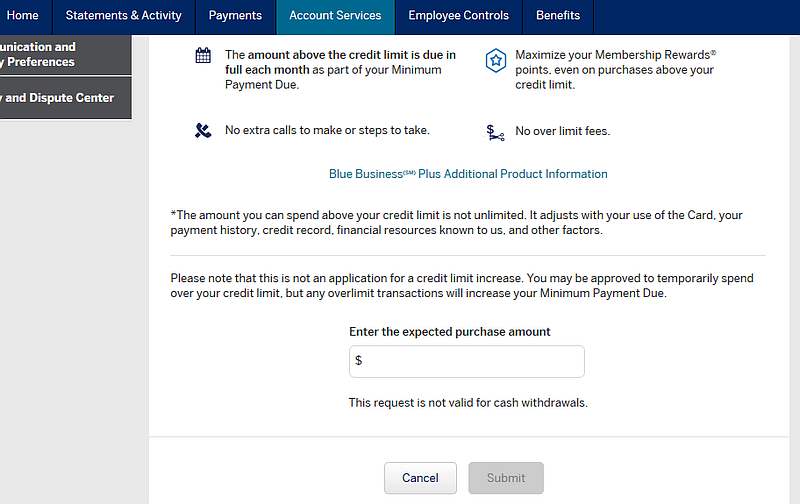

Click through two screens, and you can enter your total payment amount here.

Then hit submit. You’ll get a notification on the next screen if you’re approved or denied. If approved, just charge the amount and go. Amex does not perform a credit pull, so there is no effect on your credit score.

What About Overpaying Estimated Taxes With Your Card?

In general, I dislike the idea of overpaying taxes early in the year, just so you get a refund when filing in the spring. Why? A tax “refund” is really little more than an interest-free loan to the IRS. (As a general rule, the IRS does not pay interest on refunds on timely filed individual or corporate income tax returns.) Economically, it makes the most sense to get your balance due/refund as close to zero as possible. Granted, that is easier said than done sometimes.

But a reader asked, what about deliberately overpaying estimated taxes to earn points, then filing for a refund in April? For individuals, your final estimated tax payment comes due January 15th, with the return due April 15th. The theory goes, pay way more than you need to in January, then claim the refund in April. It becomes a form of manufactured spend, basically. Can you do that? The short answer is, sure. The IRS couldn’t care less if you overpay your taxes early. They just want their money. I guess the better question is, should you do it?

Here, it gets a little tricky, because foregone interest comes into play. In my $5,000 example, if you pay on January 15th, you lost out on bank interest for those three months. At a 1.25% annual interest rate, that adds about $16 to the “cost” of the transaction. That may or may not make a difference, depending on your situation. If you really want to do this, a better option is to overpay on an extension. File and pay the extension close to April 15th, then file the return a few days (or weeks) later. That reduces the foregone interest cost. Just make sure you have the means to pay your card in full when the statement comes in. You may or may not receive your refund back in time to pay the bill.

Other Reasons Paying With a Card Makes Sense

Besides situations where the basic points value exceeds the fee, there are other limited circumstances where it might still make sense to pay your taxes with a credit card.

You Run a Business, and Can Deduct the Convenience Fee

This reduces the effective cost of the fee, sometimes substantially. If you are in the 25% tax bracket, deducting the $93.50 from your business income reduces the effective cost to $70.13. Thus, your break-even on the points earned also lowers. Any card earning one point per dollar with a value exceeding 1.4 cents/point works in that scenario.

“Topping Up” a Frequent Flyer Account

Using the Citi AAdvantage card in the first table as an example, normally, paying $93.50 for $63.66 of AAdvantage miles doesn’t make sense. However, what if you’re only 5,000 points short of an award that you plan to redeem? In that case, paying 1.87 cents per mile might make sense. Check first for any miles purchase deals the airline might be offering, though.

Also keep in mind, miles or points on a purchase don’t post to your account until after your statement closes. If you plan on using the miles in a month or two, no problem. If you need them immediately, though, this doesn’t work.

Meeting Minimum Spend on a New Credit Card

A hefty tax bill just might go a long way to meeting your minimum spend for a big new card bonus. The Amex Plat, for example, requires $5,000 spending in three months. Paying your tax bill might wipe out a good chunk of that. However, in general, I recommend this only if you have no other options to meet it. If your normal spending habits would cover the minimum, anyway, you might as well save the convenience fee for something else.

Also, the same applies if you have a card offering bonuses for rotating quarterly categories. If you have the Chase Freedom, many of you are probably better off maxing out your $1,500 on groceries. I know I’ll have no trouble spending that much at Kroger in three months.

Final Thoughts

In most cases, I still stand by my standard advice. Paying your taxes with a credit card costs more than it’s worth. However, depending on your particular credit card mix, it might actually work to your advantage. Check the math using your personal valuation of your points currency of choice. You just might find yourself pleasantly surprised like I did.