Last Monday, I wrote a post about why the American Express Platinum Card is worth it, given that I am celebrating my one-year anniversary as a cardholder this month.

What has recently come up as a major contender with the AMEX Platinum is Chase’s Sapphire Reserve card which was debut this past summer.

I was one of the early adopters of the card, given that I have been a long-time Chase Sapphire Preferred card holder, but the benefits of the Reserve stood out to me instantly.

Here’s a recap of what you get with the Reserve:

- $300 annual travel credit

- 3 points per $1 spent on Travel and Dining

- Complimentary Priority Pass lounge access

- Global Entry/TSA PreCheck credit waiver (up to $100)

- Special Rental Car privileges

- No foreign transaction fees

- 100,000 sign-up bonus (while it lasts) for spending $4,000 within 90 days of opening

This is not the complete list of perks, but if you can click on the following link want to look at all of the benefits from from the Chase Sapphire Reserve card.

At first glance, you might think that many of the benefits overlap with what the AMEX Platinum card offers, which is partially true. However, I have placed a few of the items in bold above which I plan to expand upon more in terms of the additional, perhaps even hidden, benefits which make this card stand out even more in terms of value.

The $300 Travel Credit Knocks Down the Annual Fee

Yes, the $450 annual fee comes with a bit of a sticker shock. However, when you subtract the $300 in travel credits that you receive as reimbursement from Chase, the card “nets” at a $150 annual fee.

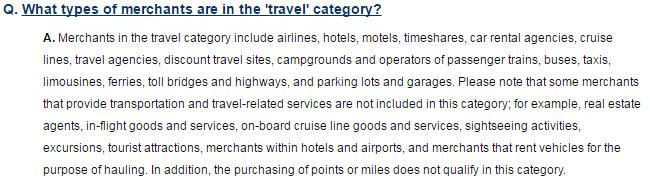

Moreover, the “travel credit” categories are fairly expansive and can be applied towards multiple uses. Per Chase’s FAQ page, merchants include not just airlines, but also hotels, cruise lines, toll bridges, parking lots and garages and even Uber and Lyft.

One note of caution: in my experience, when I initially started using the card, I began charging Uber rides to help move the needle towards the minimum spending. I noticed that Chase was reimbursing my Uber ride fares using the $300 travel credit, which I didn’t want (and AMEX also gives 2x points per dollar currently as a promotion with Uber, so I should have known better about turning off that perk, anyways).

Regardless, if you want to apply this credit towards a specific expense right out of the gate (like a hotel stay or a flight) then avoid using it to pay for small incidentals like parking or tolls right off the bat.

The other reason why the card is worth getting approved for now is because the $300 credit is given annually for the first year, meaning you would get the credit from now until the end of 2016, then again in 2017. However, after your first year, or December billing cycle, then the fee comes every 12 billing cycles.

Bottom line, that is potentially $600 in travel credits that you can get for the next month for the price of $450, netting $150 in total.

Three points per $1 spent on Travel and Dining is Probably One of the Best Deals out there

I imagine that this is why the card became so popular in such a quick matter of time: previously, Chase Sapphire PREFERRED members loved the 2x to 1 accrual rate for travel and dining, which is essentially akin to what most of the major U.S. airlines offer (except usually it is just for travel, and for tickets booked with that specific airline).

The 3x to $1 upgrade for the Sapphire Reserve card knocks it out of the park. This is, by far, probably the most generous deal out there.

Eligible dining locations include restaurants, fast-food establishments and fast-casual dining. Per Chase’s website, this is, “any merchant whose primary business is sit-down and eat” activity. Unfortunately, grocery stores do not qualify under this category.

That being said, the points for dining add up very quickly.

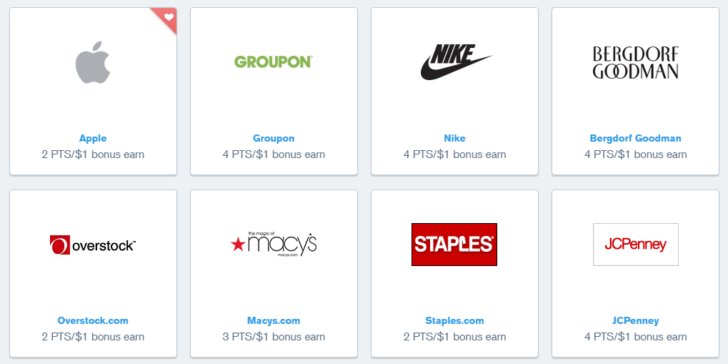

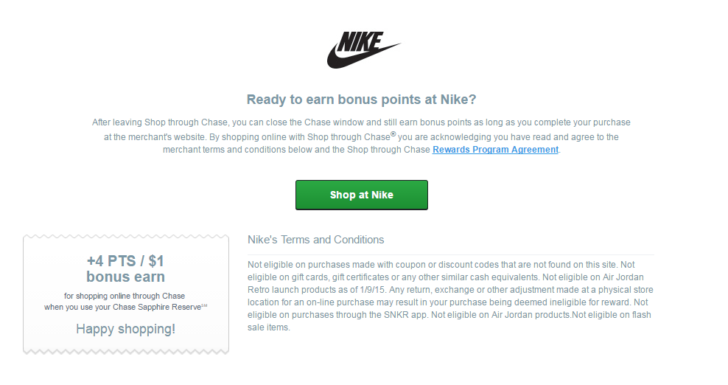

The other incredible perk, which often doesn’t get much attention, is the Shop with Chase feature that sometimes can offer four to five, and as high as twelve points per dollar, for purchases using the Sapphire reserve card, although the standard is anywhere between 3 and 5.

For example, this month, purchases with Apple, Groupon, Nike and Macy’s, among other retailers, provide bonus points. There are literally hundreds of others, including West Elm, Pottery Barn, Omaha Steaks, J-Crew, Neiman Marcus, Home Depot, Lowe’s, the list goes on. You click on the link through the icons and it takes you to the external site, where you shop and then pay with your CSR.

Given the amount of shopping for the upcoming holidays, this can be a really sweet way to earn some extra cash back.

I will add that this is a perk that AMEX also offers through it’s AMEX Offers Program. Usually, I will compare the two offers between the cards, as some might be offered by one and not the other (such as Uber, for example).

The 100,000 Point Bonus Sign-Up is a Game-Changing Deal

Though the $4,000 spend requirement is a bit daunting, the 100,000 point bonus will amount to $1,500 in travel credits that can be used to purchase flights, book hotels and plan vacations.

As a note, the Chase Sapphire Preferred card had a 4 to 5 ratio on using points for travel. What exactly does this mean?

Here is how using Points for Travel works, in a nutshell:

- You purchase your airline ticket through chase, using points. Let’s say, for example, that you had 40,000 points. You also have 50,000 American Airlines miles.

- A round-trip, coast-to-coast flight on American is pricing out at $300 for the fare. It would cost you 25,000 American Airlines miles to book the flight.

- You think, “well, 25,000 AA miles is like $250, so I’ll save $50 booking with miles. Not so fast.

- Buying the ticket with frequent flier miles would rob you of over 5,000 frequent flier miles that go towards elite status.

- With the Chase Sapphire Rewards program, if you book the flight using Chase points, you would traditionally get 20% off the price of the flight when you paid with points, while still being able to earn the frequent flier miles. You’d use 24,000 points for a $300 flight.

- Net-net, that is 1,000 points cheaper than booking the flight using American miles, and right there, saves you $60, or 20% of the price.

With the Reserve card, Chase has now upped the ante and gives 1.5 points per dollar instead of 4 to 5.

What this means is that now, a $300 ticket will only require 20,000 points.

That is a bargain.

The other awesome thing is, if you had those 40,000 points in your Chase Sapphire Preferred account, you can roll them over into your new Reserve account. The value of your 40,000 points will rise from being worth $500 in cash to being worth $600.

Thanks to this benefit, I was able to purchase a one-way ticket in Business Class on Emirates from Johannesburg to Toronto, normally worth $1,500, using Chase Sapphire Reserve’s travel portal.

The bonus points usually take about 2 months, or two billing cycles, to post into your account.

Why the Chase Sapphire Reserve Complements the AMEX Platinum

So if the benefits are similar as the AMEX Platinum, and the Chase Sapphire Reserve gives more on travel and dining, why have both cards?

There are reasons why I would keep both, and here are the top ones:

- First, even though both come with pricey tags, the annual fees get knocked down by 40 to 50% thanks to the Travel Reimbursement credit. As such, I feel like I only pay $250 out of pocket for the AMEX Platinum and $150 for the Chase Sapphire Reserve

- For Travel and Dining Purchases, the Chase Sapphire Reserve provides the best ROI.

- For everyday purchases, both cards offer exclusive bonus points for certain retailers.

- For lounge access, the AMEX Platinum provides better lounge privileges, thanks to the Centurion Lounge and the ability to access the Delta SkyClub.

- For booking travel, Chase wins, hands down.

- For hotels, the AMEX Platinum offers automatic elite status with Starwood properties

- For rental cars, both offer status with several major rental car companies.

Bottom line, I strongly believe the individual contributions that each bring to the table maximizes the overall benefit of possessing both cards. It is good to have a portfolio of credit cards such as these two in order to have a “diversification” when it comes to travel, dining and everyday spending. Even though some people may argue it is frivolous to have both, I am strongly within the camp that believes that each of them are worth having if you are just starting to become part of the miles and points game.