The Devil’s Advocate has now written two articles on the revised benefits of the Ritz-Carlton Visa Infinite card from Chase, originally sounding unimpressed and then revising his attitude slightly positive after new information came to light. As usual he writes his articles without consulting me. I’m as curious as anyone else to see what he thinks come Thursday morning. But I thought in this case it was worth adding a stronger caution against applying for the new Ritz-Carlton Visa Infinite card.

Reports are that Chase is also launching a new Sapphire Reserve card, with applications available starting August 21. Anyone who applies for the Ritz-Carlton card before then will probably find it more difficult to apply for the Sapphire Reserve card later. And so I think the debate is not between old and new versions of the Ritz-Carlton card but rather between the Ritz-Carlton card and the new Sapphire Reserve card. And it’s not as easy as comparing the two sign-up bonuses.

Even if you disagree with my analysis, it makes sense to wait until the new card becomes available so you can make your own, informed decision. You can be patient for a week.

The Times They Are a Changin’

The Ritz-Carlton Visa Infinite card brings to mind the “pump and dump” strategy for applying for credit cards: get the bonus and cancel as soon as you can. That’s great if all you want is the sign-up bonus. Three free nights! But that strategy was developed when there were plenty of cards to apply for, and plenty of opportunities to apply for them again and again. Times have changed.

New rules from Chase make it almost impossible to get approved for a new card if you’ve had five applications of any sort — even at other banks — in the past 24 months. It’s important to evaluate your strategy for long-term value because applying for Card A today may prevent you from applying for Card B tomorrow. You could be stuck waiting up to two years before you get your chance to try again. Personally, if I apply for a card from Chase it’s going to be one that I intend to keep. That’s why I care more about the rewards a card offers in the second year, after the initial bonus has passed.

The Real Comparison

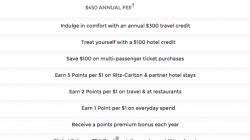

In your second year of holding the Ritz-Carlton Visa Infinite card, you’ll pay a $450 annual fee and get these unique benefits (I’m only highlighting what’s different from the rumored Chase Sapphire Reserve):

- 5X points at Marriott and The Ritz-Carlton

- 2X points on dining out and other travel expenses

- 1X points everywhere else

- Earn Gold status after spending $10,000 in a calendar year

- Receive 3 Club-level upgrades every year on paid stays up to 7 nights each

- Receive $100 hotel credit on each paid stay of 2 nights or more

Compare that to the unique benefits of the rumored Chase Sapphire Reserve, also a Visa Infinite card with an annual fee of $450:

- 3X points on dining out and all travel expenses

- 1X points everywhere else

Admittedly that looks like a short list. It doesn’t mean the Chase Sapphire Reserve has no other benefits. Both cards will offer a waiver for Global Entry, Visa Infinite benefits like discounted companion airfare, a Priority Pass Select membership, and a $300 airline fee credit (it’s been suggested that the Sapphire Reserve card’s credit will be easier to use). So both cards have lots of perks, but really, after the first year’s bonuses are out of the way, the difference between these cards boils down to how many points you earn and what you can do with them, plus a few dedicated hotel benefits.

I suspect most people will earn far more points with the Chase Sapphire Reserve and redeem them for more valuable awards. You’ll get 50% more than with the Ritz-Carlton card when you dine out or travel, and you can do more with them, transferring them to a variety of other loyalty programs or using them like cash with a value of 1.5 cents each to book whatever flight or hotel you want through Chase’s reservations portal. The only time you’ll earn fewer points with the Sapphire Reserve is when you stay at Marriott or The Ritz-Carlton.

Of Course, Exceptions Exist

That’s why there’s only one group of people for whom the Ritz-Carlton card makes sense, and that’s people who actually stay at Ritz-Carlton on a regular basis. Not just the first year when you’re using your free nights, but consistently and for years to come. And I think this group is relatively small compared to the buzz this card has created. Everyone wants three free nights, but how many of you stayed at a Ritz-Carlton property before now? You can’t even use the upgrades or hotel credits unless you pay for your room; award nights aren’t eligible.

So unless you’re a die-hard Ritz-Carlton fan, I don’t see the appeal of this card. You may earn more points for stays at Marriott and The Ritz-Carlton, but these points are generally considered less valuable than some of the other transfer options provided by Ultimate Rewards like United Airlines. And all frequent travelers will come out poorer by earning fewer points in important categories like travel and dining out.