Today’s post begins with a disclaimer, which I feel is always the best way to start off a post. In my mind, it absolves me of all responsibility for what follows. In fact, if Scott would let me, I would start every post with this statement…

“At any time the Devil’s Advocate may or may not know what the heck he’s talking about. What he says might be true, but it also might be the three glasses of wine talking. It is highly recommended you do not rely on any of it unless it happens to turn out to be correct, in which case he takes full credit for it and knew it was right all along. For entertainment purposes only. Void where prohibited by law and also in Kentucky for some reason.”

Unfortunately Scott says I have to be specific in my disclaimers. Something about lawyers or whatnot… I don’t know, I didn’t quite catch all the details. So anyway, before I start telling you how this week’s Hyatt 20% points rebate isn’t all that, let me quietly mention that yesterday I applied for and was approved for the Chase Hyatt Visa card.

OK, yes, I’ve been meaning to go for this card anyway since it’s pretty sweet. And yes, I also have several Hyatt award stays coming up, so the 20% rebate was an extra inducement to apply.

But should it have been?

There’s no doubt that a 20% rebate on anything is better than a kick in the stomach, so we certainly applaud Hyatt for offering it. For folks who were planning to make points redemptions between now and the end of July and who already have a Chase Hyatt Visa, it’s also a terrific deal.

However, this post is for those people who don’t already have a Hyatt card and who are thinking about getting one because of this rebate offer. Should you spend a valuable credit inquiry on a Hyatt Visa just because of the rebate? Does it make any more sense than it would have last week when there was no offer? And what’s the opportunity cost when we compare what we might otherwise get from Chase or other banks?

It seems what I’m arguing this week is… when it comes to the Hyatt Visa, is it do as I say, not as I do?

Who can get the rebate?

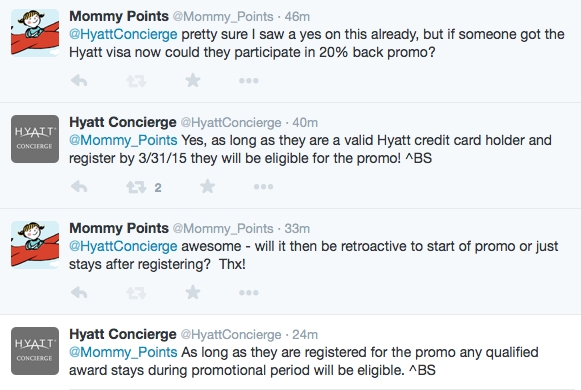

Despite some early indications that this 20% rebate might be a targeted offer, Hyatt’s Twitter team has officially confirmed that the offer is available to anyone with a Hyatt Visa and it can be added to the accounts of new cardmembers as well. Basically, as long as you’ve got a Hyatt Visa and you’re registered for the offer by March 31st, you’re in. (If you try to register for it and it says you’re not eligible, call or tweet Hyatt and ask them to add it manually to your account.)

Let’s also be clear that the Hyatt Visa card comes with 2 free nights at any Hyatt, plus a $50 statement credit if you use the right signup offer (see the end of this post for details) and a spend requirement of only $1,000 in 3 months. These 2 free nights have no restrictions, unlike the free night you get at each subsequent anniversary of the card which can only be applied at a Category 1-4 Hyatt. Finally, there’s no annual fee for the first year, and thereafter the annual fee is only $75.

Overall, it’s definitely not a bad card to have, especially if you stay regularly at Hyatt hotels where you’ll get 3x per dollar. Scott has written about how he keeps this card in his wallet and uses it on a regular basis, so if you’re interested in his analysis and reading more details about the other benefits, check out his post “Why You Should Use A Hyatt Credit Card.”

But since we can get this standard offer pretty much anytime, there’s no particular reason to sign up for the card now unless the 20% rebate makes it worth significantly more. Does it?

What’s an inquiry worth? (yes, again)

Last month I wrote a post asking “How Much is a Credit Inquiry Worth?” after I was offered a product conversion from my Lufthansa card to an Arrival card with a 10,000 point Arrival bonus equivalent to $100. The responses in the comments were both varied and intriguing, but it seemed most readers agreed that a credit inquiry was worth more than $100 unless it was $100 in cold hard cash.

Now, there’s no denying that two free nights at any Hyatt are worth a lot more than $100. But we’re trying to determine if the added 20% rebate makes the Hyatt Visa more enticing than it was before, so we’d want to knowif the rebate alone is worth $100 (or hopefully more).

If we use Scott’s valuation of Hyatt points at 1.5 cents each (and since Scott is my boss, we will definitely be using Scott’s valuation of Hyatt points at 1.5 cents each), we can calculate that we’d need to save 6,666 Gold Passport points to make the credit inquiry worth $100 more than usual. With a 20% rebate, that means we’d have to redeem at least 33,000 Hyatt points between now and July 31st.

Redeeming that many Hyatt points isn’t too hard, but it’s also only equivalent to $100, which is still a pretty low amount for a credit inquiry. You’d have to redeem nearly 67,000 Hyatt points to get to $200, which is at least 3 nights at a Category 6 Hyatt.

Even then we’re still only at $200. The 40,000 signup bonus for Barclays Arrival+ card is worth $440 alone. To get to that amount, you’d have to redeem over 145,000 Hyatt points before July 31st.

Points + Cash = Less Value?

In his post on Tuesday, Scott and Travel Codex readers also noted that this rebate actually makes Points + Cash redemptions look worse. This is because if you assume the cash you spend on a Points + Cash redemption is effectively buying back points, you’re buying back 20% fewer points for the same amount of money. The cash portion doesn’t change. The points portion still goes down, so that seems good. But it’s actually bad. I think.

While I know that’s a popular method of calculating mixed cash and points redemption, personally I think it only applies if you’re particularly cash poor and points rich. You shouldn’t be saving points just for the sake of saving points, but if you’re lacking in points, I think it’s also fair to compare the Points + Cash cost directly to the actual cash cost of the room. In that case, the 20% rebate would still make the room cost less even in a mixed redemption. Plus Points + Cash nights count towards elite status and allow for Diamond suite upgrades, so there are other benefits as well.

My point is not to necessarily argue the method of valuing Points + Cash redemptions (though I’m game for doing that another time), but simply to demonstrate that, depending on your personal situation, you might still consider the rebate valuable on mixed redemptions.

The Devil’s Advocate says consider your future Hyatt stays before firing out an application.

So should you get a Hyatt Visa because of the 20% rebate? I think it’s clearly only worth it if you have substantial award redemptions planned (though I’d count both standard redemptions and Points + Cash redemptions). Figure out how much more value you want to get for the credit inquiry and then calculate your Hyatt redemptions through July 31st to see if it’s worth that value.

If you end up deciding it’s worth going for the card, then make sure you get the best deal out there. William, Chuck, and the rest of our friends over at Doctor of Credit — who, by the way, have been tearing it up lately with great posts — can tell you exactly how to get this card with not only the standard 2 nights free but also an additional $50 statement credit. Check out this post for the details.

And when all is said and done, it seems as if it’s do as I say, not as I do. Or don’t do what I say if you calculate it makes sense to ignore me. Or do it but… I don’t know. Where’s that 4th glass of wine when you need it?

Devil’s Advocate is a weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by following him @dvlsadvcate on Twitter or sending an e-mail to dvlsadvcate@gmail.com.Recent Posts by the Devil’s Advocate:

- It’s the End of the Delta SkyMiles Award Chart, and I Feel Fine

- Devil’s Advocate Trip Review: Spirit Air A319 Las Vegas to LAX

- The Best Use for Citi ThankYou Points Isn’t the Transfer Partners

Find the entire collection of Devil’s Advocate posts here.